For the past few years, Daniel Alexander, Director of the Tanjung Kelayang Special Economic Zone (KEK), Belitung, has been hoping for the certainty of a direct flight schedule from Singapore to Belitung, Bangka Belitung Islands Province.

In the past, around 2018, there were direct flights from Singapore to HAS Hanandjoeddin Airport. However, the impact of the Covid-19 pandemic made visits to this region recede. Flights were also significantly reduced. Before the Covid-19 pandemic, the number of tourists visiting Belitung could reach 460,000 people per year.

At that time, the flight support reached 15 times every day, to and from Tanjungpandan, the capital of Belitung Regency, including international routes to Kuala Lumpur and Singapore. However, after the Covid-19 pandemic until now, the number of flights has shrunk drastically to only three to four times a day.

The number of tourists also fell. As of the end of 2024, there were 308,000 tourist visits to Belitung. "The Tanjung Kelayang SEZ Development and Management Business Entity (BUPP) is now working hard so that Belitung's golden age in 2017, 2018, 2019, can be repeated again," Daniel said.

Tanjung Kelayang SEZ was inaugurated by President Joko Widodo on March 14, 2019. Included in the 10 priority tourism destinations, this area has marine tourism objects with white sandy beaches and exotic panoramas. With a total area of 324.4 hectares, Tanjung Kelayang SEZ has a tourism development concept of "Socially and Environmentally Responsible Development and Cultural Preservation".

Belitung is one of the tourism destinations that is allowed to become an international entry point besides Bali, and DI Yogyakarta, in May 2025.

According to Daniel, Belitung as one of the 10 priority tourism destinations already has various supporting facilities with international standards. The airport in Belitung is also of international standard. The runway length is already 2,500 meters so that it can serve Air Bus A320 class aircraft.

Through HAS Hanandjoeddin Airport, Belitung is one of the tourism destinations that is allowed to become an international entry point besides Bali, and DI Yogyakarta, in May 2025. "This is a form of the central government's commitment to support the accelerated growth of the tourism ecosystem in Belitung," Daniel said.

The infrastructure supporting tourism, said Daniel, has indeed been optimally assisted by the government. "The term is difficult to find asphalt roads with holes here. Everything is available, from docks to health facilities," he said.

Tanjung Kelayang is a special area developed purely from private capital. Since its establishment in 2019 until now, investment realization has reached Rp 1.8 trillion. Operating when Covid-19 hit, the Tanjung Kelayang SEZ never stopped operating despite the difficult conditions. "Our labor absorption is also extraordinary," Daniel said.

According to Daniel, by building tourist destinations, there will be a multiplier effect that is far greater than building infrastructure in the area itself. "Since the Tanjung Kelayang SEZ, there are many new travel agent entrepreneurs or rental car entrepreneurs," he said.

Daniel said that investors in the Tanjung Kelayang SEZ are ready to go all out if there are direct flights from Singapore and Malaysia. Even now, investment conditions are maintained positively, so the Tanjung Kelayang SEZ is still waiting for its realization.

"And we can't work alone. We really need the role of the central government so that this tourism sector can contribute significantly, especially from Belitung Regency, yes, to encourage 8% economic growth," he said.

Indonesia's strategic instrument

Tanjung Kelayang SEZ, is one of 25 special economic zones built by the government to become economic leverage points in various parts of Indonesia. Although there are still many limitations, in the past year the performance of SEZs has strengthened significantly.

Data from the Coordinating Ministry for Economic Affairs states that investment realization in SEZs until the end of July 2025 reached IDR 294.4 trillion. This figure was obtained cumulatively, with an additional investment of IDR 40.48 trillion during the first semester of 2025.

Secretary of the Coordinating Ministry for Economic Affairs and Chairman of the Implementation Team of the National Council for Special Economic Zones (SEZ) Susiwijono Moegiarso said, as many as 25 SEZs spread across Indonesia consist of several sectors, such as industrial, tourism, digital and education sectors, as well as other services.

