Entering 2026, the government has a high target to increase state revenue, especially from tax revenue. However, tax revenue realization in 2025 is expected to be only 87.6% of the target. But in 2026, the tax revenue target will be increased by 7.67% from the 2025 State Budget.

On Thursday (January 8, 2026), Finance Minister Purbaya Yudhi Sadewa announced total tax revenue for 2025 of Rp1,917 trillion, equivalent to 87.6% of the tax revenue target in the 2025 State Budget of Rp2,189 trillion.

Although tax revenue in 2025 will not meet the target, the government continues to raise its tax revenue target. In the Macroeconomic Framework and Fiscal Policy Priorities (KEM-PPKF), the government has set a tax revenue target for 2026 of Rp2,357.7 trillion, an increase of 7.67% from the tax revenue target in the 2025 State Budget. This target is considered very high because it is nearly 23% higher than the 2025 realization.

Responding to the issue of tax revenue, Indonesian Employers Association (Apindo) Economic Policy Analyst Ajib Hamdani said there is a fiscal gap between the 2025 target and the 2026 projection. The 2025 target, which was not met, has been followed by an even higher target.

"Tax revenue in 2025, which is only 87.6% of the target, indicates a tax revenue shortfall of Rp271.7 trillion," said Ajib on Friday (9/1/2026).

The tax revenue shortfall in 2025, Ajib continued, will be very deep. According to him, this is due to at least three main causes.

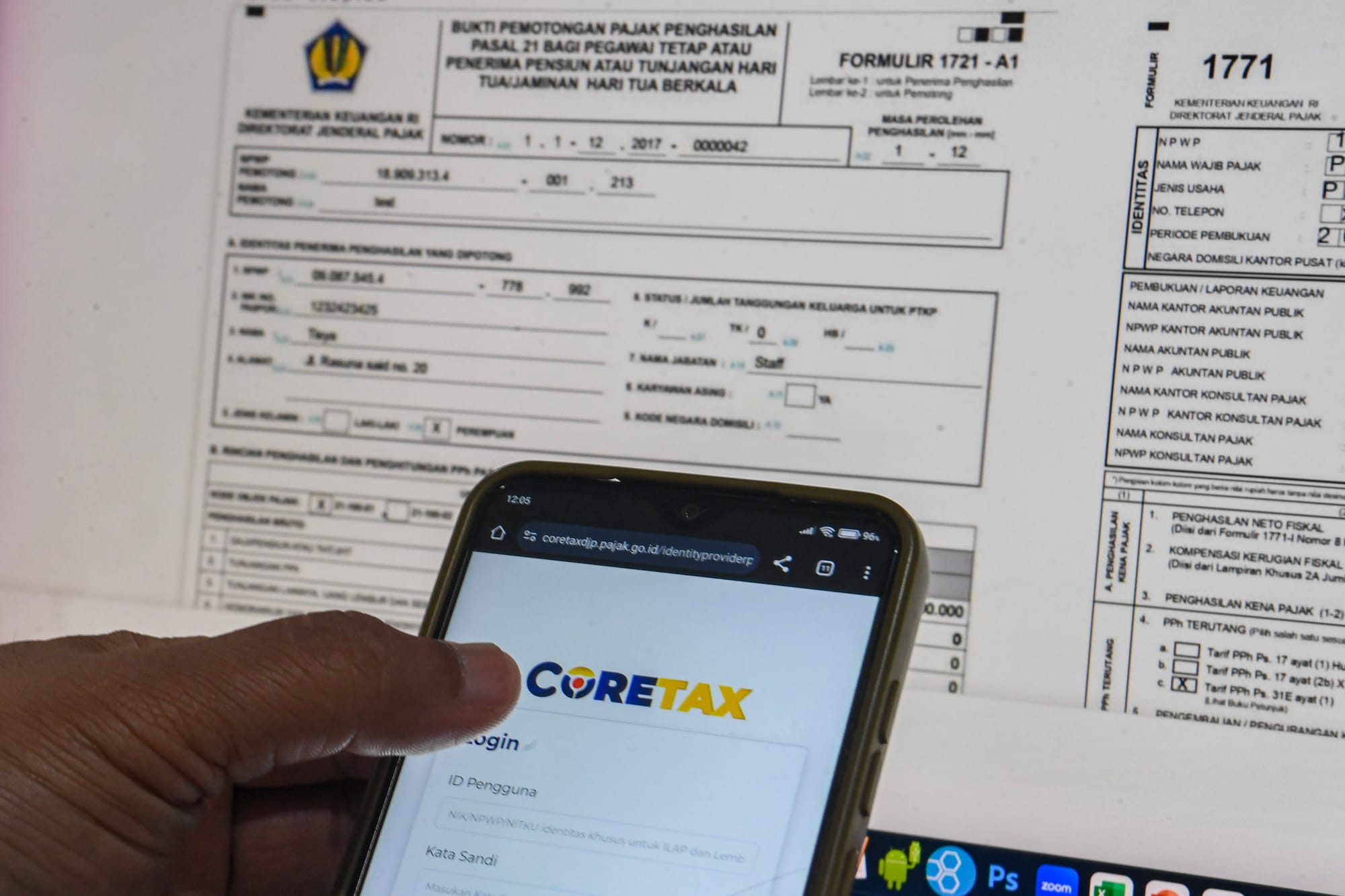

First, because Coretax has not been implemented according to the initial plan. This has caused tax revenue to stagnate and tax extensification and intensification to be suboptimal throughout 2025.

