—---------------------------------------------------------------

Good morning Chief...

The following is important information related to the development of the business universe that needs attention today based on the curation of the SUAR Team.

Who Benefits Most from IEU-CEPA?

Amid the uncertainty of Trump's tariff war, the achievement of the Indonesia-European Union Comprehensive Economic Partnership (IEU-CEPA) agreement is a big hope for the Indonesian business world.

After a long process of negotiations that took about 10 years, Indonesia and the European Union finally completed negotiations on the IEU-CEPA trade agreement in Brussels, Belgium, Sunday (13/7/2025).

Chairperson of the Indonesian Employers Association (Apindo) Shinta Kamdani said that the business world welcomes the news about the achievement of a bright spot in the IEU-CEPA negotiations. Although the entry into force of the new IEU-CEPA is targeted for the end of 2026 or early 2027, this transition period can be a very strategic time to prepare the foundation so that the benefits of IEU-CEPA can be optimized from the first day it comes into force.

At a time when global dynamics are increasingly uncertain, strengthening market orientation to Europe is a very relevant mitigative step. Moreover, many export-oriented labor-intensive industrial sectors have proven to have the capacity to compete if the ecosystem is supportive.

So what sectors will benefit the most from this policy?

Continue reading here.

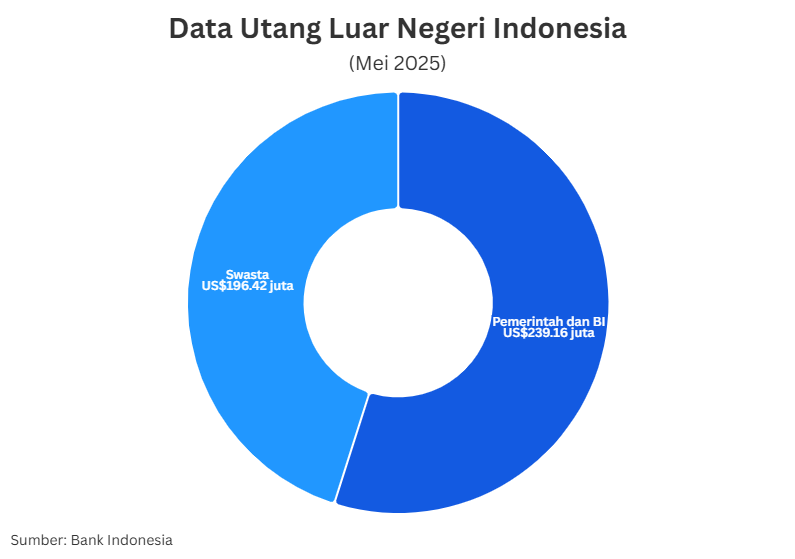

Private External Debt Slows Again, What Does This Signal?

Amid global uncertainty, heightened geopolitical tensions, and tightening global liquidity, Indonesia recorded a decline in private external debt (ULN). Will this be a positive signal or otherwise?

Citing data from Bank Indonesia (BI), private external debt in May 2025 reached US$ 196.4 billion, contracting 0.9 percent compared to the same period last year on a year-on-year (YoY) basis. Private external debt in May contracted more than April which amounted to 0.4 percent YoY.

Segara Institute economist Piter Abdullah Rejalam said that the decline in private external debt could not be separated from the slowing domestic economy.

"If private external debt falls because they are more careful, that's good. But if it drops because our economy is sluggish, investment drops, it becomes an alarm," he said when contacted on Monday (14/7/2025).

Continue reading here.

Business Opportunities in the Maintenance Power Sector

Human beings will naturally age. With this nature comes business opportunities in the care sector.

Based on data from the Central Statistics Agency (BPS), the elderly population in Indonesia reached around 12 percent of the total population in 2024. It is projected that this figure will continue to increase until it reaches 20.31 percent or around 65.82 million people in 2045.

This trend shows that Indonesia is experiencing an aging population, where the number of elderly people is increasing along with life expectancy.

Trisno Muldani, Vice Chairman of the Indonesian Senior Living Association (ASLI), said that along with the increase in life expectancy and the growing number of senior citizens, the need for professional caregivers has increased. This trend opens the door for new jobs and promising business potential.

The caregiver profession is no longer just a side job, but a promising professional career path. With the right training and certification, a caregiver can work their way up from a care assistant to an elderly case manager, and even have the opportunity to work internationally.

However, to seize this opportunity, professionalism is key. Comprehensive training, covering the physical, psychological and social aspects of the elderly, is crucial. Effective communication skills, professional ethics, and an understanding of specific medical conditions of the elderly (such as dementia) will distinguish a quality caregiver.

Continue reading here.

