The placement of government funds amounting to Rp 200 trillion in the Association of State-Owned Banks (Himbara) has begun to be channeled. These additional funds have the potential to significantly increase banking liquidity, giving banks more room to extend credit.

Chief Executive of Banking Supervision of the Financial Services Authority (OJK) Dian Ediana Rae explained that the placement of government funds has an impact on the wider liquidity space for banks to extend credit.

"This indicates that banks have more liquidity space to channel credit going forward," Dian said at the September 2025 Monthly Board of Commissioners Meeting (RDKB) virtually, Thursday (9/10/2025).

The five banks receiving the placement of government funds have now realized it gradually as credit. He also ensured that he continues to supervise the implementation of this government program so that banks continue to pay attention to risk management. On the other hand, looser liquidity conditions can have an impact on lowering the cost of funds for banks. This is expected to encourage a decline in lending rates.

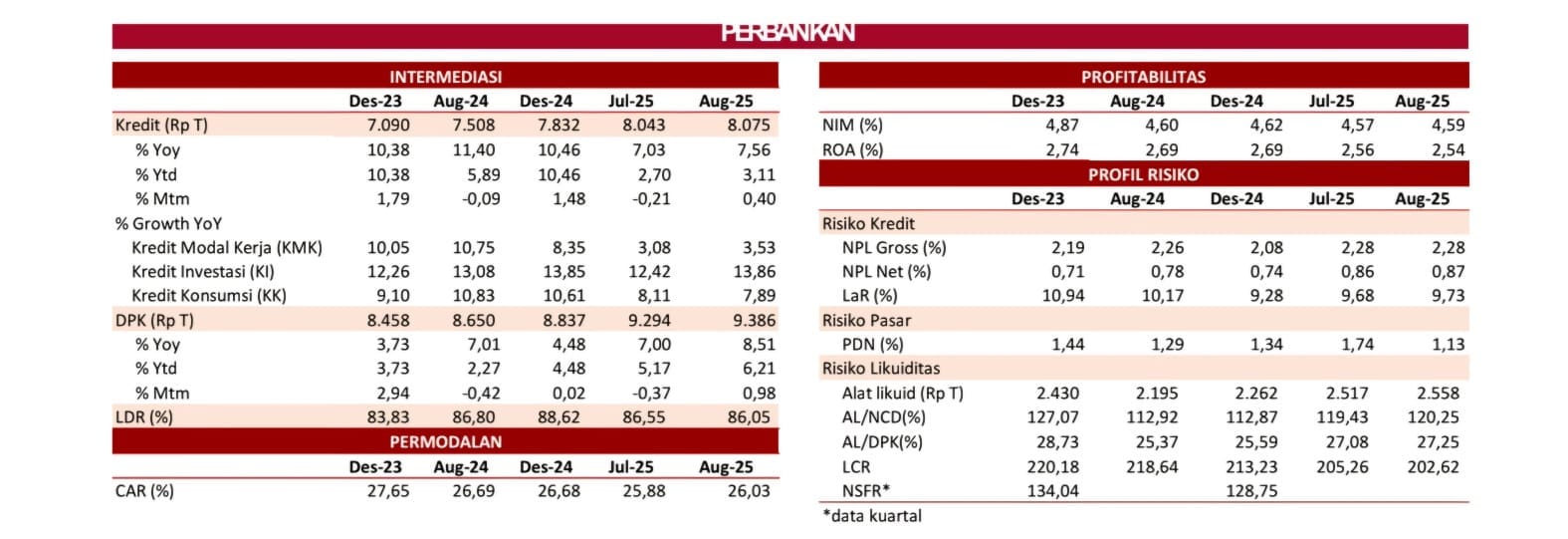

OJK noted that in August 2025 bank credit began to increase, namely, by 7.56 percent on an annual basis(year on year / yoy) or to IDR 8,075 trillion. This figure is higher than the previous month which grew 7.03 percent yoy.

