Good news for micro, small, and medium enterprisesUMKM). The government's decision to raise the ceiling of the People's Business Credit (KUR) with a fixed interest rate of 6% per year is a breath of fresh air to increase populist economic growth amid global economic uncertainty.

The government on Wednesday (19/11/2025) decided to raise the ceiling of the People's Business Credit (KUR) from Rp 500 million to Rp 1 billion as part of expanding access to financing for small businesses.

In addition to the ceiling increase, the KUR interest scheme was also changed from a gradual model to a flat one. The government sets a flat interest rate of 6% even though the debtor has made several applications.

Chairperson of the Indonesian Micro, Small and Medium Enterprises Industry Association (Akumandiri) Hermawati Setyorinny said that the news of easing KUR applications repeatedly made some business actors feel that they had additional opportunities in terms of access.

"This change is the most noticeable aspect of the new KUR policy, especially for micro businesses with a larger capacity. Business actors who have developed are easier to take advantage of this policy than the smallest micro actors. What has changed is that they can apply without restrictions as before," he said when contacted by SUAR in Jakarta, Thursday (11/20/2025).

In addition, the government also removed the KUR repetition limit, which was previously limited to four times for the production sector and twice for the trade sector.

However, he reminded that businesses with small turnover still face difficulties in accessing KUR. Many of them experienced late payments during the pandemic which were then recorded in the Financial Information Service System (SLIK), hindering their reapplication even though their businesses are still operating.

This administrative hassle creates significant barriers for micro UMKM that want to utilize financing. Hermawati views this as potentially leaving small businesses behind from the opportunities provided by the government.

Hermawati also highlighted the difference between central regulations and banking practices in the field. A number of banks, according to her, still ask for collateral even though official regulations state that it is not mandatory for certain loans.

In addition, implementation varies between banks and the lack of socialization means that business actors do not always understand the applicable rules. As a result, access to KUR still often feels more complicated than the policy narrative presented by the government.

"What should be given leeway is the procedural requirements, especially for micro businesses. SLIK that is not stuck but only late should be passed again because the business is still running. If this policy is to truly become an opportunity and solution, the supervision and implementation must be uniform in the field," he said.

Quoted from CNBC Indonesia, UMKM Minister Maman Abdurrahman said that this relaxation aims to provide space for UMKM players to strengthen their businesses.

"Now it has been opened, so it can be several times, the repetition can be several times until the UMKM are really strong and ready to be released," he told reporters.

The removal of this limit is expected to help businesses that need recurring financing.

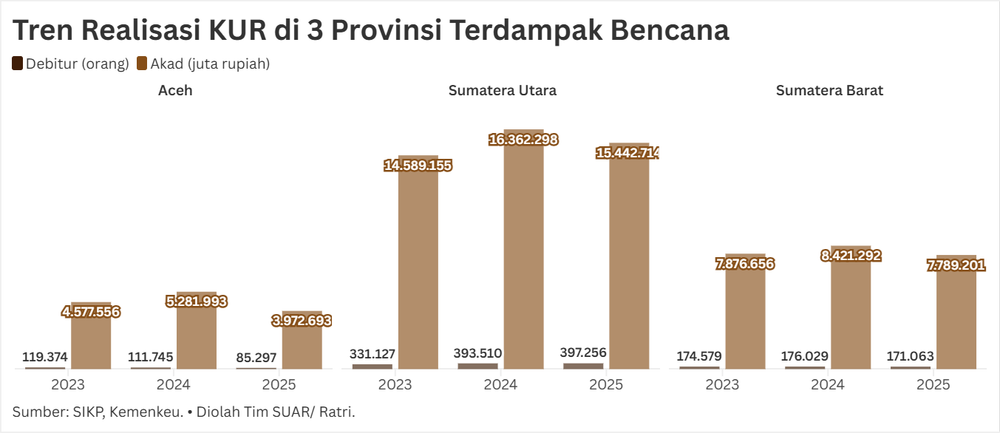

In 2025, the realization of KUR distribution reached 83% or Rp 238 trillion of the target of Rp 286 trillion. New debtors were recorded at 2.25 million or 96% of the target, while graduated debtors reached 112% or 1.3 million people.

Maman also said that more than 60% of the KUR budget in 2025 had been channeled to the production sector. This distribution also creates the potential for employment of up to 11 million people.

For 2026, the government set the KUR ceiling allocation at Rp 320 trillion, an increase of Rp 40 trillion from the previous year. Maman explained that this increase is in line with President Prabowo's focus on strengthening the people's economy. He also noted that KUR distribution in the production sector showed an increasing trend, from 54% in 2020 to 60.7% in 2025. This achievement is said to be the highest since the KUR program first ran.

By regulation, the classification of micro businesses refers to Government Regulation Number 7 of 2021 which stipulates that the annual sales revenue is at most IDR 2 billion.

This provision updates the maximum turnover limit of Rp 300 million listed in Law No. 20/2008. This update is the basis for the government in determining the target KUR recipients, including groups of business actors in the micro category.