Of the several types of SEZs, the industrial sector absorbs the most labor. "Especially in large manufacturing industries, such as Kendal SEZ, Gresik SEZ, Galang SEZ in Batam, and several large manufacturing industries, the employment is also very good," he said.

In general, SEZs managed to absorb 28,094 workers or 56.4% of this year's target. Thus, the total employment since the SEZ was established until now has reached 187,376 people involving 442 business actors. Areas that absorb a lot of labor include Kendal SEZ, Gresik SEZ, Mandalika SEZ, Tanjung Lesung SEZ, and Sei Mangkei SEZ.

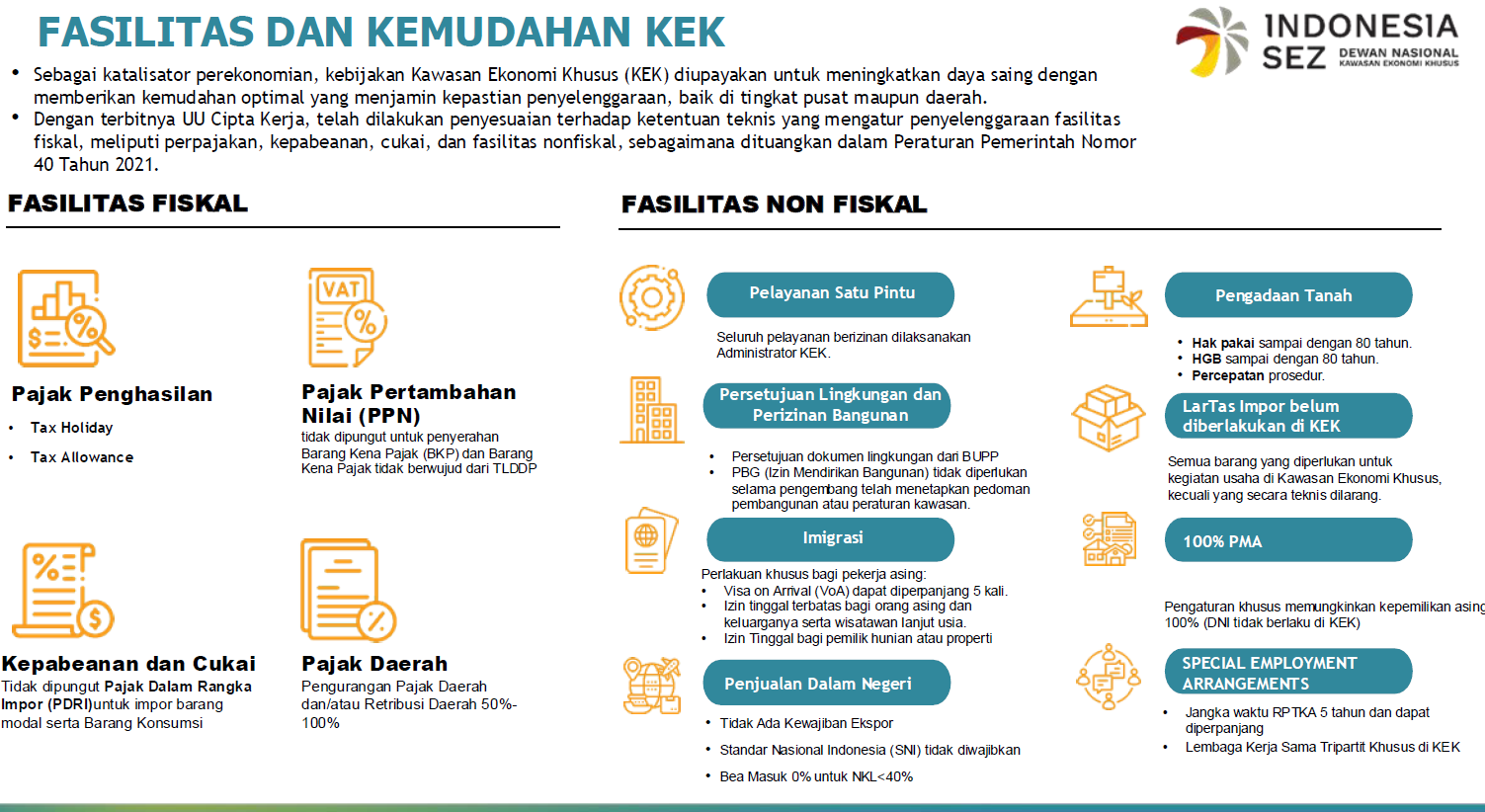

Susiwijono added that SEZs have ultimate facilities and facilities such as fiscal and non-fiscal incentives. For example, the government provides tax incentives in the form of tax holidays that apply to income received or obtained from the main activities carried out in SEZs.

In addition, there are incentives in the form of VAT and STLG exemptions, import duties, and tax exemptions for the import of capital goods for the construction or development of SEZs. There are also non-fiscal facilities such as ease of licensing and licensing, no blacklist or negative list for imported goods, and ease of building permits from SEZ developers.

Susiwijono added that the development of SEZs is not only intended as investment and downstream centers, but also as Indonesia's strategic instrument to strengthen global competitiveness.

"One of our national priorities is to continue downstreaming and developing natural resource-based industries to increase domestic added value. In the future, we will continue to develop SEZs, one of which is by encouraging exports while strengthening import substitution," he said.

Strengthened global supply chain position

In terms of trade, several SEZs such as Sei Mangkei, Palu SEZ, Bitung SEZ, Arun Lhokseumawe SEZ, Galang Batang SEZ, Kendal SEZ, and Gresik SEZ also strengthen export competitiveness with a contribution of Rp 20.33 trillion by mid-2025.

A number of SEZs in Indonesia prove that downstream policies and SEZ development have succeeded in attracting global investment, strengthening exports, and opening up great opportunities for the growth of new economic growth centers in various regions.

