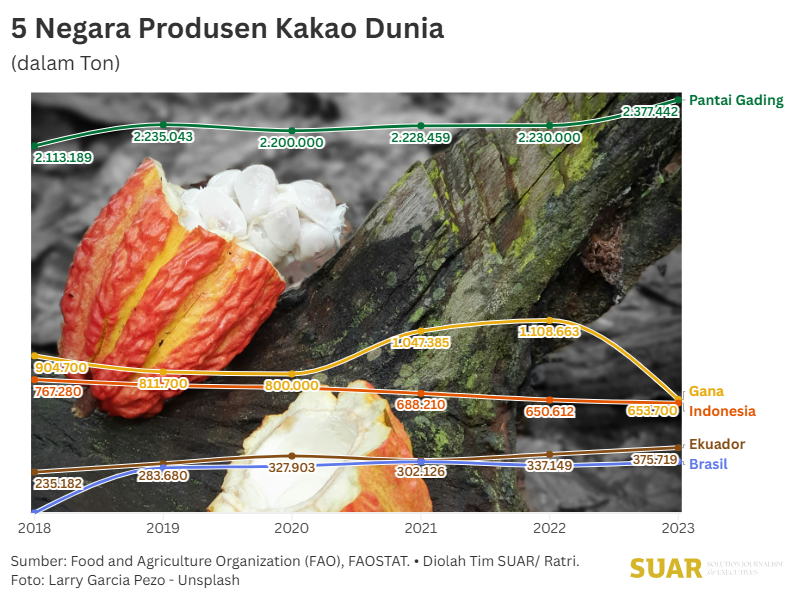

The Indonesian Plantation Crop Statistics Report from the Central Statistics Agency (BPS) in 2024 shows that Indonesia produced 617,112 tons of dry cocoa beans. This amount decreased by 2.37% from the previous year. When compared to the production volume from other cocoa-producing countries such as Ivory Coast and Ghana, which is relatively stable or increasing, the cocoa production trend data for Indonesia has actually decreased in recent years.

Price fluctuations in the international market, especially the drastic decline throughout 2025, have had a double impact. Namely, it puts pressure on farmers' income while also threatening the national productivity improvement program.

Cocoa price movements throughout 2025 can be seen in two acts. At the beginning of the year, world cocoa prices had risen to a peak above 11,623 US dollars per ton in the first week of January. This drastic increase was triggered by the El Nino phase, which triggered extreme weather that hit West Africa. Drought and plant diseases due to this climate phenomenon affected the quantity of cocoa production.

Entering the middle of the year, prices began to correct sharply, reaching a low of 5,858 US dollars per ton in mid-October 2025. This decline reflects a major correction of almost 50% from the peak at the beginning of the year. The main cause of the price slump was a surplus of supply from the West African region, which was supported by changes in climatic conditions.

For Indonesia, the decline in global prices due to surpluses from other countries has had a different impact on the upstream and downstream sectors. The downstream industry (processing cocoa into chocolate and powder products) is relatively benefited because it can obtain raw materials at lower prices. However, in the upstream sector, which is driven by farmers, the situation is the opposite.

Cocoa farmers face financial challenges because purchase prices at the domestic level have plummeted, even though most of them do not have adequate risk protection. This condition also has the potential to cause cocoa bean exporters to withhold exports because the government-stipulated export benchmark price (HPE) becomes unprofitable, especially with the export duty (BK) still in effect.

This fluctuating and generally declining price situation is a difficult challenge for Indonesia because of the tendency for national cocoa production to also decline. For the long term, efforts must be considered to anticipate price and climate shocks so that cocoa farmers do not suffer losses.

Strategies such as accelerating plant rejuvenation and rehabilitation programs to increase the productivity of old plantations, as well as improving bean quality through fermentation to create added value and product differentiation, must be carried out. By focusing on quality and increasing upstream efficiency, Indonesia can reduce its vulnerability to raw commodity prices and strengthen its position as a sustainable cocoa player in the global market.