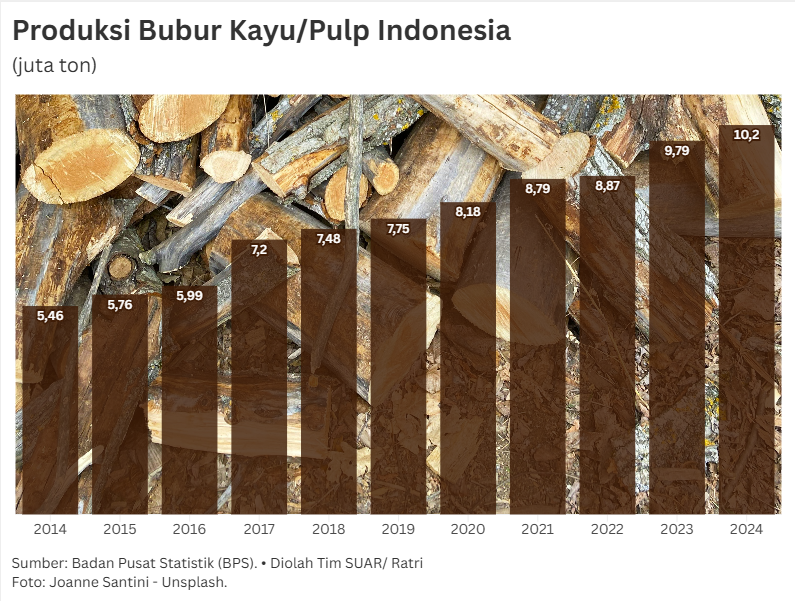

Indonesia's pulp industry has shown positive performance over the past decade. National pulp production has continued to increase, from 5.46 million tons in 2014 to an estimated 10.2 million tons in 2024.

The increase in wood pulp production is supported by the availability of domestic raw materials. Domestic wood pulp production is currently dominated by the timber industry in Sumatra, which accounts for more than 60% of total national timber production. Sumatra's dominance is the backbone in maintaining the supply of raw materials for the downstream pulp and paper industry.

This increase in production has boosted export performance, resulting in a surplus in Indonesia's wood pulp and paper trade balance. The volume of wood pulp and paper exports peaked at 12.52 million tons in 2023. Meanwhile, the highest imports were only 5.61 million tons in 2018.

However, the trade balance surplus has slowed down in the last two years. After experiencing a surge in growth in 2023, reaching 26.7%, the following year it fell to -7.26%.

Despite experiencing a slowdown in growth, the upward trend in production can offset a surplus of 6 million tons. This strengthens the competitiveness of Indonesia's wood pulp and paper industry in the global market.

However, Indonesia's paper industry faces challenges in the upstream sector. This sector is still highly dependent on imports for supporting raw materials, particularly recycled paper (KDU/waste paper) and other supporting chemicals. This dependence is ironic given the abundance of wood raw materials and creates vulnerability in the supply chain.

This dependence on imports in the upstream sector has an impact on competition in the downstream sector. Price spikes or disruptions in the supply of imported raw materials can drive up production costs, which in turn can weaken the competitiveness of Indonesian paper products.

This situation needs to be anticipated so that domestic paper production can compete with imported paper products, which are cheaper. The government needs to intervene with policies to curb the flow of imported paper products that could potentially harm the domestic processing industry.

The challenges facing this industry are not only economic, but also ecological and sustainability-related. As a major producer of raw materials, Sumatra is currently facing problems such as environmental degradation, deforestation, illegal logging, and the risk of natural disasters.

These issues threaten the sustainability of raw material supplies, which have been Indonesia's main advantage. Therefore, mitigation strategies and long-term solutions are needed that integrate industrial growth with environmental responsibility, ensuring that the economic potential of the wood pulp and paper industry can continue to be enjoyed without sacrificing Indonesia's natural environment.