Scooters are the most purchased and used type of motorcycle by Indonesian consumers from each generation, beating other types of motorcycles such as ducks and sports. Scooter ownership is the highest in each generation from Generation X, Millennials, and Generation Z. Ease of riding is the reason scooters are a favorite

Jakpat's research titled "Behavior and Preferences of Motorcycle Users and Buyers" released on November 3, 2025, shows that scooters are the choice of 70% of millennial respondents, 59% of generation X, and 43% of generation Z for mobility. This is higher than underbone bikes, which are the choice of 26% of millennial respondents, 32% of Gen X, and 24% of Generation Z.

Jakpat's data shows that scooters are the most common type of motorcycle owned by users across age groups. "Scooters remain the most common choice for urban mobility."

Honda BeAT took the top spot with 43% of all motorcycle owners. In their next purchase plan, 53% of prospective buyers also chose a scooter as their first choice.

The research also found that four out of five respondents own at least one motorcycle. Among the respondents who don't own a motorcycle, 43% cited other expenses as their top priority. "Financial priorities remain the biggest reason for not owning a motorcycle," the report states.

In addition, almost 20% of respondents still rely on family or friends' motorcycles for daily mobility needs. This pattern is also seen in the Gen Z group, who do not all own their own motorcycles.

Responding to the research findings, the Head of the Commercial Division of the Indonesian Motorcycle Industry Association (AISI), Sigit Kumala, said that the dominance of scooters is in line with industry sales data compiled by AISI.

"In the last ten years of sales, matic scooters dominate around 95%," said Sigit.

According to Sigit, the strength of the scooter market cannot be separated from changes in consumer behavior that want a more practical vehicle for daily mobility. Scooters are chosen because they do not require gear shifting and are easy to use in various road conditions.

"Consumers now don't want to bother, just gas and brake," he said. This trend is strongest, according to him, in cities where daily mobility tends to be dense, in line with Jakpat's survey locations in urban areas.

Sigit also sees that the scooter trend will remain strong as long as there are no technological breakthroughs that shift current consumption patterns. The dominance of scooters will stay at around 95% if there is no technological innovation that offers a different driving experience.

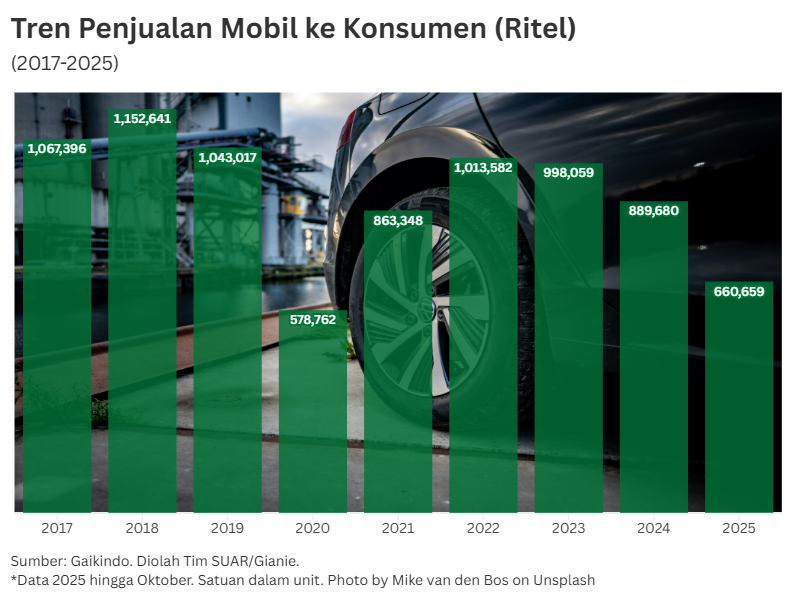

In addition, based on AISI data, the motorcycle industry sales figure at the end of October grew 0.2% year on year.

Regarding Jakpat's finding that 80% of prospective buyers plan to buy motorcycles in cash, Sigit said that preference is not fully visible in industry data.

Based on AISI records, in 2024 sales through credit will still be in the range of 60 to 65%. Sigit assessed that cash and credit payments both make a positive contribution to the industry.

Gen Z's Interest and Purchasing Power

Strategic Research Manager of the Center of Reform on Economics (CORE) Indonesia, Yusuf Rendy Manilet, assessed that the high interest in motorcycle purchases among Gen Z reflects Indonesia's demographic structure, which is currently dominated by young age groups. The Gen Z and Millennial groups are the largest segments of the productive population. "So it is natural that many surveys, including the Jakpat survey, show how Gen Z is so dominant," he said.

