Revenue and expenditure realization by the end of November 2025 reached 82.1% and 82.5% of the 2025 State Budget outlook, respectively. This less-than-optimal achievement serves as a lesson for the government to spur economic growth next year, which is targeted to reach 5.4% on an annual basis. A number of fiscal strategies and policies are being prepared so as not to waste the valuable momentum in the first quarter of 2026.

With state revenue reaching Rp2,351.5 trillion and state expenditure reaching Rp2,911.8 trillion as of November 30, 2025, the state budget deficit was recorded at Rp560.3 trillion or 2.35% of Indonesia's GDP.

Finance Minister Purbaya Yudhi Sadewa stated that the figures are still within manageable limits and in line with the initial design. However, the State Treasurer emphasized that state revenue and expenditure have room for optimization.

On the revenue side, tax optimization will be carried out simultaneously with the strengthening of customs duties and foreign exchange earnings from natural resource exports, while on the expenditure side, acceleration will be carried out next year to maximize the increase in demand during the momentum of the new year, Chinese New Year, and Eid al-Fitr, which will occur in the first quarter of 2026.

"We have improved Coretax, but of course there are still imperfections that we will fix. Yesterday, 50,000 Ministry of Finance employees tested the system by logging in simultaneously, and it performed well. We will continue to improve this digital system so that next year it will be more efficient, with even higher targets," said Purbaya at the APBN KiTA Press Conference in Jakarta on Thursday (12/18/2025).

Supplementing Purbaya's explanation, Deputy Minister of Finance Suahasil Nazara stated that in November 2025, tax collection grew by 2.5% compared to the end of October. Of the total tax revenue of Rp1,634.4 trillion, gross Value Added Tax (VAT) and Sales Tax on Luxury Goods (PPnBM) recorded positive growth of 1.7%, although tax refunds still caused both to experience a contraction of -6.6%.

"VAT and PPnBM are the lifeblood of the economy, because both are paid when transactions occur. This means that if VAT grows positively, transactions will also grow positively. We measure this lifeblood of the economy through added value, which shows improvement, and will be even better in December," said Suahasil.

In addition to taxes, customs and excise revenues grew 4.5% year-on-year ( YoY) to Rp269.4 trillion or 89.3% of the state budget outlook, with export duties continuing to experience the highest growth due to increases in CPO prices and palm oil export volumes as well as copper concentration.

In addition to the amount of revenue, Suahasil reported the achievements of the Directorate General of Customs and Excise in 17,641 enforcement actions throughout 2025, which successfully seized 1 billion illegal cigarettes, including from the latest enforcement action that secured 11 million illegal cigarettes and prevented state losses of Rp12.5 billion. In these enforcement actions, the DJBC has detained three foreign nationals as suspects.

