The labor-intensive sector is the key to saving the economy, and plays an important role in reducing unemployment.

The government has issued various policies, so that this sector can be revived, one of which is through several incentives.

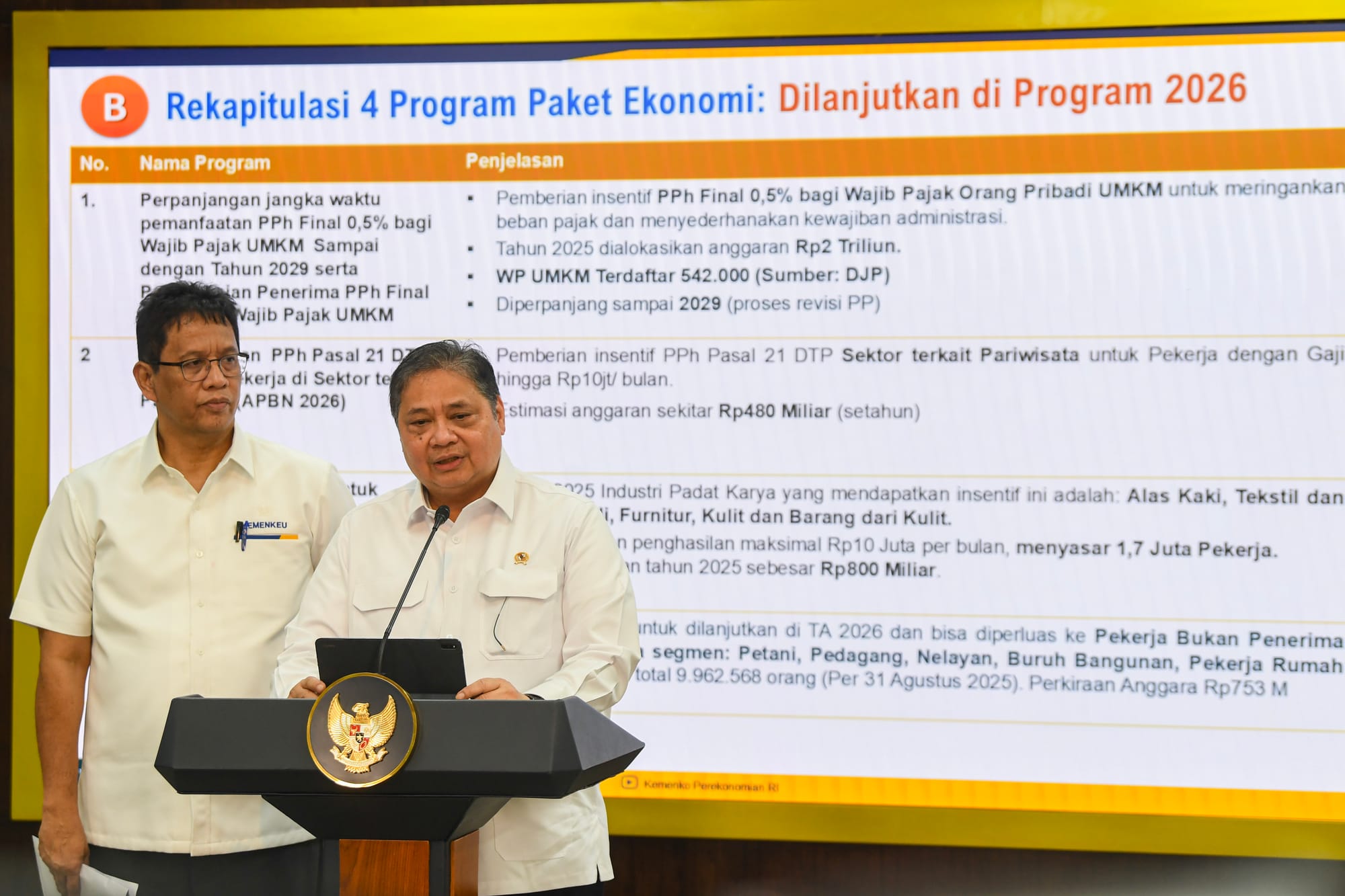

- Fiscal and Taxation Policy

Incentive for Income Tax 21 borne by the government (DTP) for sector workers in labor-intensive sectors with an income of up to IDR 10 million per month. - Labor-intensive Investment Credit Scheme

The government provides a 5% interest subsidy for 8 years for investment credit for the purchase and renewal of machinery in the form of production equipment. - Deregulation and Investment Policy

The MOT issued a new MOT Regulation consisting of eight commodity clusters to facilitate changes as the MOT Regulation is dynamic. - International Trade Policy

Negotiation of 19% tariff and finalization of EU CEPA agreement that will increase market access to Europe for exports of labor-intensive products such as textile, footwear, and furniture.

In addition to the incentives that have already been issued, the government will also seek to encourage downstreaming and diversification of manufacturing products. The goal is to increase Indonesia's contribution to the global supply chain, while at the same time aligning with the principle of environmental sustainability.

Read the full story here.

The Ministry of Industry also ensures that it will disburse incentives for labor-intensive industry players in terms of capital goods procurement.

What incentives are being prepared by the government, read an interview with Deputy I of the Coordinating Ministry for Economic Affairs Ferry Irawan here.

Can incentives save the day?

- Providing incentives for Income Tax 21 borne by the government is more effective in stimulating the economy than social assistance (bansos).

- Tax exemptions for labor-intensive sector employees can be a more targeted stimulus if the incentive is applied to labor-intensive industries.

- Tax incentives to attract investment in new machinery are expected to improve production efficiency.

- Tax incentives also provide room for companies to reduce spending, potentially reducing the risk of layoffs.