According to Yusuf, one of the things that needs to be observed from Jakpat's survey is the absence of income variables in measuring interest in buying a motorcycle. This information is important to see actual purchasing power and ascertain whether purchase interest is in line with financial capability. Yusuf said the reasons for not owning a motorcycle that appeared in the survey, such as other spending priorities at 43%, are likely related to the economic conditions of each income group. "It should be taken into account," said Yusuf.

Yusuf also warned of the risk of impulsive consumption behavior among Gen Z when buying a motorcycle. He mentioned the lipstick effect phenomenon, which is the tendency to buy goods without considering the ability to pay. "This is what we need to watch out for," Yusuf said. The financial literacy of young people, according to him, is not yet fully mature, so the decision to buy a motorcycle can cause a financial burden if it is not adjusted to their abilities.

In response to Jakpat's finding that 80% of potential buyers want to pay for their motorcycle in cash, Yusuf believes that this phenomenon has two sides. On the one hand, cash payment could mean that consumers want to avoid credit interest by saving up first. But according to him, there is a possibility that the cash payment is made with personal loan funds, which could lead to new financial risks. "Don't let it be bought in cash because, for example, you borrowed from someone," said Yusuf.

Jakpat found that 69% of motorcycle owners use their vehicles for routine daily activities such as going to work, school, shopping, or taking family members. About a third of respondents travel daily distances of between 5 and 10 km. The research also noted that there is a group of users who use motorcycles for long-distance travel.

According to Yusuf, the high preference for motorcycles is also related to the limited access to public transportation in many cities. Many of Jakarta's buffer zones such as Depok, Bogor, and Bekasi do not yet have optimal connectivity to the public transportation network, so the cost of getting to the transportation point is often higher than taking a private motorcycle. "Instead of the hassle of paying ojek to get to public transportation points, it's better to just bring a motorcycle," he said.

Automotive industry observer from the Bandung Institute of Technology (ITB), Yannes Martinus Pasaribu, considers Gen Z as the most aggressive segment because most of their vehicles are still bought by their parents. According to him, high daily mobility makes a new motorcycle feel rational for this group because it is affordable, economical, and easy to maintain. " Stylish designs, personal colors, connectivity to smartphones , and smart keys make motorcycles an extension of their personal identity," said Yannes. The doom spending phenomenon, he said, also encouraged some Gen Z to buy motorcycles as a form of self-appreciation.

In marketing, Yannes sees that the motor industry must adjust to Gen Z's digital consumption patterns. Brochures and billboards are no longer enough as young consumers rely on reviews, comparisons, and daily experiences of creators on the internet.

"Once a creator gives a positive rating, the YouTube and TikTok algorithms will push the product to the shortlist of potential young buyers," Yannes said.

Gen Z stands out in their information seeking patterns before buying a motorcycle. Jakpat's research shows that more than 50% of respondents in the overall sample rely on digital channels such as YouTube reviews, automotive content creators, social media, and online reviews . Recommendations from people close to them were cited by less than half of the respondents as a source of information.

Jakpat's research shows that in choosing a repair shop, the majority of motorcycle users prefer non-official repair shops. The reasons vary from closer proximity to their residence, more affordable costs, to faster processing time compared to official workshops. This finding confirms that ease of access and cost efficiency are the main considerations for many motorcycle users.

Yannes said Gen Z's preference for non-official workshops is driven by the need to reduce daily expenses and save time. Minor jobs such as oil changes or brake checks are not considered necessary at authorized workshops if the costs incurred are much higher. "The official workshop network is often labeled as expensive before it has time to explain its benefits," said Yannes.

In the past year, Jakpat's findings show that 32% of motorcycle owners replaced parts or added accessories 2 to 5 times. The most commonly purchased components are tires and wheels, followed by lighting systems, seats, and chains and gears. Most replacements were made due to damage, while others were aimed at improving comfort or performance.

Yannes believes that the habit of changing parts or accessories shows that motorcycles have become a medium of expression as well as a mobility tool that is used intensely every day. According to him, tires and wheels are the main focus because they are related to comfort, riding style, and the need to look different when uploading motorcycle photos on social media. "The parts and aftermarket market grows from the fashion and lifestyle cycle," he said.