Good morning Chief...

The following is important information related to the development of the business universe that needs attention today based on the curation of the SUAR Team.

Rojali and Rohana: Not Just a Slump in Purchasing Power, but a Turning Point for a Strategy Update

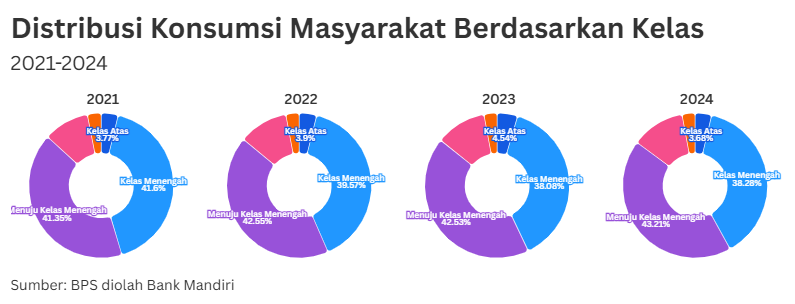

- The decline in the middle class and people's purchasing power has caused shopping centers to decrease their turnover. This has led to the phenomenon of rojali (group rarely buys) and rohana (group only asks). The rojali and rohana phenomenon, which has been appearing more frequently in shopping centers lately, is not just about thin pockets.

- "Consumers used to be brand-oriented, now they are more realistic," said Solihin, Chairman of the Indonesian Retailers Association (Aprindo), the association that oversees retailers in Indonesia. He explained how "festive" periods such as Lebaran and Christmas, which used to be the mainstay of sales, are now shorter in duration, while the inter-festive gap is longer. From May to October, for example, there are practically no major national shopping moments.

- Alphonzus Widjaja, Chairman of the Indonesian Shopping Center Association (PPBI), sees how consumers are now more selective in spending their money. "If they don't need it, they don't buy it, or they buy things with a low unit price," he said after attending the kick-off event of 100 licenses for local UMKM brands and products at the Cililitan Wholesale Center (23/7/2025).

- But prices and promos are not the only problem. "It's not just that purchasing power is down, but also that the goods are incomplete, the size is not available, or it's late to enter Indonesia," Budihardjo Iduansjah from the Association of Retailers and Shopping Center Tenants in Indonesia (Hippindo) told SUAR (31/07).

You can read more here.

Legal Uncertainty, Business Complaints, and Lessons from Singapore

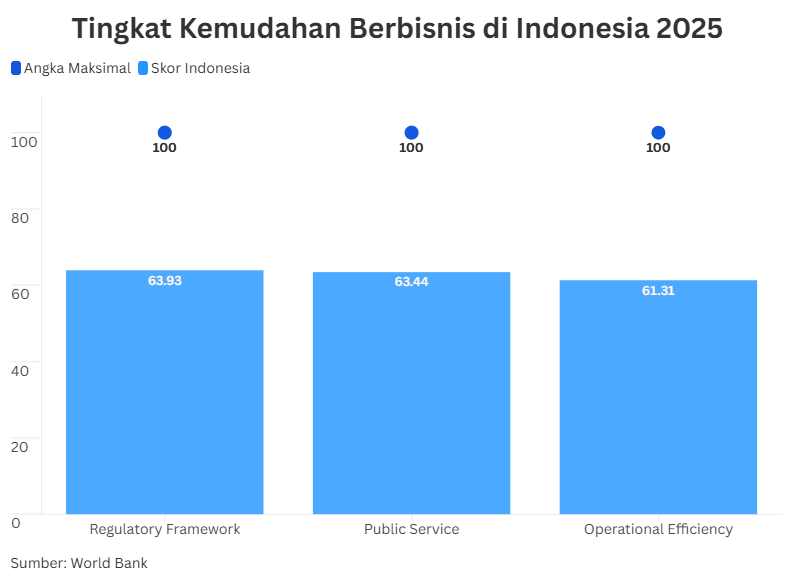

- "We consistently receive complaints about the issue of legal uncertainty from business actors," said Chairman of the Indonesian Employers Association (Apindo) Shinta W Kamdani.

- Last June, Apindo conducted a survey of more than 100 companies in 18 provinces. The results confirmed this anxiety: 72% of respondents felt there were too many required documents, 65% admitted to being forced to use third-party services, which complicated matters and increased costs, and 54% highlighted the length of the recommendation process, technical obstacles in the OSS system, and mismatches between central and regional regulations.

- For the business world, uncertainty is more than just a matter of documents. It means hidden costs: the cessation of expansion plans, relocation abroad, or an increase in product prices due to lengthy processes and additional costs.

"Business always grows on risk calculation. But if the rules themselves are inconsistent, it is very difficult to plan," said Shinta.

