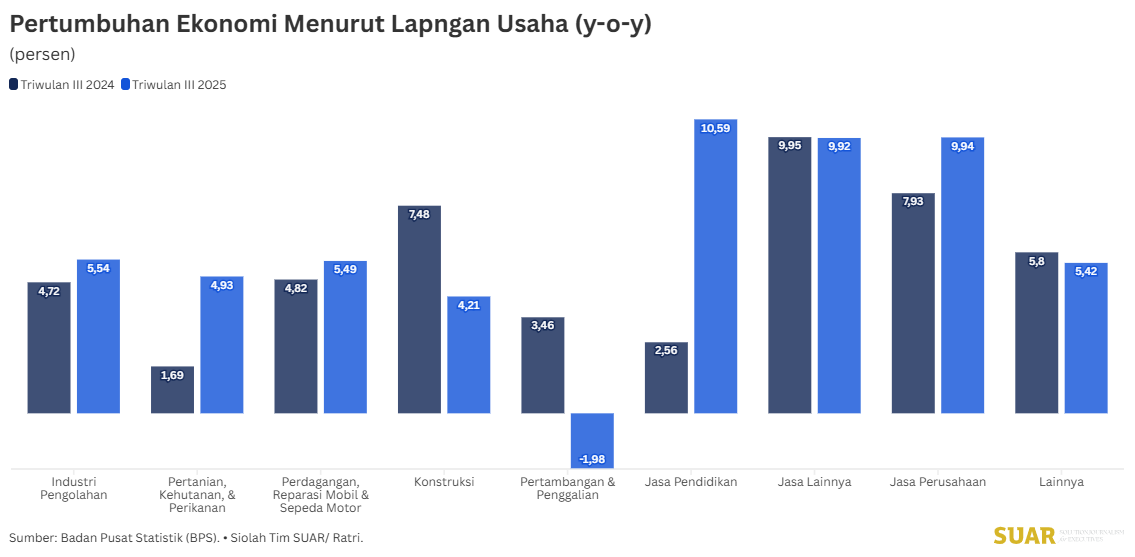

The Indonesian economy in the third quarter of 2025 showed a positive performance in line with the target. On an annual basis (y-on-y), the economy grew by 5.04%. This growth occurred in almost all business fields, except for the mining and quarrying sector which experienced the deepest contraction.

The highest growth occurred in the services business field group. Education services grew 10.59%, corporate services 9.94%, and other services 9.92%. Meanwhile, the manufacturing industry grew moderately at 5.54%. These four businesses were the driving force of the economy in the third quarter of this year.

The manufacturing industry is still the main pillar of the Indonesian economy, taking the largest share, at 19.15%. Followed by agriculture (14.35%) and trade (13.19%).

Processing industry growth was driven by increasing domestic and foreign demand. Especially in the basic metal industry group which grew 18.62% and the chemical, pharmaceutical and traditional medicine industry group which grew 11.65%. In addition, the food and beverage industry grew 6.5%.

Construction and mining are among the top five businesses that contribute significantly to the Indonesian economy. Unfortunately, both of these businesses experienced a decline in performance in the third quarter of this year. The construction sector grew by 4.21%, smaller than the third quarter of 2024 which grew by 7.48% on an annualized basis.

The only business field that contracted was mining and quarrying at 1.98%. In fact, in the third quarter of 2024 last year this sector grew by 3.46%. The decline in performance in the mining and quarrying sector was partly influenced by the decline in the prices of a number of mining commodities. Coal prices, for example, fell 21.57% in the quarter, nickel prices fell 7.42%, and crude oil prices fell 13.45% on an annualized basis.

The education services business field, one of the three high-growth services groups, recorded a fantastic growth of 10.59% in the third quarter of this year. This compares to the third quarter of last year, which was only 2.56%. This high growth was partly due to the start of the new school year and an increase in spending on education functions.

High growth in services indicates a shift in demand and significant new growth potential in the services sector. Although the contribution to GDP of these sectors is still relatively small (around 2%), their rapid growth rate provides momentum for recovery and reorientation of investment in human capital and professional services.