Dian revealed that banking intermediation performance is currently stable with a maintained risk profile and banking operational activities remain optimal to provide financial services for the community. In August 2025 credit grew by 7.56 percent yoy.

By type of use, investment loans grew the highest at 13.86 percent, followed by consumption loans at 7.89 percent, and working capital loans at 3.53 percent.

Third-party funds (DPK) in August 2025 were also recorded to have grown by 8.51 percent yoy to Rp9,385.8 trillion. This DPK growth was higher than July 2025 which grew by 7 percent.

Meanwhile, the liquidity of the banking industry in August 2025 remained adequate with the ratio of Liquid Tools/Non-Core Deposit (AL/NCD) and Liquid Tools/Third Party Funds (AL/DPK) at 120.25 and 27.25 percent, respectively.

"Still above the threshold of 50 percent and 10 percent respectively. Theliquidity coverage ratio (LCR) is at 202.61 percent," he explained.

Credit quality is also maintained with a gross non-performing loan (NPL) ratio of 2.28 percent and a net NPL of 0.87 percent. Then, for loan at risk (LAR) is relatively stable at 9.73 percent.

Banks have extended credit

Responding to the Rp 55 trillion funding provided by the government, Bank Mandiri claims to have used the funds for lending. As of the end of September 2025, Bank Mandiri has disbursed Rp 34.5 trillion or equivalent to 63% of the total funds provided by the government.

Bank Mandiri Finance & Strategy Director Novita Widya Anggraini emphasized that this additional liquidity is an important catalyst in expanding the company's intermediary function.

"Bank Mandiri is optimistic that it can optimally absorb the placement of these funds up to 100% by the end of this year with priority on labor-intensive sectors and industries as well as UMKM which have proven to be able to support family economic life in various regions of Indonesia," Novita explained in her official statement, Monday (6/10/2025).

Novita further added that Bank Mandiri also lends to other strategic sectors, including plantations and food security, downstream natural resources and renewable energy, health services, manufacturing, and industrial estates.

This financing focus is in line with the government's agenda in encouraging economic independence and strengthening national industries based on domestic added value.

"With the additional placement of funds from the Ministry of Finance of Rp55 trillion, Bank Mandiri's financing capacity is increasingly solid so that it can accelerate priority sectors. This is in line with the company's commitment to expand financial inclusion while strengthening synergies with government programs," he said.

In line with Bank Mandiri, BTN also has a plan to channel credit from the government funds.

BTN President Director Nixon L.P. Napitupulu said the company is focusing on channeling the government placement funds to home ownership loans (KPR).

"We are optimistic that the company can create credit demand , one of which is by launching low-interest mortgage products," he said in a press release in Jakarta, late September.

To boost demand for mortgages, BTN has prepared a promo mortgage rate of 2.65% for up to three years. With additional liquidity from the government, Nixon hopes to reduce the cost of funds (CoF). He targets the cost of funds to fall below 4% this year.

Improvement in credit demand

Executive Director of the Center of Reform on Economics (CORE) Mohammad Faisal said, amidst weak domestic credit demand due to slowing economic conditions from the demand side, the IDR 200 trillion liquidity injection risks being ineffective if it is not accompanied by a fiscal stimulus that can boost aggregate demand.

"This policy requires synchronization with other targeted fiscal policies to encourage demand, so that the liquidity injected can be absorbed optimally by the real sector," he said.

Furthermore, people are still waiting to see how fiscal policy fixes fundamental structural problems such as the dominance of informal sector workers, entrenched inequality, and the unbreakable cycle of poverty.

Concrete steps from the government through fiscal policy are important because they are the background to the demands of the demonstrations a few weeks ago.

There are at least three important notes related to Indonesia's structural economic problems that need to be addressed beyond the liquidity injection policy.

First, the challenge of realizing the 8% growth target amid deindustrialization. Second, job creation remains limited. Third, the unbroken cycle of poverty and structural inequality.