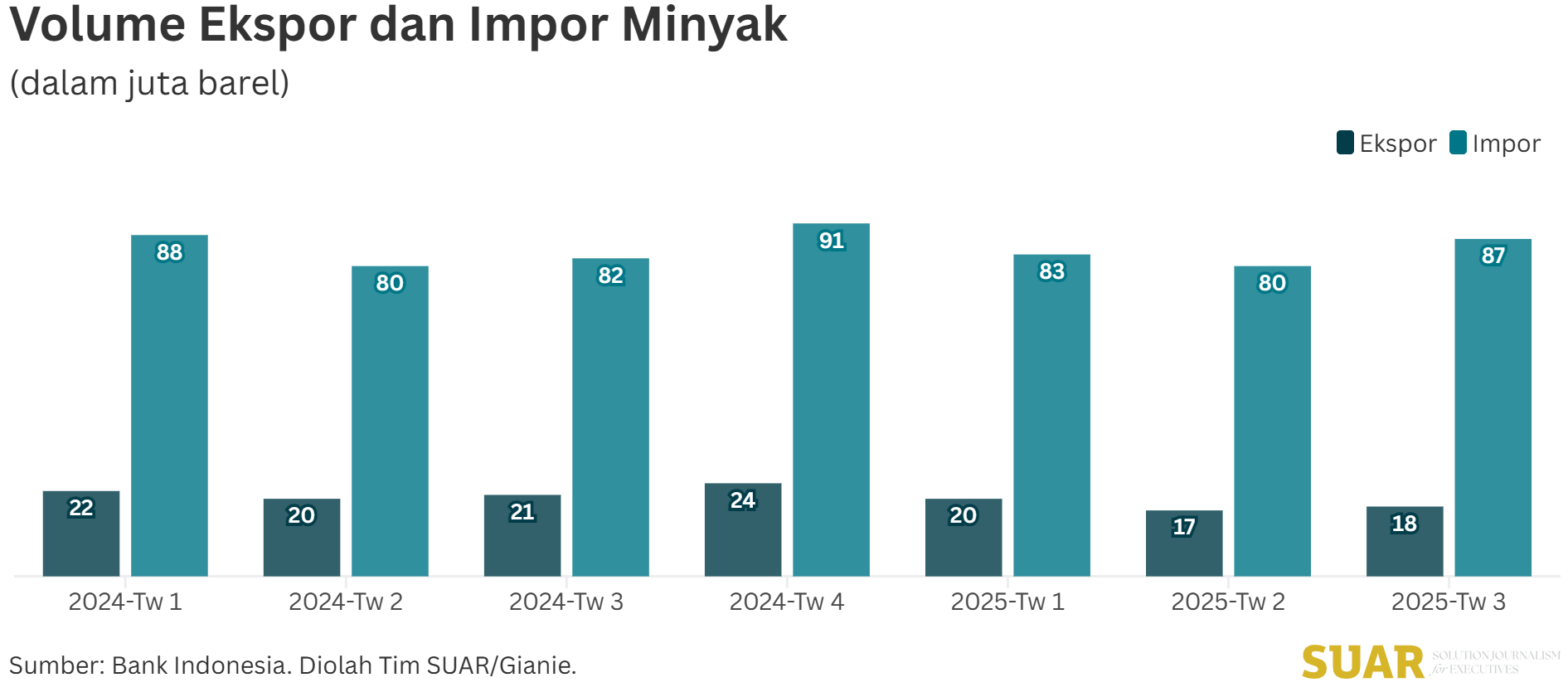

Oil imports of both crude oil and refinery products in the third quarter of 2025 increased after two previous quarters of decline. Oil imports in the third quarter totaled 87 million barrels. Of this amount, the largest import volume was in the form of refined oil products (61%).

The previous two quarters were 83 million barrels (first quarter) and 80 million barrels (second quarter), respectively. The cumulative volume of oil imports in the first- third quarters of this year amounted to 250 million barrels, the same as the volume of oil imports in the same period last year.

The value of oil imports in the third quarter was recorded at US$6.8 billion, up 10.3% compared to the previous quarter. With the increase in oil imports, the oil commodity trade balance was again in deficit with a larger amount, namely USD 5.55 billion. The deficit had reached the lowest value in the last two years, which was in the second quarter of 2025 amounting to USD 4.97 billion.

Oil exports in the third quarter were slightly higher than in the second quarter both in volume and value. The volume of oil exports in the third quarter was 18 million barrels, while in the second quarter it was 17 million barrels. This increase was more due to the increase in crude oil export volume in line with the higher oil lifting compared to the previous quarter.

The increase in crude oil exports was mainly to Thailand and Malaysia. The export volume of refined oil products amounted to 12 million barrels, the same as the previous quarter, which was destined for Singapore and Malaysia.

The oil trade deficit also occurs due to price disparity. Oil export prices are lower than oil import prices. The export price for crude oil in the third quarter was US$67.2 per barrel. Meanwhile, the export price for oil that is a refinery product was USD 72.1 per barrel.

The import price for crude oil was USD 73.9 per barrel and for refinery product oil was USD 81.3 per barrel. These figures increased compared to the previous quarter.

The volume and price of imported oil play a major role in determining the oil trade surplus or deficit. Hence, there is a need to reduce dependence on oil imports of both crude oil and refinery products by increasing oil lifting to meet domestic and export needs.