New car sales to consumers (retail) in October 2025 increased on an annualized basis. However, cumulative sales during January-October fell 9.6% compared to the same period last year. Sales during November-December will determine the achievement of the target.

In 2025, October was the only month in which retail car sales grew positively. 74,720 cars were sold during October. The other nine months, from January to September, saw car sales fall compared to the same months in 2024. The sharpest declines were in January (-18.3%) and July (-16.8%).

Car sales this year are not encouraging, a reflection of people's purchasing power which is still facing pressure. With the economy slowing down and the world facing uncertainty, the upper middle class is cautious in spending their funds on tertiary needs, let alone on cars, which are considered luxury goods.

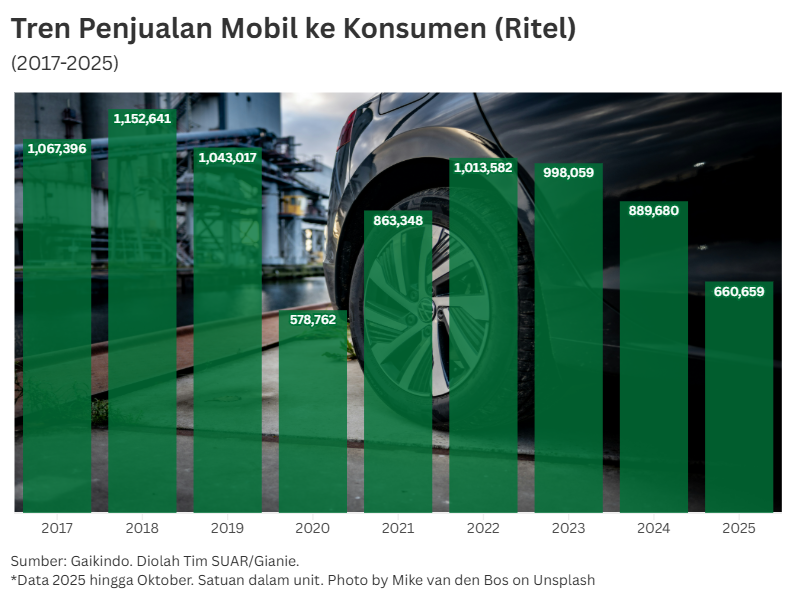

Data from the Indonesian Automotive Industry Association (Gaikindo) shows that cumulative (January-October) retail car sales only reached 660,659 units. This number is down 9.6% compared to the same period in 2024. At this rate, with two months left until the end of the year, the 2025 sales target of 900,000 units will be difficult to achieve.

When viewed by brand, nominally, the retail car sales that declined the most during January-October were Toyota, Daihatsu, and Honda, respectively. Toyota fell by 33,041 units compared to the same period last year or -13.6%. Meanwhile, Daihatsu decreased by 30,419 units (-21.3%) and Honda decreased by 24,842 units (-29.7%).

However, a number of other car brands that are electric cars recorded significantly higher sales. These include BYD, Chery, Denza, Aion, and Vinfast.

BYD cars experienced a significant increase in sales of 22,225 units, up 252% compared to the January-October 2024 period. Chery sales increased by 9,967 units, Denza increased by 6,757 units, Aion increased by 4,607 units, and Vinfast increased by 2,789 units.

However, public interest in these electric vehicles has not been able to offset the overall decline in four-wheeled vehicle sales. The automotive industry is faced with the challenge of purchasing power that has not fully recovered.

The remaining two months until the end of the year will determine whether or not the national target is achieved. Even if retail car sales can reach 200,000 units in the last two months, the total car sales target for this year will not be achieved.

This will sharpen the downward trend in car sales that has been ongoing since 2023. After the pandemic, Indonesia had reached car sales of more than 1 million units in 2022. This figure almost matched sales in the years before the pandemic. However, in 2023 new car sales started to decline to around 998,000 units and to below 900,000 units in 2024.