Amid the various pressures of global uncertainty and indications of a domestic economic slowdown, the Financial Services Authority (OJK) is optimistic that the banking sector is still showing stable performance. Its risk profile remains maintained until the end of the year, even though there was a slowdown in June 2025.

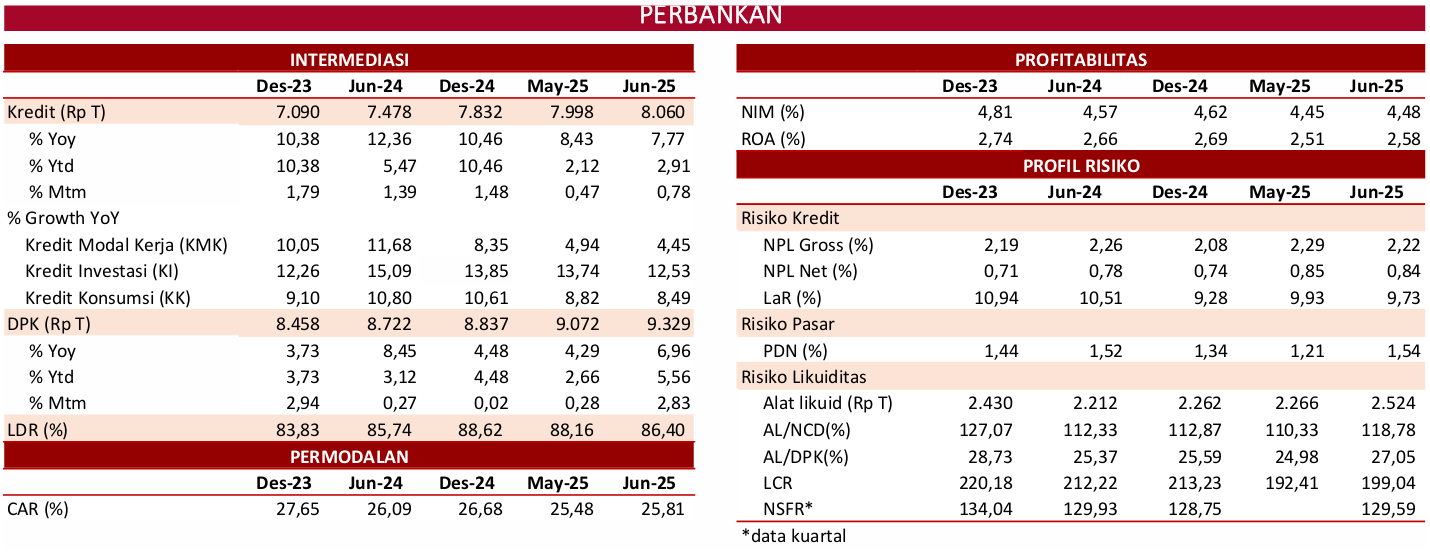

National banking credit disbursement reached IDR 8,060 trillion in June 2025, or grew 7.77% year-on-year (YoY). The rate of credit disbursement slowed down compared to the previous month, which grew 8.43% (YoY).

The Chief Executive of Banking Supervision of the OJK, Dian Ediana Rae, said that based on the type of use, Investment Loans grew the highest at 12.53 percent, followed by Consumption Loans at 8.49 percent. Meanwhile, Working Capital Loans grew 4.45 percent (YoY).

In terms of ownership, loans from domestic private national commercial banks grew the highest, at 10.78 percent (YoY). By debtor category, corporate loans grew by 10.78 percent. Meanwhile, UMKM loans grew by 2.18 percent, amid banking efforts focused on restoring UMKM credit quality.

Furthermore, credit disbursement to the mining and quarrying sector recorded the largest growth, at 20.69% (YoY).

The service sector also grew significantly by 19.17% (YoY), followed by the transportation and communication sector which grew 17.94% (YoY), and the electricity, gas and water sector which grew 11.23% (YoY).

"When viewed based on economic sector, credit disbursement to several sectors grew high annually, reaching double digits," said Dian in the OJK RDK Press Conference in Jakarta on August 4, 2025.

