The development of digital technology has changed lifestyles, creating a demand for high-quality internet access. The quality of home internet is no longer just a matter of entertainment, but the economic foundation for UMKM and remote workers. So, which internet service provider is the most reliable and preferred by customers?

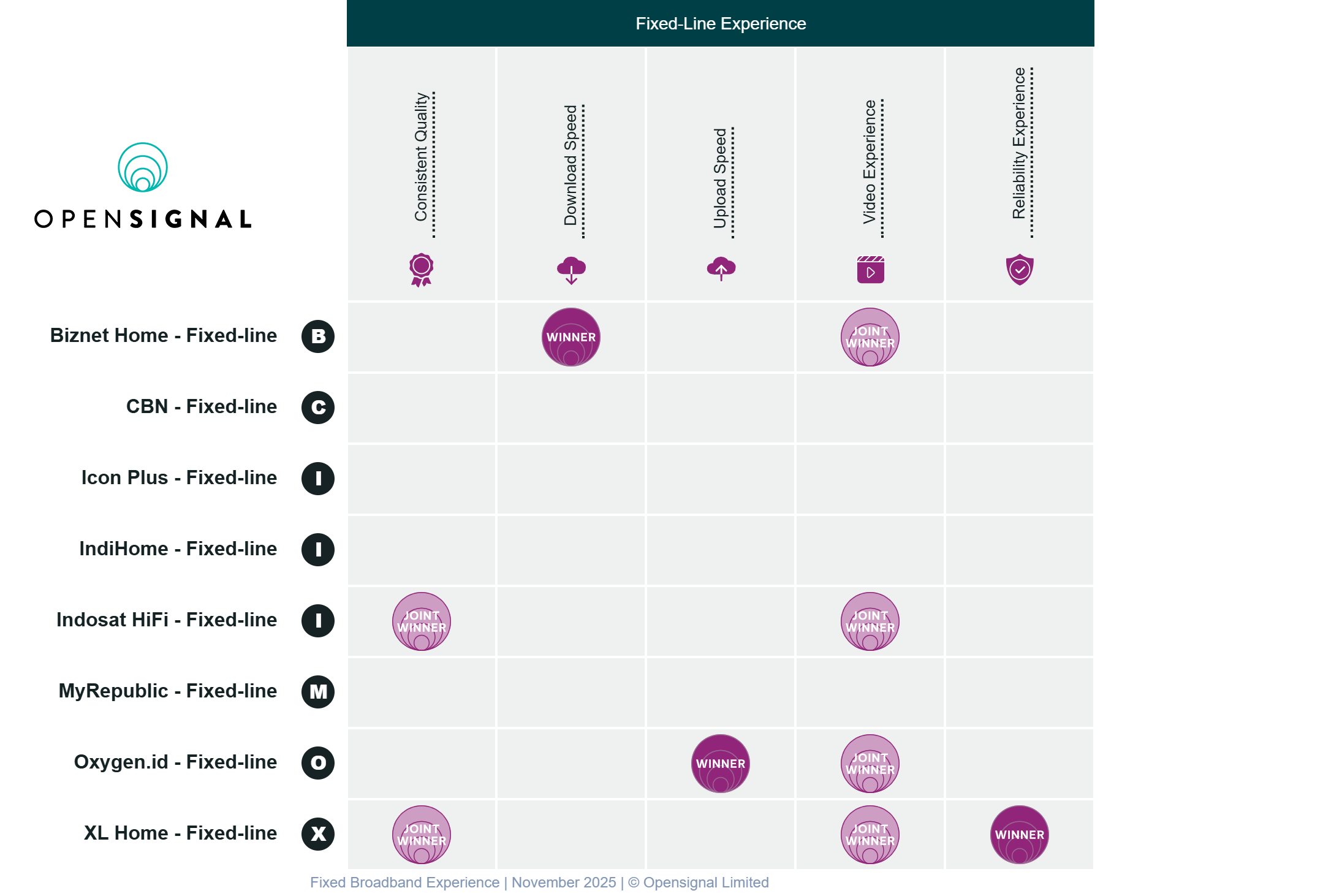

The Opensignal report titled "Fixed Broadband Experience Report November 2025" analyzes real data from fixed-line broadband users in Indonesia during August 1–October 30, 2025, covering eight major ISPs: Biznet Home, CBN, Icon Plus, IndiHome/Telkomsel, Indosat HiFi, MyRepublic, Oxygen.id, and XL Home.

