Good morning Chief...

The following is important information related to the development of the business universe that needs attention today based on the curation of the SUAR Team.

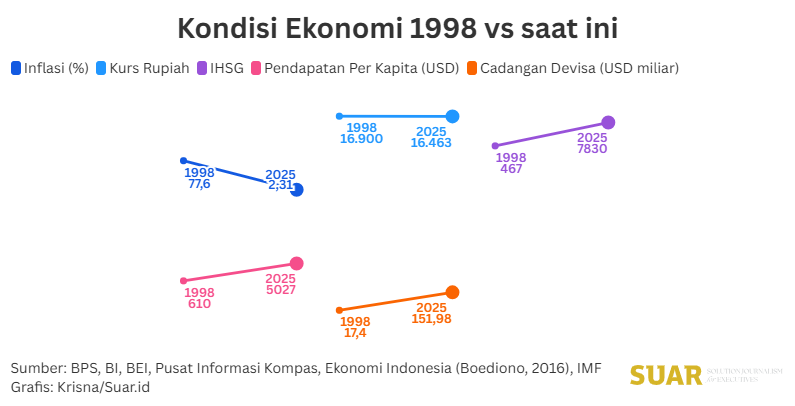

Measuring the 2025 Economy with 1998, Lessons to Avoid Another Economic Crisis

- The demonstrations at the end of August that led to chaos, looting of private homes of state officials, and loss of life triggered a collective memory of trauma that this situation could trigger an economic crisis like 1998. Let us compare the economic conditions of 1998 with now, so that we can learn lessons and take the right policies so that the economic crisis can be avoided. Also, so that we are no longer trapped in trauma and excessive fear even though we still have to address the current conditions with caution.

- All stakeholders need to look more carefully, although they have similar symptoms, the causes of economic anxiety today are different from 1998. One of the main triggers of today's worries is that fiscal management does not fit the spiritual and economic conditions of the community. All economic stakeholders hope that there will be policy changes that stabilize security and order conditions in order to boost the economy.

Read more here.

Socio-Political Stability, a Foundation for the Banking Industry to Navigate the Third Quarter

