The performance of the Financial Technology (Fintech) industry in Indonesia, particularly in the Peer-to-Peer (P2P) Lending segment, is growing stronger. By August 2025, the total amount of loans disbursed reached a new peak of Rp 29,623.31 billion.

This figure indicates that public trust and adoption of online lending services continues to increase, making fintech a key player in the national financing ecosystem.

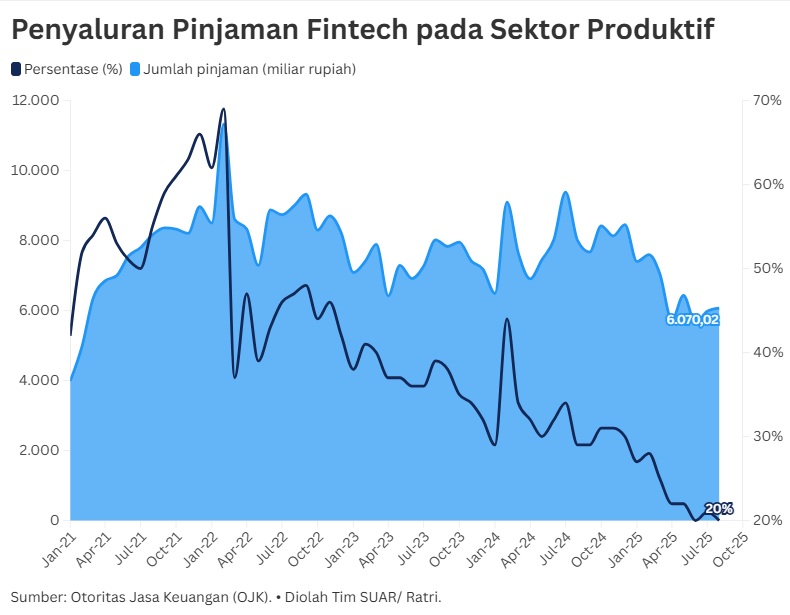

In nominal terms, online lending continues to increase. However, based on data analysis from January 2021 to August 2025, there has been a decline in the percentage of loans disbursed to the productive sector.

The percentage of lending to the productive sector peaked in February 2022 at 69% with a loan value of Rp 11,328.84 billion. However, this percentage continued to decline to only 20% in August 2025. This significant decline occurred even though the nominal amount of loans to the productive sector fluctuated relatively between Rp 5 trillion and Rp 9 trillion.

This implies that the growth rate of loans for the consumer sector is much faster than that of the productive sector, so that the proportion of productive loans is becoming smaller in the total fintech loans.

When looking at the accumulation of loans over the past year, from August 2024 to 2025, the Wholesale and Retail Trade sector dominated with a distribution of Rp 3,157.00 billion. This dominance is reasonable considering that the trade sector, especially e-commerce and UMKM , requires fast and flexible working capital, which is the main advantage of fintech services.

This was followed by the Accommodation and Food and Beverage Services sector (Rp 804.94 billion), the Agriculture, Forestry and Fisheries sector (Rp 380.85 billion), the Activities Generating Goods and Services by Households sector (Rp 194.10 billion), and the Information and Communication sector (Rp 141.56 billion).

Although nominal distribution performance is good, the decline in the percentage allocated to the productive sector signals that the potential for optimizing fintech as a driver of UMKM economic growth has not been fully realized. In fact, the productive sector is key to job creation and increasing national competitiveness.

If this condition continues, the gap between the growth of fintech lending in general and its real impact on strategic sectors will widen. Therefore, strategic intervention is needed so that fintech distribution performance can be optimized for the productive sector.

To overcome these issues and encourage optimal fintech lending performance for the productive sector, strategic solutions are needed. From the regulatory side, the government can provide incentives or more affordable interest rates for fintech companies that have a productive lending portion above a certain threshold.

In addition, fintech platforms need to invest in more sophisticated technology to mitigate UMKM agricultural risks more accurately and efficiently. Closer collaboration between fintech and credit guarantee institutions and ecosystems such as UMKM aggregators UMKM supply chains can minimize risks and open up greater funding opportunities. This can enable fintech to make a truly significant contribution to strengthening Indonesia's economic foundation.