Officially, the government has prepared a policy to relax People's Business Credit (KUR) for debtors affected by flash floods and landslides in three provinces in Sumatra, namely Aceh, North Sumatra, and West Sumatra. This step is an effort to ease the economic burden on the community, especially UMKM players UMKM have lost assets or livelihoods due to natural disasters.

The relief provided to disaster victims includes various facilities, ranging from deferral of installment payments to extension of credit periods. This policy needs to be implemented given the role of KUR as an economic driver.

Without such policy intervention, there are concerns that the number of non-performing loans will increase dramatically, which could ultimately cripple local purchasing power and productivity in areas that are currently struggling to recover from the disaster.

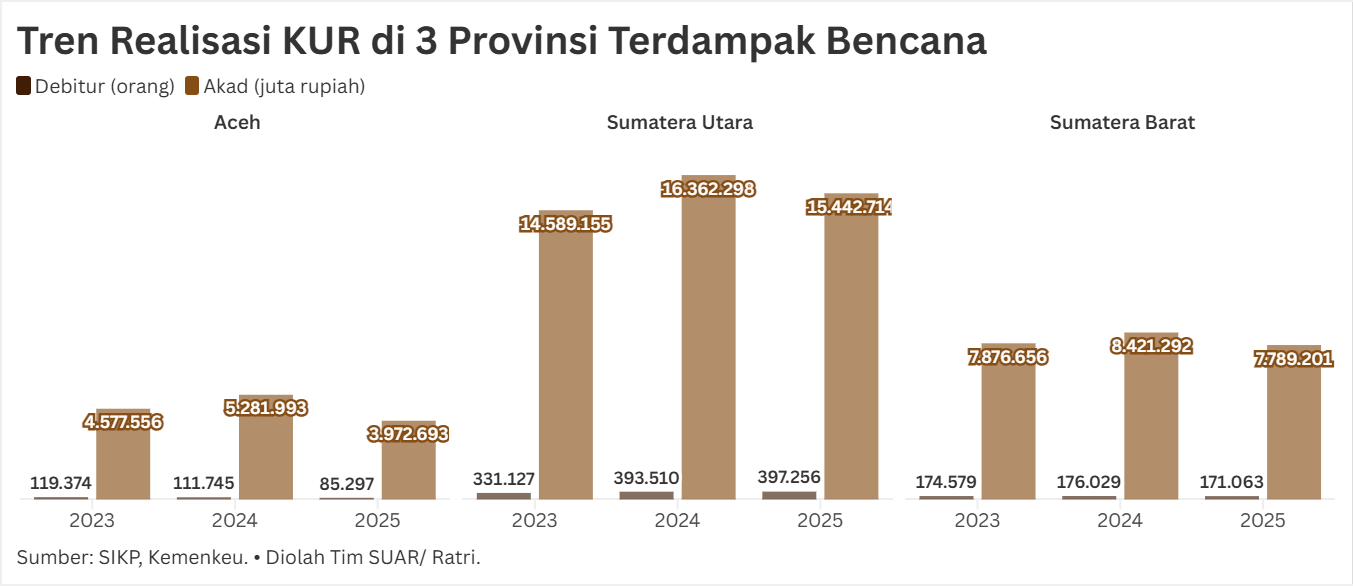

Based on data on KUR realization in 2025 in the Ministry of Finance's Program Credit Information System (SIKP), the recovery burden in North Sumatra appears to be the largest compared to the other two provinces. Until 2025, North Sumatra recorded 397,256 debtors with a total credit value of Rp 15.44 trillion.

Although this credit value has decreased compared to 2024, which reached Rp 16.36 trillion, the number of debtors has increased. This indicates that access to KUR is becoming more widespread in North Sumatra. It also means that the number of debtors who need relaxation due to disasters in this region is the highest.

In contrast, in West Sumatra, KUR distribution tends to be stable. In 2025, there were 171,063 debtors with a total credit value of Rp 7.78 trillion. The dominant sectors receiving KUR in West Sumatra were agriculture, hunting, and forestry, amounting to Rp 3.57 trillion.

Because flash floods often damage agricultural land and plantations, debt relief for borrowers in this sector is urgently needed so that farmers do not become trapped in a cycle of debt when their land is unproductive.

Meanwhile, in Aceh Province, the KUR realization trend until 2025 has been disbursed to 85,297 debtors with a credit value of IDR 3.97 trillion. Unlike its two neighboring provinces, the largest sector absorbing KUR in Aceh is wholesale and retail trade with 62,884 debtors and a credit value of IDR 2.06 trillion.

Landslides that cut off logistics routes have a direct impact on the trade sector. Therefore, government relaxation policies must target small traders so that they continue to have the liquidity to restart their businesses.

These three provinces depend on KUR distribution to drive their economies. Data from the Coordinating Ministry for Economic Affairs shows that by 2025, the combined credit value will reach Rp 43.95 trillion with 1,018,282 debtors in the three regions.

The relaxation policy is not merely social assistance, but rather an instrument for saving the economies of disaster-affected regions. With synergy between banks and the government in implementing this relaxation, it is hoped that debtors in Aceh, North Sumatra, and West Sumatra can quickly recover and resume contributing to national economic growth.