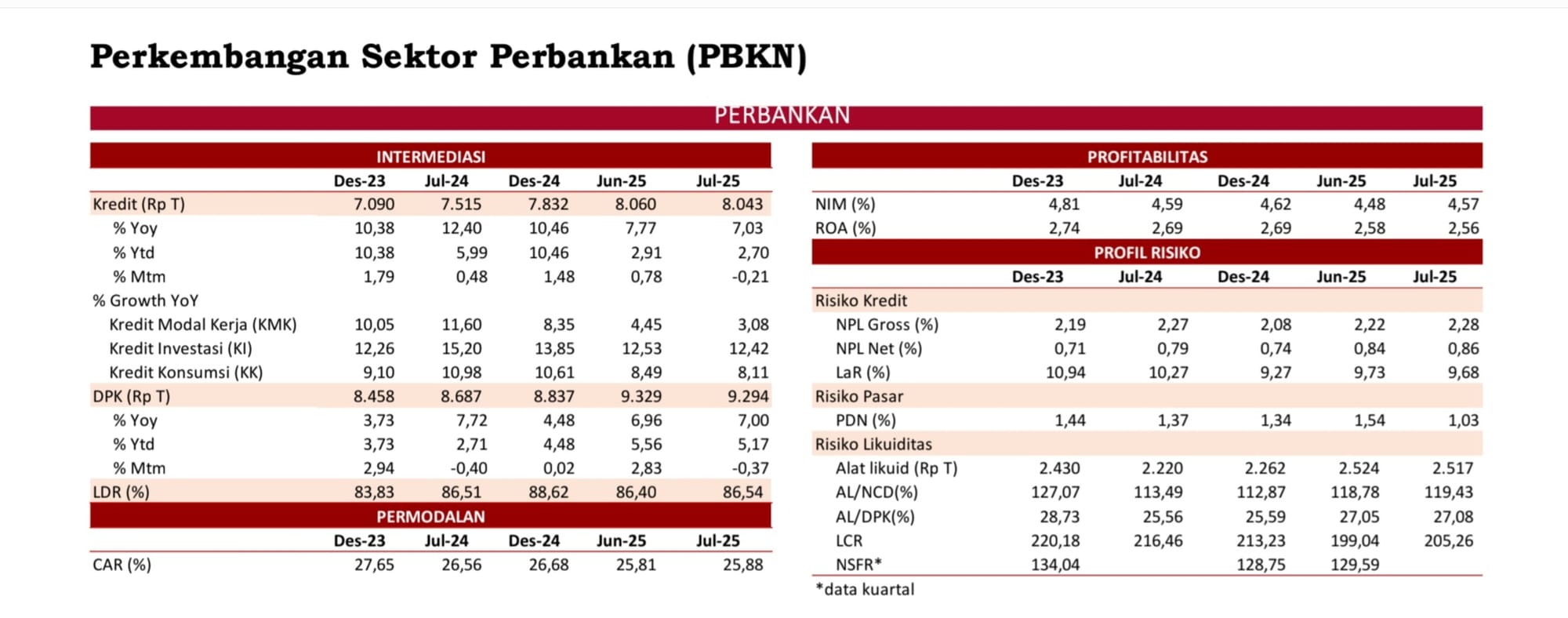

- The banking industry remained stable after the marathon demonstrations that took place since August 28. Socio-political stability is needed to navigate the third quarter. The Financial Services Authority (OJK) said that the Indonesian financial services sector successfully passed through the socio-political turbulence caused by the series of demonstrations that hit a number of cities in Indonesia.

- Banking also continued to grow. Intermediation of banking services was stable with a manageable risk profile. Third-party funds (DPK) in July 2025 were recorded to grow as high as 7.00% year on year (YoY) to IDR 9,294 trillion, with current accounts, savings, and deposits growing by 10.72%, 5.91%, and 4.84% YoY respectively. On the other hand, bank lending in July 2025 grew by 7.03% YoY to reach IDR 8,043 trillion. Meanwhile, the capital adequacy ratio (CAR) in July increased to 25.88%, up from June's 25.81%, as a strong risk mitigation cushion to anticipate global uncertainties.

Read more here.

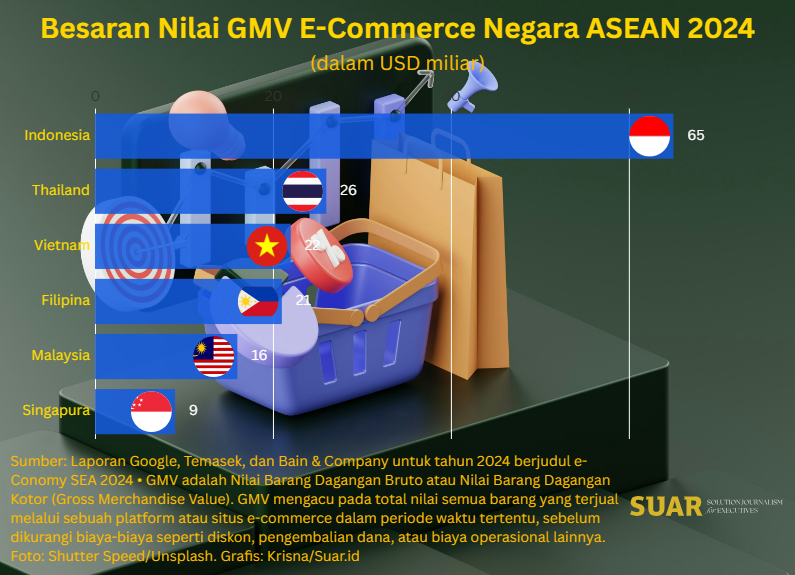

Through DEFA, Seize Digital Opportunities in the ASEAN Region

- ASEAN is preparing to step into a new chapter that has the potential to change the face of the region's economy. Through the Digital Economy Framework Agreement (DEFA), member states are designing the first comprehensive framework that unifies various cross-border digital policies. This ambitious initiative is targeted to be completed by 2025, and become one of the main achievements when Indonesia assumes the ASEAN Chairmanship in 2023.

- As of August 2025, about 60% of the DEFA text has been agreed, covering crucial issues such as personal data protection, cybersecurity cooperation, artificial intelligence (AI), digital equality, inclusion, and support for UMKM. ASEAN is targeting 70% of the substance to be completed before the 26th AECC in October, an important milestone for the overall negotiations to be completed in early 2026 and signed in the final quarter of that year. If completed, the DEFA is projected to catalyze ASEAN's digital growth, doubling the region's economic value from a projected USD 1 trillion to USD 2 trillion by 2030.

Read more here.

KIPK interest rate is much lower, stimulating business actors

- Through the Labor Intensive Industrial Credit (KIPK) program, the government subsidizes an interest discount of up to 5%. Debtors get 6% interest per year, lower than the usual 12%-13%. "We can turn capital more freely because the interest costs are smaller," said Putu Agus Aksara Diantika, owner of Dian's Rumah Songket and Endek, one of BPD Bali's debtors in the KIPK program, when contacted Sunday (7/9/2025).

