Bankers can breathe a sigh of relief that the series of demonstrations since August 28, 2025 did not continue and worsen the economic situation. Nevertheless, the situation serves as a valuable lesson, that secure socio-political stability is a key foundation to ensure that growth in the third quarter of 2025 and beyond remains on target.

The results of the August 27, 2025 Monthly Board of Commissioners Meeting of the Financial Services Authority (OJK), announced at a press conference on Thursday (4/9/2025), confirmed: Indonesia's financial services sector has successfully navigated through the socio-political turbulence caused by the series of demonstrations that swept through several cities in Indonesia.

OJK suspects, in addition to the resilience of the domestic economy, this success was also supported by various global economic dynamics. For example, the WTO forecast for global trade growth reached 0.9%, the tension of the trade war subsided, as well as increased expectations of easing global monetary policy, and the flow of funds into emerging markets, including Indonesia.

OJK Chairman of the Board of Commissioners Mahendra Siregar stated that one of the mirrors of Indonesia's economic resilience is the Jakarta Composite Index (JCI) which set a record high in August 2025, even though domestic dynamics had a limited impact on stock market volatility.

"Despite the turmoil, developments show that the impact of developments in recent days is relatively limited. OJK continues to coordinate intensively with financial service institutions to ensure that financial services remain optimal for the community. Infrastructure is well maintained, and we will continue to identify potential losses and risks, accelerate assessments, and ensure claim payments are made immediately," Mahendra said.

Specifically in the banking sector, OJK's Chief Executive of Banking Supervision Dian Ediana Rae noted that the intermediation of banking services was stable with a maintained risk profile.

Specifically in the banking sector, OJK's Chief Executive of Banking Supervision Dian Ediana Rae noted that the intermediation of banking services was stable with a maintained risk profile.

