The signing of the Free Trade Agreement (FTA) between Indonesia and the Eurasian Economic Union (EAEU), planned for December 21, 2025, in Russia, is an important moment for trade relations between the two parties. The agreement is an opportunity to increase export performance to EAEU countries.

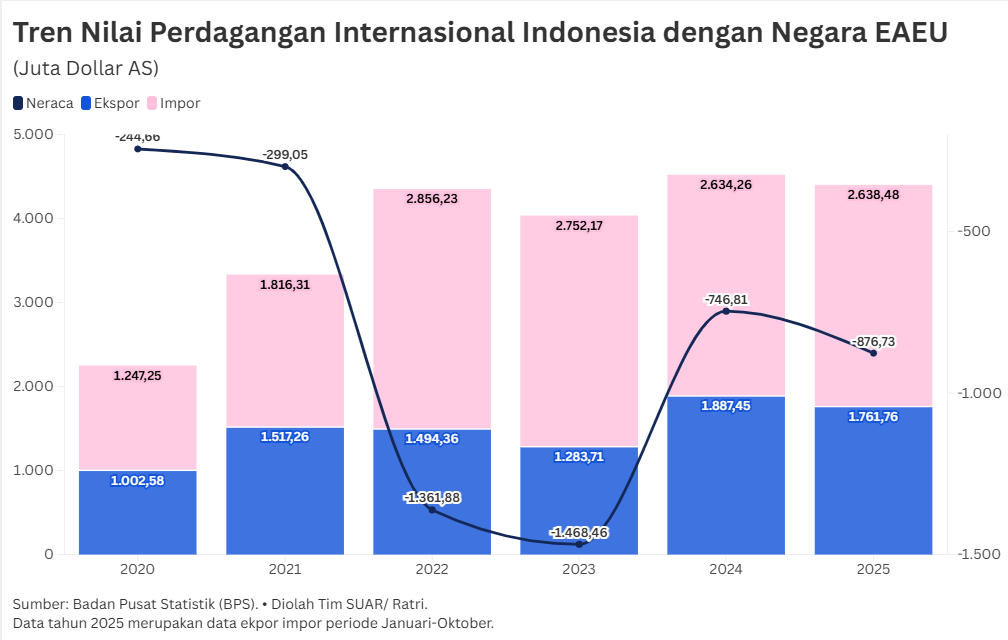

Based on data from the Central Statistics Agency (BPS), Indonesia experienced a trade deficit with EAEU countries during the 2020-2025 period. This was driven by high imports of fertilizers and mineral fuels from the EAEU, while Indonesia's exports were dominated by palm oil.

The momentum of the signing of this agreement should be seen as a strategic opportunity to reformulate the trade structure, particularly to expand Indonesia's non-traditional export markets to EAEU member countries, especially those other than Russia.

Indonesia's trade balance with the EAEU shows a trade deficit in 2020 of US$244.664 million. In 2022, the deficit is projected to increase to US$1,361.88 million. Potassium Chloride (natural salt) as the main import commodity experienced an increase in import value of up to 48.9% compared to 2021.

In the following year, the deficit rose again to 7.8%, or US$1,468.46 million (2023). Improvements in the trade balance began to appear in 2024 and 2025, reaching US$700 to US$800 million.

The trade deficit shows Indonesia's dependence on commodity supplies from the EAEU, especially Potassium Chloride, which is an important raw material for fertilizers. On the other hand, Indonesia's exports to this region are concentrated on palm oil and its derivatives, namely Refined Palm Oil and Liquid Fractions.

This concentration of commodities makes Indonesia's bargaining position vulnerable to global commodity price fluctuations and EAEU protectionism policies. To reduce the deficit, which is expected to reach nearly US$1.5 billion in 2023, diversification and increasing the added value of export commodities are urgently needed.

The I-EAEU FTA trade agreement offers great hope for overcoming market access limitations. Until now, most of the EAEU's trade with Indonesia has been dominated by Russia, which is the largest trading partner in the alliance. However, the EAEU also includes important member countries such as Kazakhstan, Belarus, Armenia, and Kyrgyzstan.

The elimination or reduction of tariffs through FTAs should focus on opening doors to these non-Russian markets, where Indonesian products may be less well known or held back by non-tariff barriers. Promoting access to the Kazakh and Belarusian markets, for example, could boost exports of new Indonesian commodities beyond palm oil. One of the main focuses in FTA negotiations is easing access for Indonesian downstream products. In addition to crude palm oil and its derivatives, Indonesia needs to promote exports of other processed products.

Data processing results from BPS show that commodities such as Robusta coffee consistently appear on the list of leading exports. Taking advantage of this momentum, processed food and beverage products, rubber and rubber products, as well as textiles and garment products, which have high added value, should be priority export targets. This will reduce dependence on a single export commodity (palm oil) and strengthen Indonesia's export foundation.

The Indonesia-EAEU FTA is a golden opportunity to achieve better trade balance. This agreement provides legal and structural mechanisms to improve the competitiveness of Indonesian products and diversify export destinations to all EAEU member countries.

The success of this agreement's implementation will depend heavily on how effectively Indonesia utilizes its new market access for value-added products beyond its main exports, such as palm oil, thereby creating mutually beneficial and sustainable economic partnerships.