This provision is also used in the distribution of financing so that business segments that meet the criteria can access facilities in accordance with regulations.

Open opportunities

Bank Permata Chief Economist, Josua Pardede, assessed that the increase in the KUR interest ceiling still opens up opportunities for capacity expansion for UMKM that are ready to expand.

"This facility can be utilized for equipment investment, production process automation, and certification financing so that products meet modern market and export standards," he said.

According to him, the gradual financing pattern is also more feasible because the re-application uses the same interest rate.

From the banking side, Josua assessed that the sustainability of the 6% interest scheme is strongly influenced by the adequacy of subsidies and the effectiveness of risk guarantees. The addition of the subsidy ceiling in 2026 is considered to provide wider cost space for distributors as long as guarantee claims remain under control.

"The guarantee scheme that bears most of the potential losses also improves the feasibility of distribution for banks," he said.

Josua assessed that the risk-based guarantee fee plan has the potential to make the cost structure more aligned with the characteristics of sectors and regions.

To achieve the target of 65% KUR distribution to the production sector, Josua emphasized the importance of focusing on priority value chains in each region. Credit schemes that follow the production cycle can help businesses adjust financing to their operating patterns.

Expansion of forms of collateral for the creative sector as well as data integration with local governments is also needed to make access to productive financing more equitable. "These steps will be a lever so that the distribution really flows to value-added activities," he said.

Regarding the elimination of the limit on the number of KUR applications, Josua assessed that this policy needs to be accompanied by safeguards so that credit quality is maintained. He said the need for selection based on the debtor's track record and partial repayment of the principal before re-submission.

Recurring financing should be directed towards a measurable plan of use, such as capacity expansion or fulfillment of new order contracts, rather than to cover short-term cash flow.

"Removing the limit on the number of applications does expand access, but there needs to be a safety fence so that credit quality remains healthy," he said.

Here are some of the ways:

- First, the discipline of selection based on the debtor's track record and transaction history should be the main requirement for reapplication, including the obligation to repay part of the principal before top-up.

- Second, recurring financing should be tied to a measurable plan for the use of funds, not just a cash flow patch.

- Third, re-enforce the no-collateral provision for KUR below Rp 100 million to keep the door open for new players, while ensuring that field practices do not deviate from the regulation.

Financial literacy

On different occasions, initiatives to empower UMKM have also emerged. Efforts to increase the capacity and empowerment of UMKM can also be done by increasing their literacy level. This was the common thread in the Smart UMKM event in Jakarta (20/11/2025).

Temmy Satya Permana, Deputy for Small Business of the Ministry of UMKM , said that UMKM players must understand financial literacy as capital to manage finances professionally.

The impact that can be caused if UMKM actors do not understand finance is that UMKM actors may have difficulty in recording, budgeting, and managing cash flow, and do not separate personal and business finances.

Vulnerability to fraud, lack of understanding can make UMKM players vulnerable to illegal online loans or risky investment schemes with the lure of instant profits.

"The absence of accountable financial reports and lack of understanding of financial products can make it difficult for UMKM to obtain loans from formal financial institutions," he said.

SeaBank Indonesia Deputy President Director Junedy Liu said that the rapid growth of the digital economy has not been accompanied by equal readiness. According to him, one of the challenges faced by UMKM in the digital era is financial management and business development.

To meet these challenges, SeaBank supports the launch of the UMKM Pintar digital learning platform to provide easy, practical and relevant access to financial literacy for UMKM , especially micro-small businesses and women in building sustainable businesses and financial resilience in the digital era.

Junedy added that through UMKM Pintar, businesses can access interactive modules on financial management, business digitalization strategies, and the use of formal financial services.

"All materials are compiled with a gender-based approach and adapted to the local context, so that every woman and business actor can manage and grow their business sustainably, whenever and wherever they are," she said.

The module also comes with several calculators and self-check-ups to see their own financial situation and how to calculate the cost of goods.

Read also:

On the same occasion, Women's World Banking Southeast Asia Regional Director Angelique Timmer said, Women's World Banking believes financial inclusion is an important element in women's economic empowerment.

She emphasized that Women's World Banking's 2023 research on e-commerce entrepreneurs showed that only 44% of women entrepreneurs in Indonesia managed to maintain their business for 3-5 years, and the number was even smaller for those who lasted longer.

"The findings confirm that access to capital, education, mentoring and learning opportunities are equally important in strengthening the resilience of their businesses. Through our collaboration with SeaBank, we want to ensure women have access to capital and knowledge," said Angelique.

UMKM Pintar comes as a solution to make UMKM players, especially women, develop and understand finance.

The benefits of women successfully becoming UMKM players are that they become pillars of the national economy, can achieve financial and economic independence for their families, and can become agents of social change by creating jobs and driving the community economy. In addition, this success also strengthens the role of women as economic support and provides a positive example for the surrounding environment.