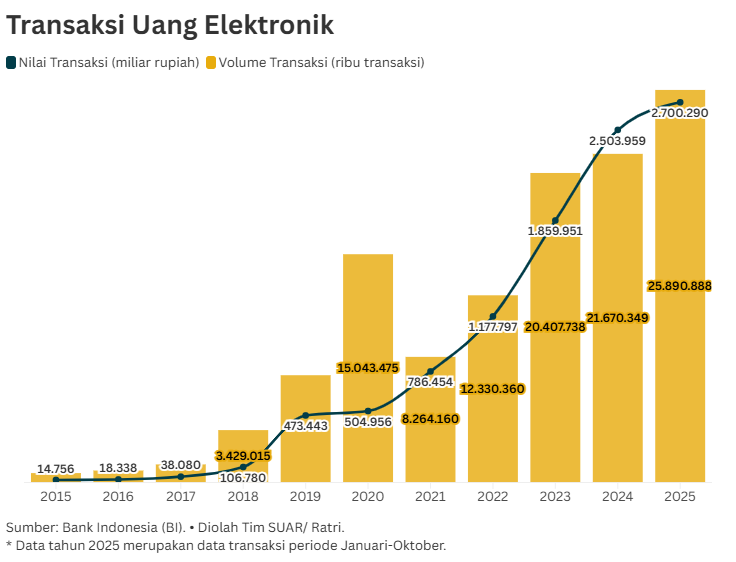

Bank Indonesia (BI) recorded a consistent upward trend in electronic money transaction data from 2015 to 2025 (January-October) in terms of both value and volume. In 2015, the transaction volume was recorded at 590.74 million transactions and jumped dramatically to more than 25,890.89 million transactions by October 2025.

In line with the increase in volume, during the same period the transaction value also showed a fantastic surge from IDR 14,756 billion to IDR 2,700,290 billion. This increase in transactions reflects that Indonesians increasingly trust digital instruments as the main payment method in their daily economic activities.

Transaction growth showed a very significant increase between 2018 and 2020. Starting in 2018, the transaction value grew by 180.41% compared to the previous year, or grew from IDR 38,080 billion in 2017 to IDR 106,780 billion in 2018. This surge in transactions occurred again in 2020. The transaction volume increased by 113.3% from the previous year, reaching 15,043,475 thousand transactions with a transaction value of IDR 504,965 billion.

The main factor behind this surge was the acceleration of digitalization during the COVID-19 pandemic, which limited physical contact and forced the public and UMKM players UMKM to digital payments. In addition, the increasingly mature e-commerce ecosystem and aggressive promotions from various financial service providers also contributed to this exponential growth.

BI also noted that electronic money instruments showed an interesting competition between chip-based (physical cards) and server-based (digital wallet applications). At the beginning of the period (2015-2017), chip-based instruments still dominated due to their massive use in the transportation sector, such as tolls and parking, as well as credit and debit card transactions.

However, in the last decade, this pattern of dominance has shifted since 2018. Server-based instruments began to overtake and grow rapidly. By 2024, server-based instruments reached 807.46 million units, far surpassing chip-based instruments at 114.61 million units. The development of server-based instruments has been a driving factor in the significant increase in digital money transactions over the past decade.

The surge in server-based instruments is due to their much greater flexibility compared to physical cards. Integration with the Indonesian Standard Quick Response Code (QRIS) technology allows mobile applications to be used at millions of merchants, from street vendors to large retailers.

In addition, easy registration without the need for a formal bank account (unbanked population) and additional features such as bill payments, game top-ups, and investments make server-based services an integral part of the digital lifestyle of modern Indonesian society today.

Given current trends, electronic money transactions are predicted to continue growing, with transaction volumes exceeding 25,890,888 thousand and a value of Rp 2,700.290 billion in 2025 (January-October). This is a positive sign for Indonesia's digital economy as it increases financial inclusion across the board.

The high volume of digital transactions creates efficiency in money circulation, reduces the cost of printing physical money for the state, and makes it easier for the government and financial institutions to map the economic profile of the community for more targeted distribution of aid or credit.

To maintain this growth momentum, there are several crucial aspects that need to be prepared and maintained.Cyber security and personal data protection must be a top priority in order to maintain public trust amid the rise of digital crime threats.

In addition, the equitable distribution of internet infrastructure to remote areas is crucial so that the benefits of the digital economy are not concentrated solely in large cities. With the synergy between adaptive regulations and infrastructure readiness, Indonesia has the potential to become a digital economic giant in Southeast Asia.