Like Gresik SEZ, one of its tenants, PT Freeport Indonesia, inaugurated the world's largest smelter plant. This facility not only strengthens the national copper industry, but also produces up to 52 tons of gold per year from processing 6,000 tons of anode sludge.

Meanwhile, Kendal SEZ officially presents a battery anode factory with a capacity of 80,000 tons per year, equivalent to supporting the production of 1.5 million electric cars (EVs). This strategic product will be exported to the United States, strengthening Indonesia's position in the global supply chain of electric vehicles.

As the first industrial special zone to be built on Java Island, Kendal SEZ has already been filled with 134 companies, and pocketed investments until last August, reaching IDR 179 trillion.

According to the Executive Director of KEK Kendal, Juliani Kusumaningrum, the area managed by the company is focused on six industrial sectors. Starting from the food and beverage industry, furniture, then textiles, garments, apparel, and also all derivatives. "The automotive industry, renewable energy as well, electronics and logistics and packaging. Those are our main industries," he said.

As for employment, according to Juliani, Kendal SEZ has absorbed at least 66,000 workers. This figure exceeds the target of 20,000 workers set. "That's why now we are expanding the area to the second phase. If the first phase was 1,000 hectares, the plan was to finish in 2026, but it turned out to be achieved faster," Juliani said.

Currently, Kendal SEZ has 26% domestic investors, while 74% are foreign investors. They are from China (44%), Hong Kong (17%), and Taiwan (7%). There are also investors from South Korea, Malaysia, India, and Germany.

Meanwhile, in the palm oil downstream sector, Sei Mangkei SEZ is strengthening its role with an investment of IDR 6.5 trillion from PT Unilever Oleochemical Indonesia. By 2024, exports from this area will reach IDR 2.7 trillion, and will be strengthened by the expansion of the KernelMax project which will absorb an additional investment of US$ 20 million.