- Indonesian Ambassador to Singapore Suryopratomo revealed that the success of this neighboring country is not a mere coincidence, but the result of a consistent and predictable regulatory culture.

"The Singapore government rarely makes sudden policy changes," Suryopratomo told SUAR (30/7/2025).

- Every strategic policy revision is always preceded by a public consultation process, regulatory impact assessment, to multi-year planning. "That gives room for business actors, both local and foreign, to adapt and develop their business strategies," he added.

You can read more here.

Food Tray Manufacturer Ready to Supply to MBG Program

- Localfood tray manufacturers who are members of the Association of Kitchen and Dining Equipment (Aspradam) and the Association of Indonesian Food Container Manufacturers (Apmaki) assert that they have more than enough production capacity to independently supply food trays in the Free Nutritious Meal (MBG) program without having to rely on imported products.

- The government's plan to import food trays to accelerate the expansion of the program, which is referred to as an ambitious project of President Prabowo Subianto's administration, has raised concerns among local entrepreneurs.

"The local industry is able to provide quality food trays without having to rely on imports," said Andi, a member of Aspradam at the Sarasehan Peran Produsen Food Tray Dalam Negeri Mendukung Makan Bergizi Gratis (MBG), Jakarta, (31/7/2025).

You can read more here.

Learning from Temasek and North Fund's Global Green Finance Model

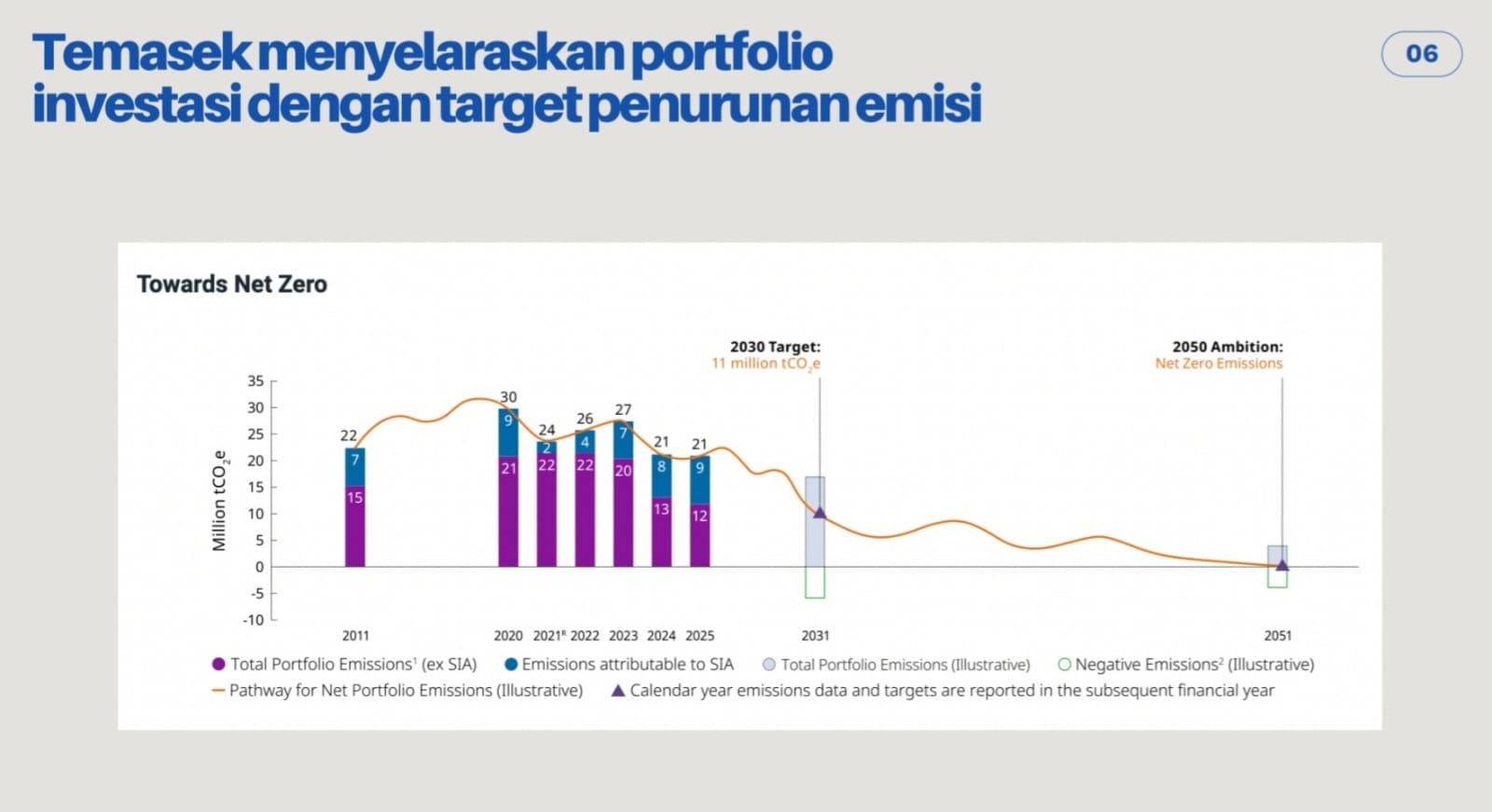

- Singaporean sovereign wealth fund (SWF) Temasek Holding and Norwegian SWF North Fund are focusing on financing green projects to achieve zero emissions.

- Temasek has five strict policy rules regarding funding, including a ban on entry into the fossil energy sector and ensuring every financed entity achieves its net zero 2050 ambition. They do not only fund only banks, but also go in to open up financing for project-based industries and activities.

- Norway's North Fund is also an inspiration. This institutional fund, which comes from oil and gas management dividends, is known for its high transparency. The general public can access detailed information about the investment portfolio, project list, and returns.

