A glimmer of optimism has emerged regarding apartment unit sales during 2025. From the demand side, apartment absorption is projected to increase up to 87% cumulatively until the third quarter of 2025. This increase is largely driven by government incentives and financing flexibility. Annual sales volume growth since the beginning of theyear (year to date) 2025 compared to 2024 grew up to 16%, although overall it remains at a low level.

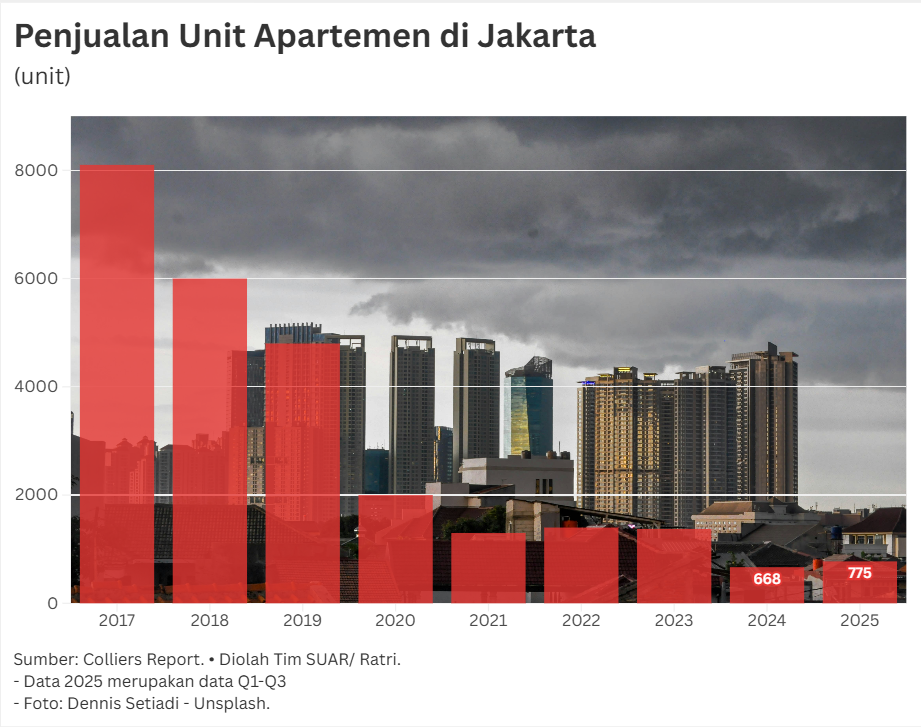

Historical data from the Colliers institute shows that vertical residential sales in the Jakarta area declined dramatically after 2017. In 2020, sales stagnated below 2,000 units. Sales dropped again to around 1,300-1,400 units per year since 2021. This condition indicates that the provision of incentives has not been able to attract more buyers.

The significant decline in sales was partly due to a shift in buyer preferences supported by VAT subsidies. The Colliers report in the third quarter of 2025 explains that people now prefercompleted units. For developers, this shift in preference is a concern when launching new projects(greenfield). This also has an impact on the sales strategy of existing inventory stock (both premium and mid-range units).

In addition, the increase in asking prices is currently also most active in the middle segment, particularly in East Jakarta (0.8% quarter-on-quarter) and North Jakarta (1.1% year-on-year). These areas are a barometer of price dynamics as they are supported by the purchasing power of end-users. In contrast, premium segment apartments in the Central Business District (CBD) and South Jakarta experienced price stagnation, suggesting that prices in the upper segment have reached a saturation point.

Price developments also show significant disparities between submarkets in Jakarta. The average increase in asking prices was still moderate, at 0.8% (y-o-y) until Q3-2025. The highest price increases were recorded in the middle segment, particularly in North Jakarta at 1.1% (y-o-y) and East Jakarta at 1.5% (y-o-y). In fact, these two areas are the locations with the lowest prices, at around IDR 22 million per square meter (East Jakarta) and IDR 27 million per square meter (North Jakarta).

Meanwhile, premium submarkets such as CBD, with the highest price of IDR 53.4 million per square meter, and South Jakarta showed stagnant or very small price growth of 0.0% (q-o-q) to 0.6% (y-o-y).

Future projections indicate that prices will continue to increase moderately at around 2% per annum until 2027, supported by new supply of around 1,820 units per annum from 2026-2027. This growth position is influenced by middle segment consumers as the main driver of price growth.

In facing the market dynamics of 2025, Colliers also provides a view for vertical residential business players to pay attention to strategies ahead of the closing of the fourth quarter of 2025. There are several factors that need to be considered, namely, maximizing the absorption of VAT incentives and flexible financing schemes before it ends. With changes in consumer behavior in purchasing units, businesses need to make ready-to-occupy units a top sales priority.

In addition, businesses need to allocate marketing resources to the growing submarkets (East and North Jakarta), not just the stagnant high-price markets. In addition to market scope, product development that truly addresses the needs of middle-class end-users, both in terms of size, facilities, and price, also needs to be considered. By focusing on segments supported by real demand, it is hoped that Jakarta's vertical residential industry can continue its positive momentum in increasing sales volume.