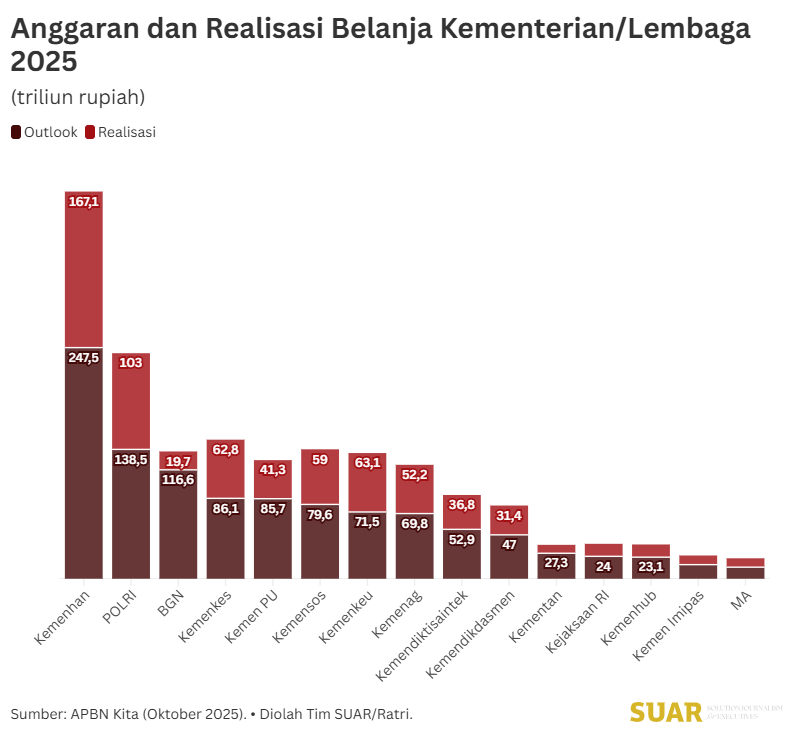

In terms of spending, in addition to spending by ministries/institutions and spending on government priority programs, Suahasil emphasized that local government spending had only reached Rp922.5 trillion, or 65.3% of the budget ceiling, even though the nominal amount of transfers to the regions (TKD) had reached Rp795.6 trillion, or 91.5% of the state budget ceiling.

When compared to the TKD amount of Rp713.4 trillion at the end of October 2025, this means that the government has provided an additional Rp82.2 trillion in one month to local governments throughout Indonesia.

"During November, local governments spent 114 trillion rupiah, causing the balance of local government accounts to fall from 230.1 trillion rupiah to 218.2 trillion rupiah. However, regional spending still needs to be higher because only 65 percent of the budget has been realized. Local governments need to continue to accelerate spending in December so that the benefits to the community are more noticeable," said Suahasil.

Early-year strategy

Reflecting on suboptimal revenue and expenditure realization, Director General of Economic and Fiscal Strategy at the Ministry of Finance Febrio Kacaribu revealed the government's fiscal strategy mapping to spur economic growth next year, especially by looking at the truly expansive state budget posture.

"Spending must be faster in Q1 2026, so that the government expenditure growth component will be positive and high for Q1 growth. The business climate must be improved, so that the private sector's role will be greater. Our exports still have opportunities, especially textiles and footwear, which are very competitive. The added value of natural resources must increase in Indonesia," said Febrio.

Read also:

So far, Febrio explained, the strategy to pursue revenue that will soon take effect is to increase the conversion of foreign exchange from natural resource exports (DHE SDA) by up to 50%. In addition to increasing revenue, DHE opens up opportunities to increase foreign exchange liquidity in the domestic money market.

In addition to increasing the conversion of natural resources, the imposition of coal export duties effective January 1, 2026, will secure state revenues of up to Rp24-25 trillion. Both measures have been approved by the House of Representatives, and maximizing the potential of natural resources for state revenues is in line with the mandate of Article 33 of the 1945 Constitution.

"So far, natural resource exporters have been holding at least 40%. Now, by increasing conversion, we are working with the OJK to deepen the market and add the necessary instruments, including domestic SBNs with tenors of less than 1 year. Liquidity will increase, transactions will increase, and the financial market will become more efficient," explained Febrio.

Pay attention to quality

Although the state budget has been successfully implemented at more than 80% of the outlook, LPEM FEB UI macroeconomic researcher Mervin Goklas Hamonangan tends to be skeptical that the annual growth target of 5.2% will be achieved. This is not only because of the shortfall in revenue and expenditure, but also other factors that affect the budget, namely public consumption and the dynamics of the real sector.

"One of the main concerns is disaster management, which could potentially impact the Q4 figures that are expected to boost annual growth," explained Mervin when contacted by SUARon Thursday (12/18/2025).

Read also:

Mervin emphasized that the government must remember that the budget is not a matter of quantity, but rather quality. Regarding priority programs that are touted as driving the grassroots economy, ensuring that they reach their intended targets is more important than increasing the number of recipients and the amount of budget disbursed, especially for MBG and KDMP.

In line with Mervin, Executive Director of the Institute for Development of Economics and Finance ( INDEF) Esther Sri Astuti hopes that the government's budget allocation will be truly productive and reduce ceremonial events. Therefore, the budget allocation for government programs that tend to be forced should be saved and transferred to other budgets.

"Ourfiscal budget is limited, which means we have to reduce what we want to what we need, if we don't want to work even harder. Non-fundamental, populist, and unproductive policies need to be evaluated so that the budget can be saved and the programs don't just become flagship policies," Esther said.