Indonesia's base metals industry has proven to be an anchor of national manufacturing growth, even amidst turbulent market conditions. The sector, dominated by the development of nickel, aluminum, and especially iron and steel, has shown good resilience.

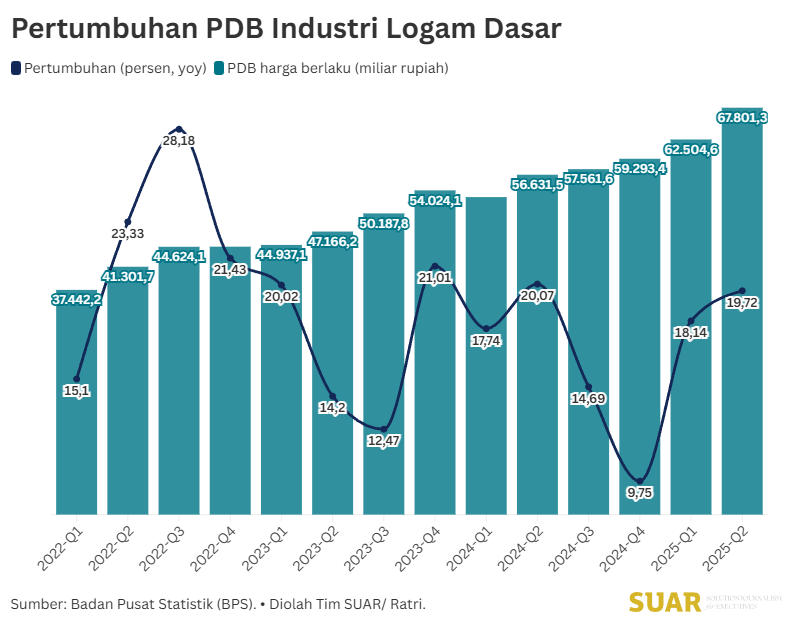

Data from the Central Statistics Agency (BPS) shows that the Gross Domestic Product (GDP) value of the Basic Metal Industry sector continues to record significant growth. In the second quarter of 2025, the growth of this sector jumped to 19.72% (yoy), with a GDP value at current prices reaching IDR 67,801.30 billion. In the third quarter, this sector grew 18.62%.

The positive performance was achieved amid challenging global market conditions. Including facing fluctuations in energy prices, tight monetary policies in developed countries, and the economic slowdown of China, which is the world's largest steel consumer. However, Indonesia managed to take advantage of its strategic position through downstream programs. The focus on high value-added derivative products, such as stainless steel from nickel and various steel products, creates new demand that is more resilient to raw commodity price volatility.

The government's initiative to build an electric vehicle ecosystem also supports growth by ensuring that demand for nickel and its derivatives remains stable. This step also keeps the iron and steel sector moving as the main supplier of domestic infrastructure and manufacturing.

Among the basic metal subsector groups, the iron and steel industry plays a vital role as the main support for growth and trade balance. The downstream policy has successfully turned the steel trade balance from a deficit to a surplus. BPS export and import data shows that the steel trade balance had a deficit of IDR -3,532 billion in 2020.

After that, the industry slowly recorded a surplus of IDR 5,715 billion in 2024 and reached IDR 5,943 billion in the third quarter year-2025. The increase in steel exports from 9,209 thousand tons in 2020 to 17,885 thousand tons in 2025 shows that the increase in domestic steel production capacity has successfully penetrated the global market.

Despite recording GDP growth and an export surplus, Indonesia's steel industry is now facing problems in the domestic market with unfair competition from imported products. The influx of steel products from abroad, which is strongly suspected of involving dumping practices and abuse of the Harmonized System Code (HS Code), has depressed the utility of local mills and threatened the sustainability of investment.

This issue is a serious concern that was also brought to Commission VI of the House of Representatives of the Republic of Indonesia (DPR RI) on November 10, 2025. Council members and industry representatives agreed that massive imports of cheap steel risk paralyzing the domestic steel industry, which is key to national manufacturing independence.

As a strategy to ensure the continuity of the iron and steel subsector as a strong support for the base metal industry, firm regulatory intervention is needed. Commission VI of the House of Representatives urges the government to tighten supervision of illegal import practices and optimize the application of trade protection instruments such as Anti Dumping Import Duty (BMAD) and Safeguard Duty (BMTP).

In addition, strengthening the Commodity Balance (NK) and prioritizing the use of local products (TKDN) in strategic projects must be implemented in a disciplined manner. With effective measures to protect the domestic market, Indonesia's base metal industry, supported by the performance of the iron and steel industry, can continue its growth trend and realize the vision of national industrialization.