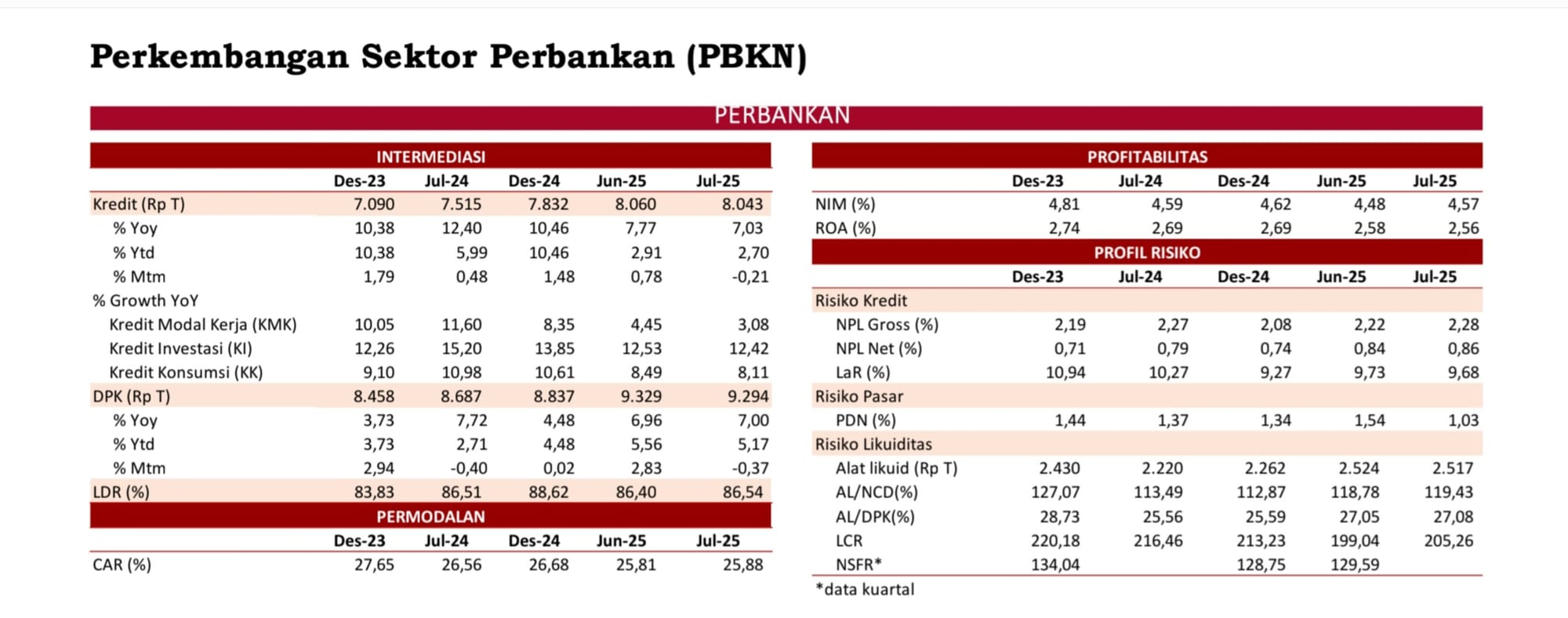

Banking services intermediation was stable with a manageable risk profile. Third-party funds (DPK) in July 2025 were recorded to grow by 7.00% year on year (YoY) to IDR 9,294 trillion. In detail, current accounts, savings, and deposits grew by 10.72%, 5.91%, and 4.84% YoY respectively.

On the other hand, bank lending in July 2025 grew 7.03% YoY with a value of IDR 8,043 trillion. Credit quality was maintained with a gross non-performing loan (NPL) ratio of 2.28%, slightly higher than the June ratio of 2.22%.

Meanwhile, the capital adequacy ratio (CAR) in July increased to 25.88%, up from 25.81% in June. This could be a strong risk mitigation cushion to anticipate global uncertainties.

By utilizing the maintained infrastructure, Dian expects the banking industry to start encouraging special schemes for financing UMKM and providing relaxation of lending, while still paying attention to the principles of prudence and customer protection. In addition, OJK expects the banking industry to continue to cooperate with PPATK to prevent account blocking, except for suspicious transactions and indications of criminal acts.

"OJK continues to ensure that the banking industry is not disrupted, especially services to customers. The impact of the demonstration was relatively minimal, with no significant withdrawal activity detected in the past week. Deposit movements are running normally. For this reason, OJK asks the banking industry to establish communication to minimize the risk of withdrawing funds," Dian concluded her statement.

"The impact of the demonstration is relatively minimal, no significant withdrawal activity has been detected in the past week. Deposit movements are running normally. For this reason, OJK asks the banking industry to establish communication to minimize the risk of withdrawing funds," said Dian.

Positive, can be more brilliant

Banking industry players confirmed the accuracy of OJK's analysis presented in the last press conference. Executive Vice President Corporate Communication & Social Responsibility of Bank Central Asia (BCA) Hera F. Haryn expressed optimism for lending growth throughout 2025, with economic conditions continuing to grow positively until the end of this year.

"As of June 2025, BCA's total loans grew 12.9% YoY, to Rp 959 trillion. This growth was above the industry average. Until the end of 2025, BCA's credit growth target remains in line with the bank's business plan (RBB)," Hera wrote in a written answer received by SUAR, Friday (5/9/2025).

In response to customers' concerns, Hera emphasized BCA's commitment to keep all customer transactions running normally and to increase first semester transaction frequency growth, which has reached 17% YoY.

"Supported by adequate liquidity, BCA is optimistic that it will continue to support economic growth and encourage lending to various segments and sectors, while considering the principles of prudence and disciplined risk management, to remain prudent until the end of 2025," said Hera.

Despite the optimism of banking industry players and OJK's affirmation that provides a sense of security, the banking situation and conditions must still be seen within the larger economic framework.

Indonesian Banking Development Institute (LPPI) economist Ryan Kiryanto emphasized that with sluggish credit growth, the prognosis for credit growth throughout 2025 may remain below 10%.

"As an industry, banks are on the downstream side, while the upstream is the real sector and manufacturing industry. When the business world is disrupted, malls reduce working hours, shops close, banking financing opportunities will decrease because entrepreneurs wait and do not ask for new loans to banks, or approved credit commitments are not withdrawn. This affects the bank's performance which remains positive, but not brilliant," said Ryan when contacted by SUAR, Thursday (4/9/2025).

According to Ryan, an absolute prerequisite for overcoming the possible growth slowdown is to ensure a stable socio-political situation as the key that allows economic activities to roll on, mobility to occur, and manufacturing industries to keep producing.

According to Ryan, an absolute prerequisite for overcoming the possible growth slowdown is to ensure a stable socio-political situation as the key that allows economic activities to roll on, mobility to occur, and manufacturing industries to keep producing.

"The main prerequisite is a conducive socio-political situation. The business world will only be able to expand if entrepreneurs remain optimistic and banks dare to extend credit while remaining cautious due to demand. If stability and security are under control, workers can enter factories, and industrial capacity moves up, credit demand will definitely rise and bank performance can grow from there," Ryan concluded.