Meanwhile, the Singhasari SEZ, which also has an education development program, has started lectures at the King's College London (KCL) campus with a target of 5 study programs and 750 students by 2030. Not only that, Queen Mary University of London (QMUL) will begin operations in September 2026 with a target of 6,000 students. And through cooperation with the Russell Group, it is targeted that a total of 10,000 students will study in this area.

According to Corporate Secretary and General Manager of BUPP KEK Singhasari, Kriswidayat Praswanto, the company has attracted investments of up to Rp 2.3 trillion with a workforce of 895 people.

Singhasari Special Economic Zone, located in Singosari District, Malang Regency, with an area of 120.3 hectares, has 4 main activities. Namely, tourism, digital economy, research and technology development, education, and creative industries.

Singhasari SEZ is geographically located in a very strategic area for business development and investment. "The large population of Greater Malang and the superiority of the Human Development Index above the average of East Java Province will be the capital for the development of potential human resources, especially the development of the digital ecosystem and creative economy," Kriswidayat said.

From digital economy to minerals

Speaking of the digital economy, the Nongsa SEZ in Batam, Riau Islands Province, which also manages this sector, has succeeded in attracting investment worth IDR 5.8 trillion from global data center companies. These include GDS (China), Gaw Capital (Hong Kong), Princeton Digital Group (Singapore), and BWDigital Infra Indonesia (New Zealand).

The Banten SEZ in BSD City, Serpong, known as D-HUB SEZ, has attracted strong interest from international and national investors in the health, education, digital, and creative industry sectors.

The value of incoming investments continues to increase to date. "Most importantly, every investment that comes brings technology transfer, job creation, and real impact to the people of Indonesia," said Dian Asmahani, Chief of Corporate Sales & Marketing of D-HUB SEZ.

Companies that have joined or plan to enter the D-HUB SEZ include a fertility institute from Malaysia, a regenerative healthcare company from Singapore, an aesthetic and reconstructive surgery institute from South Korea, a vocational education institution from Japan, a global open-source solutions company from Belgium, as well as Monash University, and Binus University as education sector anchor tenants.

According to Dian, this combination of investors reflects the vision of D-HUB SEZ as an international health and education center that also supports the technology and creative industries.

What sets D-HUB SEZ apart from other SEZs is its collaborative ecosystem.

He added that what sets D-HUB SEZ apart from other SEZs is its collaborative ecosystem. Global investors can collaborate directly with universities, hospitals, technology companies and creative studios. "It is this cross-sector synergy that makes investment in D-HUB SEZ relevant, sustainable and impactful for Indonesia," he said.

Several other sectors that are also managed in the SEZ ecosystem have also experienced improved performance. For example, in the mineral sector, Galang Batang SEZ has recorded remarkable achievements, exporting 2 million tons of smelter grade alumina (SGA) per year. Its capacity is currently being increased to 4 million tons per year, strengthening Indonesia's position as the world's alumina producer.

In addition, international cooperation also continues to grow. Through the Indonesia-China two countries twin parks (TCTP) scheme, the Batang Industropolis SEZ is planned to absorb an investment of USD 3.6 billion or equivalent to IDR 59.3 trillion.

In the health sector, Sanur SEZ presents superior services through the presence of Bali International Hospital (BIH) and a number of clinics with an investment realization of IDR 4.42 trillion. The existence of this area is projected to save foreign exchange up to IDR 86 trillion from public health services that were previously carried out abroad.

Not your average industrial park

Acting Secretary General of the National Council for Special Economic Zones Rizal Edwin Manansang explained that the SEZ development model in Indonesia is indeed made more specific than in other countries.

According to him, the SEZ concept in Indonesia encourages initiatives from business entities, mainly private or state-owned enterprises, and is given the freedom to determine the location and sector to be developed.

