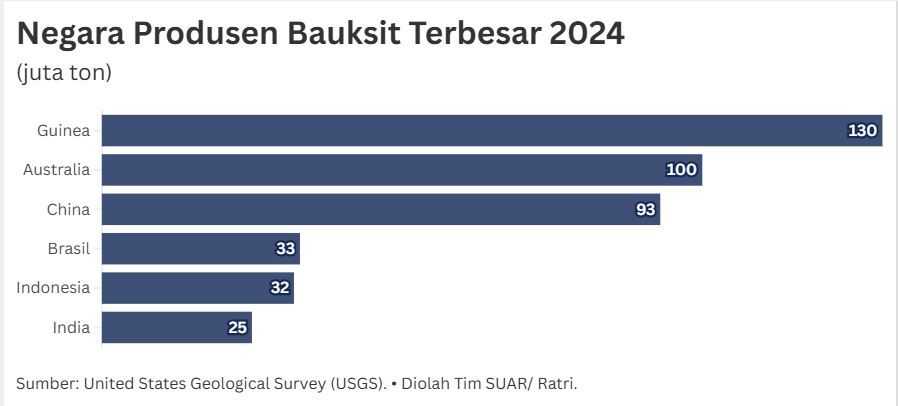

Globally, Indonesia is the 5th largest bauxite producer by 2024, with production reaching 32 million tons. This position is just below Brazil (33 million tons), although far below Guinea (130 million tons) and Australia (100 million tons) based on USGS data. Optimism is growing for Indonesia to develop its aluminum industry.

However, making this happen is not easy. Despite its vast resources and strong position in raw bauxite production, Indonesia's aluminum industry still faces challenges downstream. Reports from USGS and Inalum show that Indonesia's current primary aluminum production is still relatively low, at only around 275,000 tons. This is only about 0.38% of the total global aluminum production of 72 million tons.

This large gap between the potential of raw materials (bauxite) and the actual production of processed aluminium indicates the need for a strong push to accelerate the transformation from an exporter of raw materials to a producer of processed products.

Bauxite downstreamization is a necessity for transformation. The downstream policy requires the domestic processing of bauxite ore into alumina and aluminum, replacing the export of raw materials.

The policy will be of great benefit to the national economy, as it not only increases the value of commodities, but also creates jobs and technology transfer. The success of this downstream program is key to boosting national aluminum and alumina production.

The commitment to boost aluminium and alumina production is evident from the increasing investment realization in the bauxite commodity downstream sector. Data shows a significant increase in investment value over time. Realization in Q1-2024 of IDR 1.4 trillion jumped to IDR 3.7 trillion in Q2-2024, growing by 164.3% (q-t-q).

This trend continues with the projected investment value reaching IDR 14.8 trillion in Q2-2025 and IDR 15.6 trillion in Q3-2025. This increase in investment realization is a catalyst that is expected to boost the production capacity of Smelter Grade Alumina Refinery (SGAR) and aluminum smelters, thereby increasing Indonesia's contribution to the global aluminum market.

Although Indonesia's aluminium production currently stands at 0.38% of the global total, high investment realization and strong downstream policy support provide great hope for change. By optimizing the abundant bauxite potential and converting it efficiently, where in general, around 4 tons-6 tons of bauxite is required to produce 1 ton of primary aluminium.

Indonesia has a great opportunity to immediately increase production capacity, meet the needs of the EV market, and transform from a mere bauxite producer to one of the major forces in the global aluminum supply chain.