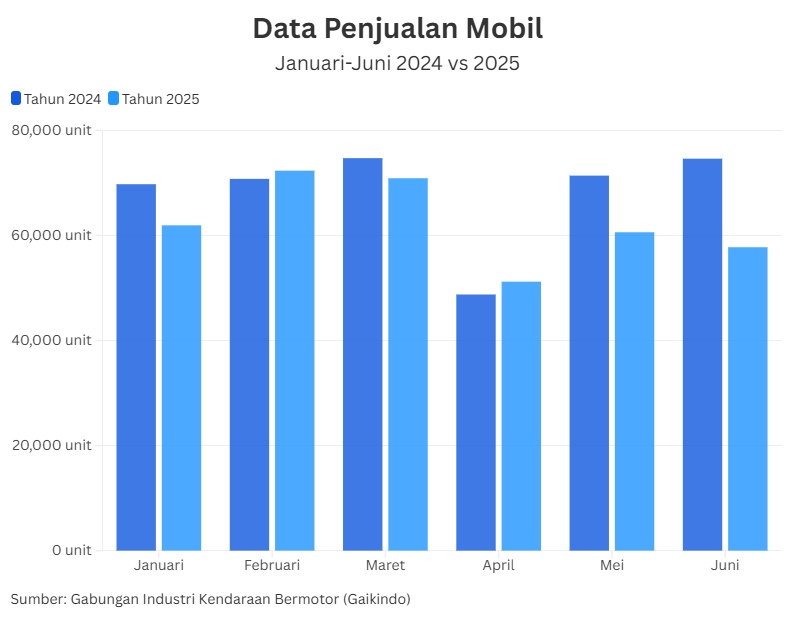

Industry Needs Tax Incentives to Boost Sluggish Car Sales

Car sales are still sluggish. Affected by weakening purchasing power, both automotive industry players and economists need an injection of tax incentives to stimulate sales.

According to the Association of Motor Vehicle Industries (Gaikindo), wholesale car sales in June 2025 amounted to 57,760 units, down 22.6 percent compared to 74,615 units sold in June 2024. Meanwhile, car sales from January to June 2025 reached 374,740 units, down 8.6 percent compared to the same period last year of 410,020 units.

Not only wholesale sales, but retail sales also experienced a slump. In June 2025, only 61,647 units of cars were sold to consumers. This figure is down 12.3 percent from the 70,290 units recorded in June 2024. The decline in retail sales directly reflects the weakening purchasing power or consumer interest in the domestic market.

Given that car sales are sluggish, Gaikindo Secretary General Kukuh Kumara said that the role and presence of the government is needed to encourage the growth of motor vehicle sales. The government is expected to carry out tax restructuring to save the motor vehicle industry in the long term.

"If we study what has been done, there is PPnBM-DTP at the time of Covid-19 which was able to leverage the sales and production of motorized vehicles in a short time. But we are thinking deeper, yes, restructuring motor vehicle taxes," said Kukuh.

Continue reading here.

Chinese cars favored amid sluggish market

In the midst of sluggish retail or direct-to-consumer sales of new cars, a number of vehicle brands have recorded an increase in sales by 2025. Take BYD and Chery. People are interested in feature-packed cars that are more affordable.

Sales of new cars to consumers have been declining in recent years. After the pandemic, retail car sales recovered and reached the 1 million unit sales mark in 2022. After that, retail sales slowly declined.

In 2025, Gaikindo targets car sales to reach 900,000 units. This target is slightly higher than the realization of car sales in 2024, which was 889,680 units. However, sales until the first semester of this year only reached 390,467 units (43 percent). This number is down 9.7 percent compared to the same period in 2024.

Some car brands whose sales fell include Toyota (-9.8 percent), Daihatsu (-25.4 percent), Honda (-24.2 percent), Suzuki (-20.5 percent), and Wuling (-25.9 percent). However, there were other brands whose sales increased such as BYD cars from 1,596 units to 13,705 units (758.7 percent) and Chery cars from 3,887 units to 10,283 units (164.5 percent).

Continue reading here.

Official Statistical News Releases and Publications of the Central Bureau of Statistics

The Central Statistics Agency (BPS) will release two official statistical reports (BRS) and one publication on Tuesday (15/7/2025). The BRS that will be released are about the poverty profile and the level of inequality in population expenditure. The publication that will be released is about Statistics on Large Animal Husbandry Companies and Small Animal Husbandry 2024. The release of these statistics and publications can help the business world get a clearer picture of the current economic conditions so that they can make more accurate decisions.

Bank Indonesia Board of Governors Meeting

Bank Indonesia (BI) will hold its July 2025 Board of Governors Meeting (RDG) starting Tuesday July 15, 2025-Wednesday July 16, 2025. As with the monthly RDG routine, BI will determine the policy of raising or lowering or continuing the current benchmark interest rate. The results of the July 2025 BI RDG meeting will be announced in a press conference on Wednesday, July 16 at 14.00. The determination of the benchmark interest rate is important for the business world because it will affect not only the interest rate of the financial services industry, but also have an impact on stimulating real sector funding.

"You don't need to be the best to succeed, but you do need to be the most persistent." Barbara Corcoran (Entrepreneur and Investor)

Have a great day, Chief.

Team SUAR