"Incentives or facilities and facilities in SEZs are also the ultimate to strengthen competitiveness, both in terms of fiscal and non-fiscal," he said.

In order to optimally leverage the economy, SEZs are also asked to involve UMKM and economic activities of communities around the area. "All of this grows the local economy in real terms," said Edwin.

In order to be evaluated and monitored, the achievements of these increasingly complex economic zones have also been specifically recorded by the Central Statistics Agency (BPS) as a separate indicator. Previously, SEZ performance was included in the industrial sector. According to the Head of the Central Bureau of Statistics, Amalia Adininggar Widyasanti, this change in recording standards is intended to measure economic performance more accurately and to capture the dynamics of Indonesia's economic growth.

According to him, special economic zones have complex economic activities that need to be monitored. "In the SEZ, there is a very large economic activity that must be measured by BPS. We must not miss recording this activity, so that we can more accurately measure economic activity," Amalia explained to SUAR.

He added that more accurate records will directly contribute to the national economic growth picture. The trend of increasing economic activity in SEZs, according to him, is also consistent over time.

Regarding further SEZ activities, Amalia emphasized that any new developments will always be monitored: "If there are activities, new investments, new activities, new operations, they will be recorded," she said.

Deputy Chairman of the Indonesian Industrial Estate Association (HKI), Didik Prasetiyono, admitted that the performance of SEZs was quite encouraging with increased investment interest in the manufacturing, tourism and renewable energy sectors.

However, he also warned that there are still a number of obstacles that need to be addressed. "Challenges in the field remain, ranging from limited infrastructure, legal certainty, to inter-agency coordination that is not yet fully solid," he said.

According to Didik, the most urgent improvement is to improve the ease of doing business to make the investment climate more competitive. "The key to future competitiveness lies in improving the ease of doing business, especially in simplifying licensing, accelerating land and customs services, and consistency in providing fiscal incentives," he explained.

He also considered the digitalization of government services to be crucial to cut bureaucratic time and costs, which investors often complain about. "If digitalization is done seriously and measurably, it can be a big leap in efficiency," he said.

With consistent reforms, Didik is optimistic that Indonesia's position in the eyes of global investors will become stronger. "If these steps are carried out systematically and consistently, I believe Indonesia can appear more competitive than other countries in the region," he said.

Likewise, Deputy Chairman of the Manufacturing Division of the Indonesian Employers Association (Apindo) Rachmat Harsono assessed that SEZs have great potential. However, the reality is sometimes not much different from ordinary industrial zones, because bureaucracy and additional costs still exist.

In addition, the various facilities offered by the government are attractive, but still less competitive than other countries in the Asian region. "Not competitive enough compared to neighboring countries," he said.

Rachmat emphasized that there are three things that are far more crucial for SEZs to develop. "The most important thing so that SEZs can really become growth centers is legal certainty, reliable logistics infrastructure, and one-stop services that really work," he said.

Meanwhile, senior economist from the Institute for Development of Economics and Finance (Indef) Eko Listiyanto sees that SEZs have indeed had an impact in attracting investment, although they still need to be strengthened. "The investment realization target also needs to continue to increase, offsetting the need to grow above 5% in order to get out of the middle income trap," Eko explained.

But he reminded that not all SEZs are able to appear attractive to investors. Thus, improvement efforts need to continue. Meanwhile, a number of obstacles still need to be improved, ranging from the quality of local labor to infrastructure factors.

"Limited regional human resources that meet the needs of the industry, promotions that need to be more vigorous, supporting infrastructure, especially smooth logistics, and competitive energy prices are still a challenge," he said.

Even so, Eko assessed that the additional number of SEZs can still be understood with Indonesia's vast conditions and rich strategic sectors. "The new SEZs must be made more competitive and attractive in attracting investors," he said.

Mukhlison, Dian Amalia, and Gema Dzikri