You can read more here.

Most Credit Flows to Trade Businesses

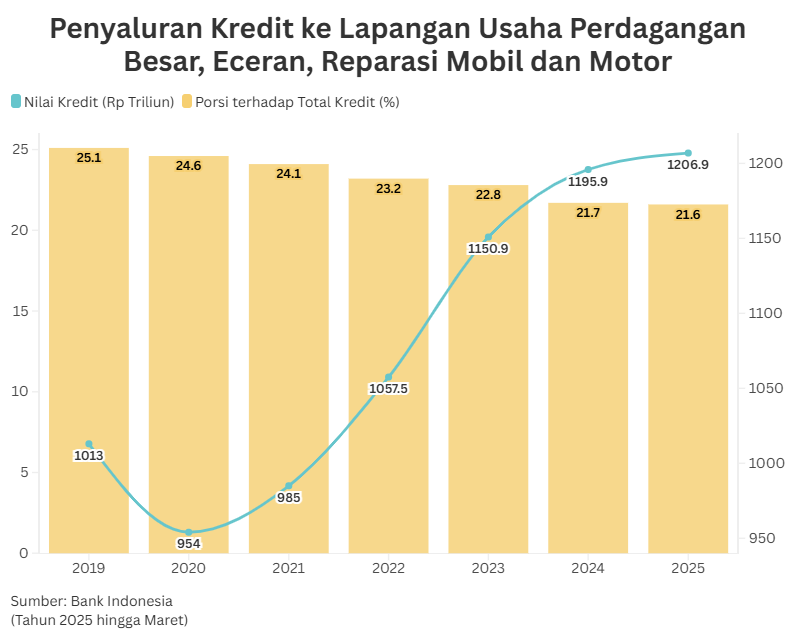

- In the midst of uncertain economic conditions, the third BI-Rate cut so far this year has been a breath of fresh air for the business world. The trade business sector is still likely to be the sector that receives the most credit.

- As of March 2025, Bank Indonesia data shows that total loans disbursed by commercial banks and BPRs reached Rp 7,818,235 billion. Loans allocated to productive business sectors (business fields) also continued to show an increase, reaching IDR 5,581,160 billion or 71% of total loans.

- The business field that received the most credit disbursements until March 2025 was trade, namely 1,206.9 trillion or 21.6 percent of total credit by business field. Nominally, credit to the trade sector grew by an average of 3.5% per year (during the 2019-2024 period). However, its share tends to decline from 25% (2019) to 21.7% (2024).

You can read more here.

BPS Releases Inflation and Export-Import Data for July 2025: The Central Bureau of Statistics (BPS) will release inflation and export-import data for July 2025 on Friday (1/8/2025), at 14.00 WIB, at the BPS Building, Jakarta. In addition, BPS will release other official statistical news (BRS) such as the Harvest Area of Corn & Rice Production, the Development of Farmer Exchange Rate (NTP) and Rice Price, Tourism Development, and Transportation Development. These data are important indicators for the business world in making decisions.

New Tax Realization for Gold Bullion Bank Purchases: Starting August 1, 2025, the Ministry of Finance will impose a tax on the purchase of gold bullion at bullion banks that will be passed on to the buyer. This change in tax rules will have a significant impact on the gold industry, investment and financial markets. It will also affect people's interest in investing in physical gold through bullion banks.

"If you think about the long term, you can make very good decisions that you won't regret. "Jeff Bezos (Amazon founder)

Have a good day Chief.

Team SUAR