Five key indicators were used, namely Quality Consistency, Download Speed, Upload Speed, Video Experience, and Experience Reliability, to capture how Indonesian households use the internet: from online work and school, streaming, to gaming.

The results that emerge are not just rankings, but a competitive landscape that connects network performance, the business strategies of the players, and the increasingly fierce battle for broadband market dominance leading up to 2026.

Consistency in quality

In the Quality Consistency indicator, Indosat HiFi and XL Home came out on top. Indosat HiFi was chosen by 68.9% of respondents, with XL Home following closely behind at 68.7%. These figures represent the percentage of users who met the minimum threshold for heavy activities such as watching HD videos, video conferencing, and gaming.

Download speed

In terms of speed, the competition is getting more interesting. Biznet Home leads in download speed with a score of 37.8 megabytes per second (Mbps). This leaves its closest competitor, XL Home, behind with a speed of 34.6 Mbps.

Upload speed

The winner in the upload speed category was Oxygen.id with a speed of 26.1 Mbps, 0.6 Mbps ahead of its closest competitor, Biznet Home.

Video experience

In the video viewing experience category, there were four winners with very close scores. They were Indosat HiFi and Oxygen.id with the same score of 69.3. Following behind them were Biznet Home with a score of 69.2 and XL Home with a score of 69.0.

The assessment score ranges from 0 to 100. The higher the score, the greater the customer satisfaction.

Reliability of experience

In this category, XL Home took first place with a score of 463. Indosat HiFi came in second and third with scores of 448 and 445, respectively.

Expert view

Discussing OpenSignal's technical indicators, Teguh Prasetya, Chairman of the Indonesian Telecommunications Association (ATSI), emphasized two things: price and reliability. "If it suits consumers' pockets and needs, it will definitely sell well," he said in a telephone conversation with Suar 1/12/2025). He said that Indonesia's internet rehabilitation is still lagging behind neighboring countries such as Vietnam.

In the context of the broadband business, reliability is increasingly becoming the "new currency." The more stable an ISP's network is, the lower the risk of customer churn, the lower the cost of handling complaints, and the stronger the reputation for expansion into new areas.

Upload and download speeds, said Teguh, can no longer be taken lightly. "UMKM catalogs and large videos. If it takes a long time, it's not attractive," he explained. Broadband infrastructure determines whether users can work, study, and create stably.

This phenomenon points to a "new battlefield" in the broadband industry. Whereas ISPs used to compete to offer the fastest download speeds for streaming, uploads are now becoming increasingly important, in line with the surge in the ecosystem of creators, online sellers, and remote workers who need stable upload quality for video calls and online collaboration.

On paper, IndiHome's dominance remains unchallenged. With around 67 percent of the national broadband market share, Telkomsel, through its IndiHome fixed-line service, has the widest coverage and largest customer base in Indonesia. However, interestingly, according to Nailul Huda, a digital economy researcher at the Center of Economics and Law Studies (CELIOS), this market advantage is not directly proportional to service quality.

"IndiHome dominates the market, but in terms of quality, they are not superior. Their download and upload speeds are slower than their competitors, and their prices are also relatively more expensive," Huda told Suar on Monday (1/12/2025). Even so, demand for IndiHome services remains high, especially in Eastern Indonesia, where ISP options are much more limited and IndiHome's network coverage is still the mainstay.

According to him, this situation differs from that in major cities in Java, where consumers have more choices and are starting to choose based on quality rather than mere availability. IndiHome's competitors are expected to maximize this momentum. "With their large revenues, they should be able to expand outside Java, either through their own capital expenditure or by partnering with other parties."

Outside of Java, the broadband market is still dominated by IndiHome, not because of its superior performance, but because its infrastructure is the most developed. However, new players are beginning to enter the market, slowly changing the competitive landscape. Starlink has entered the market with high device prices, while Surge is attracting attention because it is still in its promotional phase.

