More and more Indonesian women are working. As of February 2025, based on data from the Central Statistics Agency (BPS), the figure reached 58.4 million people or around 40% of the total working population.

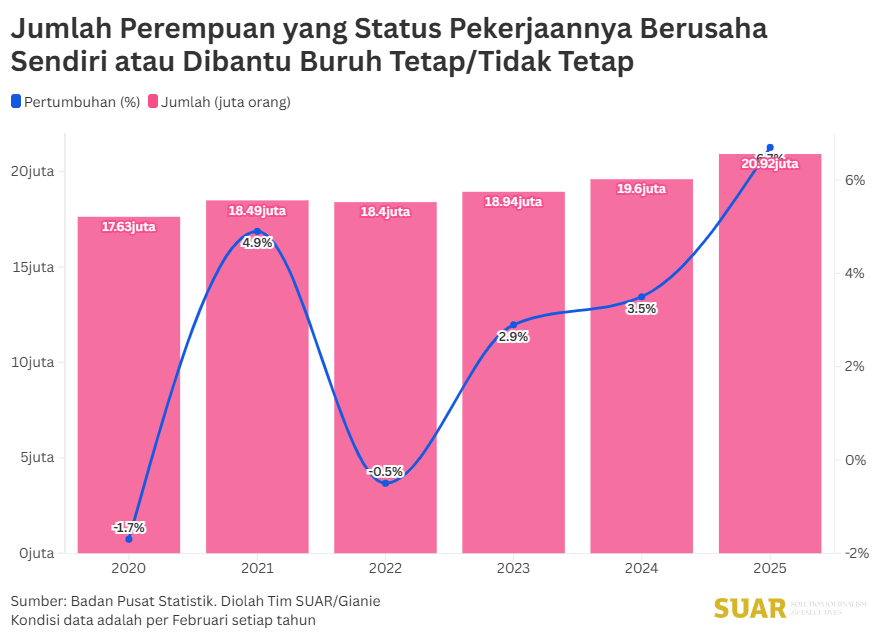

Interestingly, of the 58.4 million working women, those whose employment status was self-employment - either assisted by permanent or non-permanent laborers - reached 20.9 million people (35.8%).

The trend is rapidly increasing, even when compared to pre-pandemic times. In 2019, the number of self-employed women - both assisted by permanent and non-permanent laborers - was only 17.9 million people (34.4%). Over the period 2020-2025, this group of working women grew by an average of 2.6% per year.

This growth rate is higher than that of women who work as employees. This group of women wage earners only grew by an average of 1% per year over the same period.

The growing number of self-employed women cannot be separated from the ease of access to business capital to start and develop a business. Especially for micro, small and medium enterprisesUMKM).

Research from financial institution Amartha states that of the various sources of loans available to UMKM, conventional banks still provide the highest percentage of loans (48%). Followed by microfinance institutions (33.3%) and cooperatives (16.8%). However, there is also a growing interest in accessing online fintech loan applications (12.2%) to obtain capital.

One of the financial technology applications that provides alternative lending is Amartha. Established in 2010, Amartha provides financial services that can be accessed by grassroots small and medium enterprises through the concept of a microfinance marketplace with a peer to peer (P2P) lending model.

Amartha's main mission is to empower UMKM by targeting rural women to gain access to working capital loans. Until 2024, Amartha has disbursed more than Rp 6 trillion to one million women micro-entrepreneurs in more than 35,000 villages in Java, Sumatra, and Sulawesi.

By 2023, 61.56% of UMKM partners, also known as Amartha's Ibu Mitra, have reported an increase in annual income. In fact, as many as 67,672 Amartha Ibu Mitra have grown from the micro business level to the small business level.

Fintech P2P lending is a financing option because of its easy requirements. It usually only requires an ID card for application and offers faster loan disbursement. This platform is beneficial for entrepreneurs in urgent situations. In addition, there is an ease of procedure that is considered to provide more privacy as there are no home visits by lending officers. However, the higher interest rate poses a challenge for UMKM to repay on time.

UMKM and women are like two sides of a coin. Concern for the development of UMKM, especially those run by women, is the key to community economic empowerment to improve welfare.