When tax revenue contracted, revenue from customs and excise posts was strong enough to support the state's opinion. This condition was driven by an increase in export duty revenue and the role of the crackdown on illegal cigarettes to optimize excise revenue.

The government's financial report in early October showed that the realization of tax revenue until the end of September was IDR 1,295.3 trillion or 62.4% of the 2025 semester report outlook target. This realization was down 4.4% compared to the same period the previous year.

These receipts caused the state's revenue from the taxation sector in general to fall (-2.9%). As a result, total state revenue also fell by 7.2% compared to the same period in 2024. The new state revenue collected is 1,863.3 trillion or 65% of the lapsem outlook target.

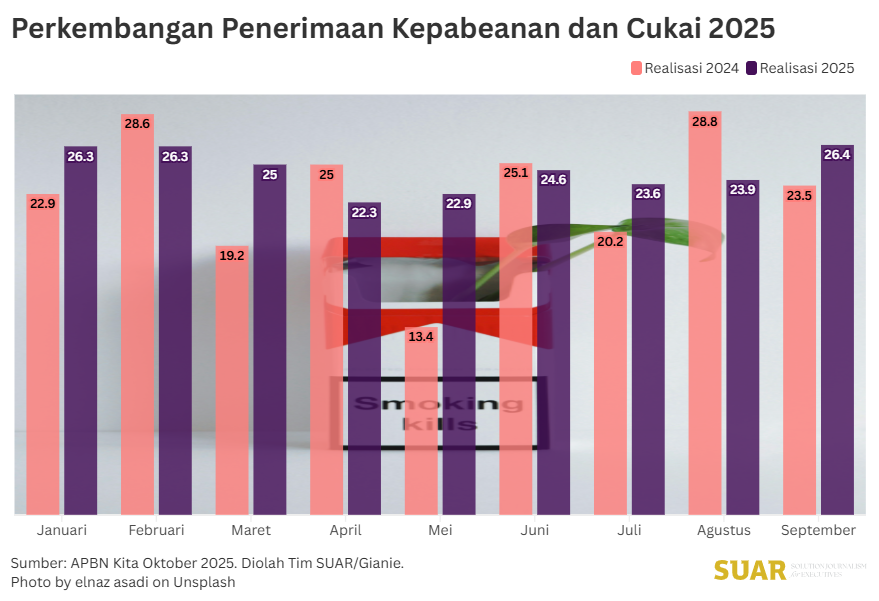

The only revenue post that grew was from customs and excise. As of 30 September, this sector realized Rp 221.3 trillion or 71.3% compared to the outlook lapsem target. Compared to the same period last year, customs and excise revenue grew by 7.1%. However, the portion of revenue from customs and excise is only around 12 percent of total state revenue. Losing to the dominance of tax sector revenue.

The increase in customs and excise revenue was supported by excise revenue which grew by 4.6% and export duty revenue which grew by 74.8%. The increase in export duty revenue was partly due to the increase in crude palm oil (CPO) prices and palm oil export volumes. It was also due to the copper concentrate export policy during March-September.

Meanwhile, the increase in excise tax was partly influenced by the Directorate General of Customs and Excise (DGCE)'s crackdown on illegal cigarettes. During the last 9 months, DGCE managed to secure around 816 million illegal cigarettes. This number increased by 37% on an annual basis and is the highest number of prosecution results in the last five years. Illegal cigarette prosecution is dominated by machine-made clove cigarettes (SKM) and machine-made white cigarettes (SPM) without excise tax (plain).

The circulation of illegal cigarettes, in addition to reducing state revenues, also harms the cigarette industry due to unfair business competition. By the end of the year, if enforcement remains vigorous, the number of illegal cigarettes that can be secured is likely to reach 1 billion sticks. This effort will greatly affect excise revenue, which means it will also increase state revenue.