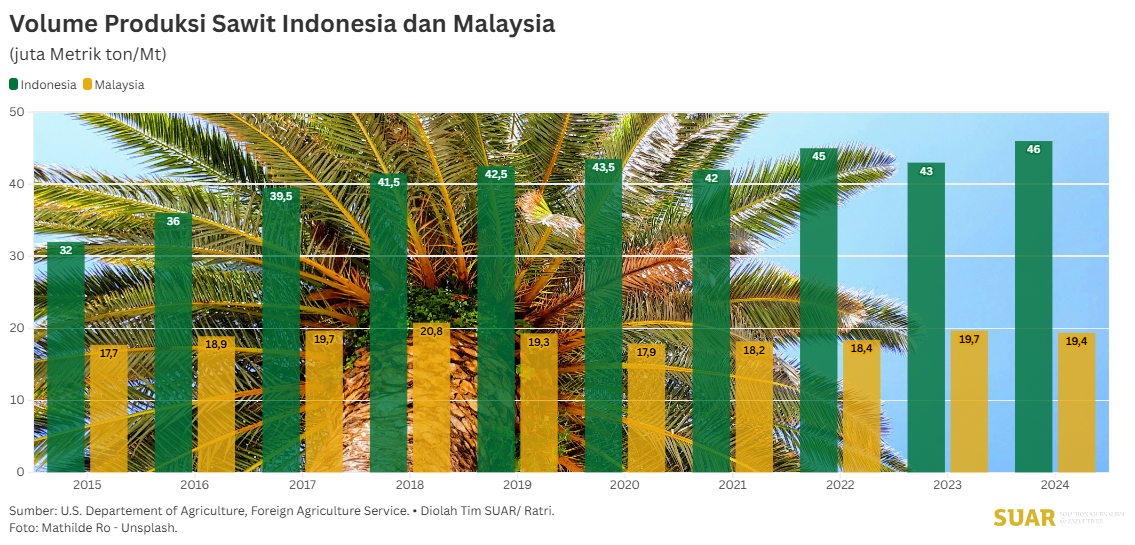

As the world's two main producers of crude palm oil (CPO), Indonesia and Malaysia continue to compete fiercely in the export market. Indonesia accounts for more than 50% of total global production or around 46 million metric tons (MT), while Malaysia accounts for around 20% or around 19 million MT.

However, despite these high production figures, the issue of legitimacy and sustainability certification is a critical one - especially in the European market.

The European Union (EU), committed to the environment and human rights, is increasingly prioritizing certified products. On September 10, the EU recognized Malaysian palm oil products that meet sustainable standards through the Malaysian Sustainable Palm Oil (MSPO) certificate. The MSPO legitimization is an advantage and gives Malaysia a strategic advantage in accessing the European market.

This recognition makes it easier for Malaysian palm products to meet stringent EU import standards, reduces bureaucratic barriers, and gives European consumers confidence that the products they buy come from sustainable sources. The competitiveness of Malaysian palm oil increases and paves the way for greater market expansion.

In contrast, Indonesia, which has yet to achieve equivalent recognition for its Indonesian Sustainable Palm Oil (ISPO) certification, faces major challenges. Although ISPO is a comprehensive mandatory certification scheme, the lack of official recognition by the EU means that Indonesian palm products could potentially face non-tariff barriers and additional inspections - slowing down the export process.

The challenges of EU regulations related to sustainability and environmental issues have been felt in 2020. The export market was depressed, because at that time the EU began to make it difficult for products indicated to be involved in deforestation cases - including palm oil - to enter the European market. Thus, from around 28% of vegetable oil demand, namely palm oil, reduced to only around 20%.

Although declining drastically from year to year, Indonesia's market share of palm oil products in the European market still takes a larger portion than Malaysia. The palm oil market in Europe itself is getting narrower, but the legitimization of sustainable product certification has the opportunity to gain easier space in accessing the market.

Indeed, the domestic market is able to absorb large amounts of palm oil production for various uses. However, awareness of sustainability, environment, and other humanitarian issues is important to penetrate the European market.

With a combination of diplomacy, improved standards, and effective promotion, Indonesia can improve its competitiveness and ensure a sustainable future for its palm oil industry in the global market.