- The government launched the KIPK program with a loan ceiling of between IDR 500 million and IDR 10 billion, an interest subsidy of 5%, and a tenor of up to eight years. This scheme is intended to help industry players increase productivity, expand employment, and strengthen national economic resilience.

Read more here.

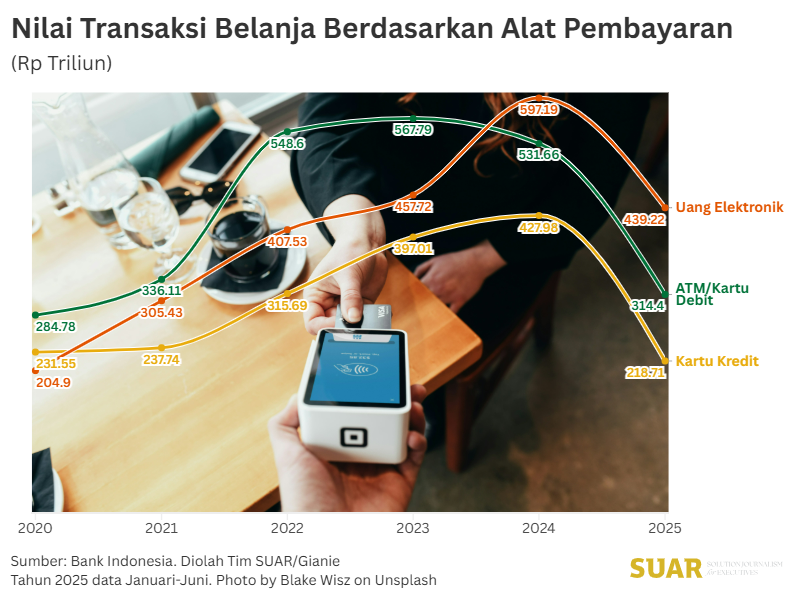

Nurturing Customers, Increasing Shopping Transactions

- The value of shopping transactions in Indonesia continues to increase every year. In 2024, the nominal value was more than Rp 1,500 trillion or around 7% of gross domestic product. Until the first half of this year, the value of shopping transactions was already 62% of last year's nominal.

- Based on Bank Indonesia data, during the 2020-2024 period, the value of shopping transactions recorded through the use of payment instruments in the form of cards and digitally (ATM, debit, credit cards, and electronic money) has doubled. Namely, from Rp 721.2 trillion in 2020 to Rp 1,556.8 trillion in 2024. In 2025, during the first 6 months, the value has been recorded at IDR 972.3 trillion or around 62% of last year's value.

- This increase in the value of shopping transactions can be seen as an improvement in public consumption, especially the upper middle class as users of all types of cards monitored by Bank Indonesia. The largest increase occurred in 2022, which grew 44.6% compared to the previous year.

Read more here.

Statistical Release of Foreign Exchange Reserves August 31, 2025: Bank Indonesia (BI) plans to release the position of Indonesia's foreign exchange reserves as of August 31, 2025 on Monday (8/9/2025). The monthly publication agenda reported by BI is important to note to understand the position of Indonesia's foreign exchange reserves, which is one of the vital indicators to maintain the stability of the rupiah exchange rate and support national economic resilience. Information on Foreign Exchange Reserve Statistics can be accessed by the public through Bank Indonesia's official website https://www.bi.go.id/id/default.aspx.

Discussion on Labor Wages by P3D DKI Jakarta: Jakarta Productivity Podcast Series VIII, with the theme Productivity-Based Wage Implementation Strategy: Challenges and Solutions, will be held on Monday, September 8, 2025, at 10:00 WIB. The event, organized by the DKI Jakarta Provincial Productivity Development Center (P3D), will feature expert speakers, including academics, business representatives, and productivity professional associations, such as Turro Selrits Wongkaren (Lecturer FEB UI), Ronald Sihombing Hutasoit (Vice Chairman of DKI Jakarta Kadin), Drs. Nurjaman (Indonesian Employers Association), and Sanggam Purba (Chairman of Approdi). Participants can attend this event through the Zoom online connection. If you are interested in participating, please register for free at https://S.ID/REGPPJ or you can watch the live broadcast on P3D DKI Jakarta's YouTube channel.

"Success is not about how big we start, but how big we stay and keep going." (Chairul Tanjung - Indonesian Entrepreneur)

Have a good day Chief.

Team SUAR