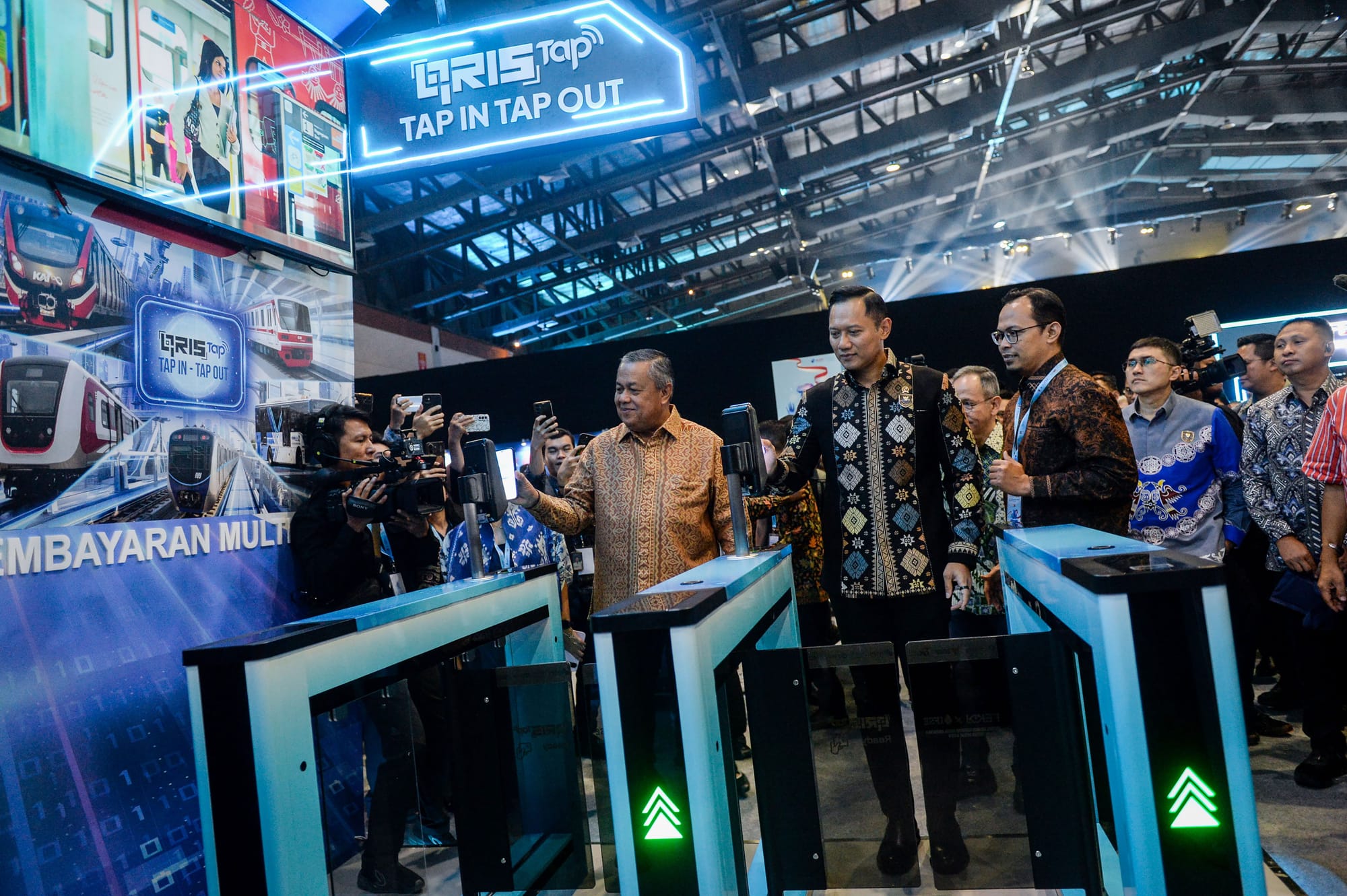

Bank Indonesia on Thursday (30/10/2025) officially launched the Quick Response Code Indonesian Standard (QRIS) Tap In & Out for five modes of transportation in the Jabodetabek area, starting from the KRL Commuter Line, Transjakarta, LRT Jakarta, LRT Jabodebek and MRT.

This is done to make it easier for people to make digital payments without the need to scan a QR code.

"This QRIS Tap In & Tap Out will be launched for five modes of transportation in Jabodetabek," said Bank Indonesia Governor Perry Warjiyo at the Indonesian Digital Financial Economy Festival x Indonesia Fintech Summit & Expo (FEKDI x IFSE) 2025 in Jakarta.

Different from conventional QRIS which requires a QR code to scan, QRIS tap works by touching a cellphone to a reader machine in general, but without a card.

Indonesia, he said, is the country with the fastest growing digital financial economy in the world, with a volume reaching 37 billion transactions worth IDR 520 trillion in 2025.

According to Perry, since it was first launched on August 17, 2019, QRIS has connected 57 million users and 39 million merchants, most of whom are UMKM.