Furthermore, from the funding side, Dian explained that Third Party Funds (DPK) were recorded to have grown 6.96% (YoY) to Rp9,329 trillion. Current accounts recorded growth of 10.35%, savings 6.84%, and deposits 4.19%.

He assessed that the decline in the Bank Indonesia benchmark interest rate or BI-Rate also contributed to the decline in banking interest rates. The decline in the BI rate was also followed by a decrease in banking interest rates. Meanwhile, the average deposit interest rate (DPK) has also begun to show a downward trend compared to the previous month.

Meanwhile, the national banking liquidity level in May 2025 is also considered adequate, which is reflected in the ratio of liquid assets to non-core deposits (AL/NCD) which is at the level of 118.78 percent, and the ratio of liquid assets to DPK (AL/DPK) of 27.05 percent. Both ratios are far above the minimum threshold set at 50 percent and 10 percent respectively.

In terms of asset quality, the ratio of non-performing loans or non-performing loans (NPL) is also still maintained. Gross NPL was recorded at 2.22 percent, and net NPL was 0.84 percent.

Meanwhile, the loan at risk (LAR) ratio decreased to 9.73 percent, which according to Dian, has returned to pre-pandemic levels. Banking resilience is also reflected in strong capital, with a capital adequacy ratio or capital adequacy ratio (CAR) which is at a high level, namely 25.81 percent.

Banking performance is still shining

The signal of the still stable banking sector is reflected in the banking performance which still recorded positive growth. PT Bank Central Asia Tbk (IDX: BBCA) and its subsidiaries posted credit growth of 12.9% year-on-year (YoY) to Rp959 trillion as of June 2025.

This growth was supported by credit disbursement in various segments, as well as maintaining the company's liquidity condition. In line with the achievement of credit and funding growth as well as the volume of banking transactions, the net profit performance of BCA and its subsidiaries grew 8% YoY to Rp 29 trillion in the first semester of 2025.

"BCA's credit growth is positive in various segments, starting from corporate, UMKM, and consumer. BCA always distributes credit prudently, considering the precautionary principle with discipline in implementing risk management," said President Director of PT Bank Central Asia Tbk, Hendra Lembong.

BCA's corporate loans grew 16.1% YoY reaching Rp451.8 trillion as of June 2025. Commercial loans rose 12.6% YoY to Rp143.6 trillion, and SME loans increased 11.1% YoY to Rp127 trillion. Supported by mortgage growth of 8.4% to Rp137.6 trillion, and motor vehicle loans (KKB) 5.2% reaching Rp65.4 trillion, total consumer credit growth reached 7.6% YoY to Rp226.4 trillion.

Outstanding other consumer loans (mostly credit cards) grew 9.4% YoY reaching Rp23.4 trillion. BCA's loan quality is maintained solid, as reflected in the loan at risk (LAR) ratio of 5.7% in the first semester of 2025, improving from 6.4% in the previous year. The non performing loan (NPL) ratio is managed at a level of 2.2%. NPL and LAR reserves are adequate, at 167.2% and 68.7% respectively.

A similar record was also noted by PT Bank Rakyat Indonesia (Persero) BRI. This state-owned bank also recorded positive and resilient performance throughout the second quarter of 2025. Meanwhile, BRI Group's profit reached Rp26.53 trillion with assets worth Rp2,106.37 trillion or grew 6.52% year on year (YoY) until the Second Quarter of 2025.

President Director of BRI Hery Gunardi explained that BRI will continue to strengthen its performance through ongoing transformation, namely 'BRIVolution Reignite'.

"BRI will improve the funding structure for healthy CASA growth through deposit service segmentation, product simplification, current account acceleration, strengthening digital channels, and strengthening the brand to strengthen its position in the retail and wholesale market," said Hery in his written statement.

Not only that, BRI's transformation will also focus on improving the core business and developing a new growth engine (new core).

"BRI is also reviewing the micro business model and improving business processes, increasing mantri capabilities, and expanding pawn/bullion services. On the other hand, BRI will also strengthen its payroll business dominance, as well as increase its medium segment business and accelerate the growth of the commercial segment," said Hery.