Second, economic growth has slowed and is uneven in real terms. The middle class, which has consistently supported spending, continues to shrink. As a result, tax revenues have contracted.

Third, the government did not make any tax revenue projections in December 2025. As a result, tax revenue reflects the actual revenue for that year.

"If tax deferrals are implemented, potential tax revenue in 2025 will increase. However, as a result, revenue from January to March 2026 will be constrained. This is a fairly bold move by the Minister of Finance," he said.

2026 tax revenue projections

In his calculations, tax revenue from January to March 2026 is projected to return to normal, and the target can be achieved by 20% in March 2026.

Several factors affecting tax revenue in 2026 are supported by the realization of tax revenue in 2025, which amounted to IDR 1,917 trillion. This figure is calculated based on the potential increase in taxpayer compliance due to the optimization of Coretax, which is 0.5% of the Gross Domestic Product (GDP), valued at around IDR 120 trillion. Then, there is also the potential for uncollected tax revenue in 2025, which is estimated at IDR 100 trillion.

In addition, there is potential for increased revenue due to economic growth and inflation in 2026, amounting to 8%, which is equivalent to Rp. 153.4 trillion.

"Based on the calculation of potential revenue, tax revenue in 2026 has the potential to reach Rp. 2,291 trillion, or equivalent to 97.19% of the 2026 tax revenue target of Rp. 2,357 trillion," he said.

Ajib added that the projected tax revenue could be achieved if at least three conditions were met. First, Coretax must function optimally so that service, extensification, and intensification aspects could run according to the government's program.

"When optimal extension is achieved, it will have a positive effect on the business world by creating a level playing field," he said.

Read also:

Second, the government must educate and improve the literacy of taxpayers to increase compliance. In 2025, the government is likely to promote a law enforcement approach. In fact, the taxation system adopted in Indonesia is self-assessment, where taxpayers calculate their own taxes, pay the taxes owed, and report to the authorities.

Revenue collection should be based on payment awareness, not law enforcement. In this regard, the authorities also need to improve public communication patterns. This is in line with the Ministry of Finance's commitment to structural reform.

Third, promote regulations that are favorable to the budget without disrupting the real sector. An example of this is the implementation of the Global Minimum Tax (GMT), which remains favorable to investment but has the potential to increase revenue. Furthermore, tax expenditure schemes and programs should be more targeted and serve as a lever for economic growth.

"The business world appreciates the breakthroughs made by the Minister of Finance in managing fiscal policies that were quite revolutionary throughout 2025. With a relatively sufficient adjustment period and consistent regulations that are favorable to budgeters and the business world, tax revenue potential will be better throughout 2026. Taxes will once again become an optimal function of revenue and economic regulation," he said.

Unrealistic

Economists are expressing caution. Tauhid Ahmad, an economist at the Institute for Development of Economics and Finance (Indef), believes that the surge in the 2026 tax revenue target is far from realistic when compared to the national economic capacity.

"In the history of Indonesian taxation, the highest tax revenue growth has been in the range of 8%–10% per year. We have never recorded a surge of up to 22%–23%," said Tauhid via telephone to Suar.id on Sunday (1/11/2026).

According to Tauhid, the wide gap between targets and economic capacity risks encouraging increasingly aggressive tax collection. Purchasing power remains weak, growth is uneven, and businesses tend to hold back on expansion.

"If the target is too high, the consequence will definitely be more aggressive tax collection. The tax burden will increase, both for businesses and the public. This is counterproductive to economic recovery," said Tauhid.

Tauhid reminds us that taxes are a double-edged sword. When used too aggressively, taxes can actually slow down the economy and erode the revenue base in the future.

He also highlighted the risk of intensified collection of past obligations, which could create uncertainty for businesses. "Businesses are hesitant to expand. It's better to hold back than to be targeted again later. This is dangerous for the investment climate," he said.

The impact does not stop at the business sector. If consumption and investment are held back, economic growth will slow down, which will ultimately put pressure on the tax base itself.

On the fiscal side, overly optimistic tax targets also have the potential to widen the budget deficit. Tauhid believes that with the assumption of 5.4% economic growth in 2026, which may not necessarily be achieved—while the global economy is slowing down—the risk of the state budget deficit exceeding 3% is even greater.

"If revenue targets are missed, while spending cannot be reduced, the deficit will certainly widen. Moreover, many government programs have already been locked in and are difficult to adjust," he said.

He also noted that the weakening of global commodity prices, particularly coal and palm oil, contributed to the decline in tax revenue in 2025. The global conditions in 2026, which remain uncertain, have the potential to repeat a similar pattern.

Finance Minister Purbaya Yudhi Sadewa's decision not to carry out tax revenue projections at the end of 2025 was appreciated by Tauhid as a bold breakthrough. The practice of projections has been considered to mask structural problems, as it shifts revenue from the following year.

However, discontinuing ijon also requires a much more robust data system. "Without ijon, the data must be real time. The integration of company financial reports with the tax system must be in place. Without that, there will always be pressure to return to ijon," he said.

Tauhid believes that a healthy tax revenue target should be adjusted to economic capacity. He considers revenue growth in the range of 10% to be a more rational target.

"If the target is moderate, the business world still has room to grow. If it is too high, what will happen is excessive taxation and a slowdown in the economy," he said.

He emphasized that improving the system, providing assistance to taxpayers, and diversifying revenue sources—without relying too heavily on natural resources—must be the top priorities. "Taxes should drive the economy, not scare off businesses," said Tauhid.