He targets that by 2030, digital finance will increase to 147.3 billion transactions.

"This is Indonesia's future as the fastest growing digital payment. We continue to move forward to become the best digital economy in the world," said Perry.

Reiterating Perry's explanation, Chairman of the OJK Board of Commissioners Mahendra Siregar stated that the digital economic transformation to strengthen the competitiveness of the digital industry requires innovations that provide inclusive access, efficient and safe services, thereby creating stronger public trust.

"OJK continues to strengthen data and technology-based supervision, including collaborating with fiscal, monetary authorities and industry players. Through this opportunity, Indonesia is no longer just a technology user, but also a determinant and director of the digital economy in the Southeast Asian region," said Mahendra.

To the land of ginseng

Not stopping there, the development of Cross-Border QRIS to South Korea has also been officially launched, following the success of the Cross-Border QRIS which has been successfully used in Thailand, Malaysia, Singapore, Japan and China.

Head of ASEAN-ROK Financial Cooperation Centre Lee Young-jick openly expressed his appreciation for this launch.

According to Lee, Indonesia's well-established QR payment system is an initial step towards integration into the global EKD system, which currently reaches USD 14.3 billion and is projected to reach USD 61.7 billion by 2033. The expansion of internet service access, marketplaces, and demographic transition in the digitally literate generation pave the way to achieve that growth.

"This situation illustrates not only technological changes, but also lifestyle changes. Following the success of QRIS, which connects more than 50 million users, the next step is to build cross-border payment integration that connects QR payment networks for smooth transactions between countries," he stated.

Read also:

Similar to Indonesia, digital payment convenience has also experienced significant growth in South Korea, with an average daily transaction volume reaching 30.72 million transactions worth KRW 959.4 billion. After the pandemic, this frequency increased as Korean travelers' need to use QR payments when traveling to Southeast Asia grew.

As the interbank payment authority in South Korea, KFTC has selected Hana Bank as the exclusive settlement bank for the cross-border QR project, with a pilot project launched in Indonesia. This choice is based on KFTC's finding that Hana Bank recorded QR transactions worth KRW 31.8 billion (USD 23 million) in 2024, a 10-fold increase from 2022, with most transactions made by South Korean travelers in Southeast Asia.

During the current trial period, travelers from South Korea can use Korean digital payment applications to scan QRIS when visiting Indonesia. Likewise, travelers from Indonesia can scan ZeroPay and SeoulPay with Indonesian digital payment applications to transact in South Korea. Both ZeroPay and SeoulPay are payment platforms used by more than 2 million merchants throughout South Korea.

"We will continue to work with our Indonesian partners to ensure this project is increasingly accessible. This is not just about payments, but a step towards better mutual understanding and strengthening relations between South Korea and Southeast Asia, to know each other, connect, and grow together," Lee concluded.

Not ideal

In addition to horizontal inclusion by expanding the reach of Cross-Border QRIS, efforts to encourage vertical inclusion through increasing the financial literacy capacity of UMKM were also a concern of FEKDI x IFSE 2025. On this occasion, PT. Bank Rakyat Indonesia (Persero) Tbk. demonstrated the mobile Stroberi Kasir application as BRI's dedication to helping UMKM through a point of sales application.

Head of BRI's Business Partnership Department, Faiz Nasrullah Samara, explained that the Stroberi Kasir application was born from the awareness that UMKM, as pillars of the Indonesian economy, need better financial inclusion support, considering their still low financial literacy capacity.

Through this application, BRI wants to build the habit of UMKM having better record-keeping, achieving operational efficiency, and simplifying stock and financial reports. In its use, Stroberi Kasir helps UMKM to calculate stock, record transactions and nominal values, and assist in calculating profit results in sales at the end of the day.

"This application is free as long as BRI exists. Simply download it and register easily with a mobile phone number. This application can be used by anyone, whether they are BRI customers or not. Through this application, we want to instill the habit of recording sales, which is very important, including for micro-entrepreneurs," said Faiz.

The practices of providing opportunities for every layer of society to gain access to financial products and services are the spirit of BI in giving an increasingly broad meaning to financial inclusion. However, Lecturer in the Department of Management and Public Policy at Gadjah Mada University, Media Wahyudi Askar, noted that account ownership as a benchmark for BI and OJK in measuring the level of financial inclusion can trigger problems.

"It is very possible that Indonesia has a high level of account ownership, but the owners do not use these accounts to access financial services. We know that almost all social assistance uses bank accounts, and these accounts are only used to receive money from the government, not for active transactions," he said when contacted by SUAR, Thursday (30/10/2025).

Media emphasized that although the number of bank account ownership is high, it does not reflect good financial inclusion. The measure of the usefulness of financial products and services should be the benchmark for inclusion, along with the level of public welfare.

"Inclusion is more than just opening an account. Most importantly, people actually use products according to their needs. Data on high account ownership, but measured by indicators of product usage, especially with the added significance of the impact of product usage on welfare, we can find that inclusion is still far from ideal and must be accelerated," he concluded.