Huda believes that the market outside Java is still dominated by IndiHome, while the most likely competitors are Starlink and Surge, although both have challenges: Starlink is expensive in terms of equipment, while Surge is still in its promotional period.

However, expansion is considered mandatory. "If it is not expanded immediately, digital development outside Java will fall further behind. The government must quickly and accurately close this digital divide."

What Does This Mean for the Broadband Industry?

Opensignal's findings essentially open up a new map for Indonesia's broadband industry. It's not just about who is the fastest or who is the most stable, but who is best prepared to respond to increasingly complex user needs, from ordinary households to digital-based start-ups.

According to Heru Sutadi, Executive Director of the ICT Institute and telecommunications observer, the Indonesian internet market is still "very dynamic." He believes that competition in this sector is still wide open to anyone who wants to enter and grow. Data from the Indonesian Internet Service Providers Association (APJII) shows that there are currently around 1,400 internet service providers (ISPs) operating, a figure that reflects how crowded and fluid the market is.

According to Heru, these internet providers are spread across almost all regions of Indonesia. "APJII notes that they are already present in 38 provinces," he said in a voice message on Monday (1/12/2025). Even so, the map of players remains layered: there are large, medium, and small players, including RT/RW-net, which survives with a small but stable number of customers.

He explained that price remains the main area of competition. Users choose an ISP primarily based on price. However, when prices are relatively uniform in a given region, competition shifts to aspects such as quality, download and upload speeds, connection stability, and the responsiveness of technical support teams when disruptions occur.

"High speed is useless if it breaks down two days later and takes a long time to repair," said Heru. Stability and after-sales service are now factors that determine customer loyalty.

Read also:

The expansion of broadband networks to homes (fixed broadband) is also underway. Many small ISPs have been acquired by larger players, but in general the ecosystem has not shown signs of major consolidation. Quite the contrary: the number of ISPs has continued to grow from 1,200 to 1,400 in recent years.

Heru called this phenomenon interesting. "We don't know yet where the peak will stop. At some point, consolidation will certainly occur, with large players absorbing medium and small ones. But for now, the trend is still rising," he said.

Ultimately, he believes that customer decisions are not solely determined by price and speed. Network availability in certain areas, connection stability, and complaint handling speed are factors that make users stay with a provider or switch to another ISP. In such a highly fluid market, these switches can happen at any time.

Towards 2026: Consolidation, Expansion, and Customer Acquisition

Reading the preliminary outlook for 2026 through the Opensignal report signals a year of intense competition, with several patterns beginning to emerge.

Small ISPs are in the most vulnerable position. Without improving quality or expanding coverage, they could lose significant market share. Biznet and XL Home, two players that now want to step out of their comfort zone, are likely to face direct competition outside Java, especially in new urban cities.

Indosat HiFi is also beginning to emerge as a serious contender, especially in the consistent quality segment. Meanwhile, Oxygen.id has a great opportunity to move up a class, as long as it can turn its upload advantage into a business strategy, rather than just technical statistics.

In addition, Teguh from ATSI also highlighted two winners of the 1.4 GHz frequency auction by the Ministry of Communication and Digital Affairs (Komdigi) last October, namely PT Telemedia Komunikasi Pratama, a subsidiary of Surge (WIFI), and Eka Mas Republik, owner of MyRepublic.

"Telkom is strange. They have money, they have networks, they have markets. Why are they giving up?" he said. He said Telkom's decision to withdraw from the competition opened up space for the private sector to offer new packages called "people's internet" at a price of around Rp100,000 per month.

"This will be a new competitive landscape. But my critical observation is: why isn't Telkom playing here? What is its strategy? Does it only want to focus on mobile? I don't know," he added.

However, Teguh said that in the future, the industry will move towards consolidation. "We don't know what direction it will take, but with the entry of new players offering low prices and good quality, the market in 2026 could move towards consolidation. Especially if technologies such as Starlink's direct-to-cell are opened up, our telecommunications industry could be greatly shaken."

Without the need for BTS, Starlink's operating costs are much cheaper. However, the government has not yet granted permission for this. He also mentioned President Prabowo's plan to build an internet network that is more advanced than Starlink through cooperation with Japan. "But that is also not direct-to-cell," he added.