The SUAR Team, through the Business World Universal Survey, explores the thoughts of company leaders, regulators, and economic observers in an effort to play a role in developing UMKM. The results of the survey:

- The activity of UMKM has supported many families and contributed to the National economic growth. The Ministry of UMKM of the Republic of Indonesia stated that based on data from the Central Statistics Agency, the number of UMKM currently is 65.5 million units, being able to absorb 119 million workers. This number is more than half of the Indonesian workforce, which amounts to 153 million people. The UMKM sector contributes 61.9% to the Gross Domestic Product (GDP).

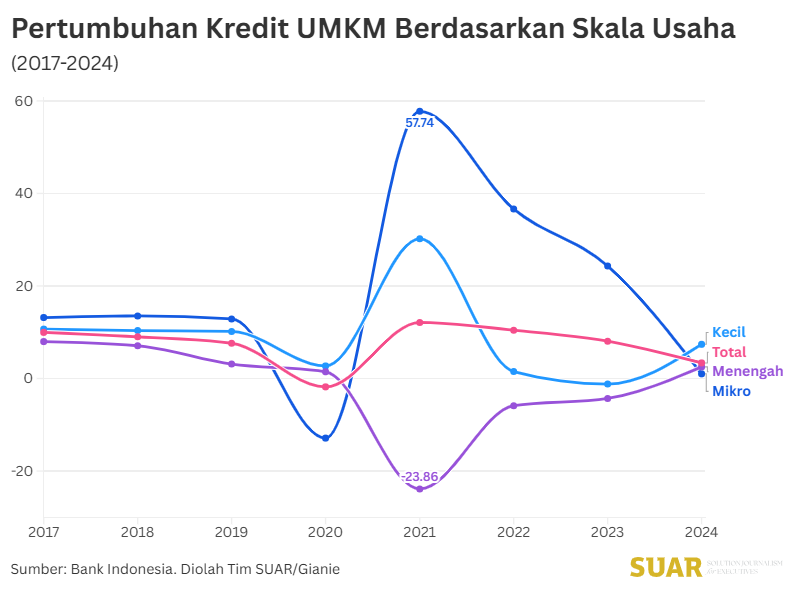

- However, UMKM still face major challenges, one of which concerns access to financing for business development.

- The results of a survey conducted by the SUAR Team revealed that, in general, UMKM actors actually have quite easy access to financing (60%). However, another 40% believe that UMKM actors still find it difficult, even very difficult, to reach access to financing.

- Most of the sources stated that the factor that makes it difficult for UMKM actors to obtain credit from banks is the problem of the absence or limitations of collateral owned by UMKM actors (26.7%). Furthermore, there is also the factor of information regarding credit that is not known by UMKM actors (16.7%) and the low financial and digitalization literacy of UMKM actors (16.7%).

- Difficult regulations or administration are also a reason (13.3%), ranging from difficult requirements to long credit disbursement times. Another reason that also emerged was the unworthy business condition with minimal resources and legality issues so that they did not get trust from banks (13.3%). Besides that, there are also banks that are too selective in channeling credit, to high interest rates (10%).

- To overcome these limitations in access to financing, as a solution, the sources agreed that regulatory reform needs to be carried out. In addition, UMKM actors need to partner with large companies (as fostered partners) for ease of obtaining credit from banks. Another solution is to diversify collateral to make it easier for UMKM actors to get credit.

- Property assets, motorized vehicle assets, and assets in the form of machinery or production equipment are the three largest types of collateral that can be used as collateral to banks. However, for flexibility, other things that can be used as collateral include products or projects from the UMKM itself and invoices or sales orders. Diplomas are also suggested to be used as collateral in banks.

- The Business World Universal Survey concludes that there are three main factors that make UMKM develop. First, promotion, marketing, and market expansion strategies (26.7%). Second, ease of access to financing or ease of obtaining credit for business expansion (23.3%). Third, business management that is run well by UMKM actors (16.7%).

Efforts to develop UMKM are continuous efforts that have been carried out since the past. In accordance with the great potential possessed by UMKM, building and developing UMKM means building the Indonesian economy.

Read more here. Happy reading, Chief.