The imposition of export duties poses a challenge for coal mining, which has been the backbone of exports and contributes significantly to gross domestic product (GDP).

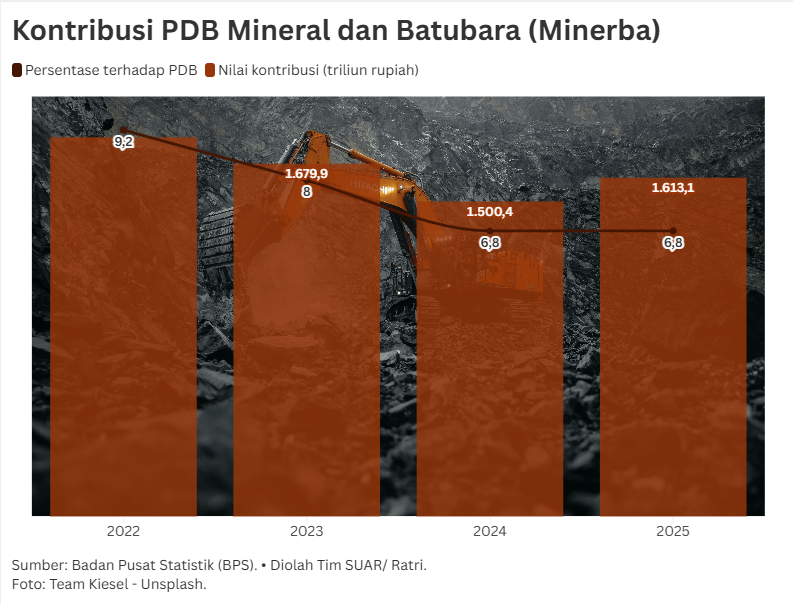

In 2022, the mineral and coal sector (minerba) contributed 9.2% to GDP. However, its role declined to around 6.8% in 2025, with a contribution value of IDR 1,805.8 trillion (2022) to IDR 1,613.1 trillion (2025). This decline in percentage is likely influenced by commodity prices or growth in other sectors. In 2025 (up to the third quarter), the contribution value of this sector increased by 7.5% compared to the previous year.

Meanwhile, export performance has shown a significant surge since 2020. The value of coal exports peaked in 2022 at US$46,764.90 million. The increase in export value in 2022 was mainly driven by a surge in global commodity prices following geopolitical conflicts. This is because export volume only increased slightly from 345,453 thousand tons (2021) to 360,115 thousand tons (2022).

Although export volume continued to increase during the 2020-2024 period, export value, which is influenced by global price dynamics, has declined since 2023. After reaching US$46,764.9 million (2022), the value of exports fell by 26% in 2023, even though export volume increased by 5.4% from the previous year. Despite the decline in coal prices in the global market since 2022, producers continue to push for higher export volumes.

The imposition of export duties on these key export commodities poses a challenge for the industry, especially the coal and lignite mining sector. Among other things, this challenge includes a decline in price competitiveness in the global market. The imposition of export duties will increase prices, potentially causing Indonesian coal to be more expensive than that of other major competitors such as Australia.

This situation could cause a shift in demand by international buyers, thereby reducing export volumes, which have been a dominant source of revenue. In addition, company profit margins, especially for companies with high production costs, will be squeezed, which could hamper investment in mining operations and exploration.

Although intended to encourage domestic coal processing (downstreaming), export duties have not served as an incentive to encourage the greater investment needed to build gasification facilities or methanol plants. Downstreaming projects require trillions of rupiah in funding and involve high technological risks. If export margins from raw coal are too depressed, companies could lose capital that could otherwise be used to fund downstreaming projects.

In addition, this policy also has the potential to trigger regulatory concerns among investors, who view export duties as government intervention that can be changed at any time, thereby reducing long-term business prospects.

The discourse on export duties needs to be considered carefully, especially to balance the need for downstreaming and the reality of the commodity market. To anticipate its impact, export duties need to be accompanied by both fiscal and non-fiscal incentives as well as legal certainty for downstream projects. The aim is to reduce the risk of Indonesia losing its share of the raw coal export market amid the global energy transition.