The acceleration of digital economic growth throughout 2025 is proof that Indonesia has great opportunities and potential in the digital economic ecosystem. Moreover, various stakeholders appear committed to maximizing Indonesia's potential, which is increasingly opening up in terms of product and service innovation as well as supporting infrastructure in 2026.

However, reflecting on the experience of 2025, innovation and market potential do not necessarily translate into tangible contributions without adaptive regulatory certainty that provides a safe space for innovators to take steps and grow.

Secretary General of the Indonesian E-Commerce Association (idEA) Budi Primawan stated that throughout 2025, e-commerce performance in a broad sense, ranging from marketplace transactions, online travel agents, to fintech, will be quite solid, although not as explosive as during the pandemic. Budi assessed that this situation is the final phase of e-commerce normalization, leading to positive and quality growth next year.

"The industry is increasingly focused on profitability, operational efficiency, and strengthening the UMKM ecosystem UMKM local brands . The most notable milestones are the maturation of digital payments, the recovery of the travel sector, and logistics services that are increasingly reaching second- and third-tier cities," Budi told SUARon Friday (12/12/2025).

One of the challenges facing e-commerce next year is maintaining consumer trust amid challenging purchasing power. Strategies to increase cost transparency, improve after-sales service, manage data responsibly, and deliver a relevant shopping experience, including the use of AI in recommendations, customer service, and fraud detection, are key to ensuring e-commerce remains competitive in a growing market.

In addition to improving governance and customer service, Budi expects certainty, consistency, and coordination of regulations between the Ministry of Communication and Digital Affairs, the Ministry of Trade, the Ministry of Finance, and the Ministry UMKM by intensive two-way communication between the industry and regulators to keep each other updated, align perceptions, and understand the dynamics in the field.

"Our principle is simple: good regulation is regulation that can be implemented, not just good on paper. With dialogue from the outset, policies will be more realistic, less overlapping, and strengthen the digital economy in an inclusive manner," he said.

Sharing his views with Budi, Bareksa Chief Executive Officer Karaniya Dharmasaputra explained that in terms of market potential, Southeast Asia has actually surpassed China and India since early 2020. With the largest market size, Indonesia could become a key player. However, Karaniya reminded that this size is still potential, measured by market growth rates and projections, not concrete figures that can be identified.

"I think Indonesia still has to overcome several major challenges. One of them is that we have not yet emerged from the tech winter. Many technology companies are experiencing governance issues, even those on a large scale . They are no longer unicorns, but rather decacorns, so when they encounter problems, everyone is shocked," said Karaniya when contacted by SUARon Wednesday (October 8, 2025).

Based on these conditions, Karaniya believes that the shift in orientation of technology companies from top line to bottom line will help strengthen their foundations before achieving profitability targets. Here, the role of the government is greatly needed, especially for technology companies operating in highly regulated fields such as fintech.

"Year after year, BI and OJK have always encouraged the strengthening of governance, transparency, and accountability, so that fintech companies are now entering a more mature era. I think this is necessary, but governance parameters must also always adapt to the latest technology," he explained.

Read also:

Although the role of regulators in regulating the governance of companies driving the digital economy is necessary, Karaniya also hopes that the government understands the characteristics of companies that desperately need domestic and foreign investment to continue to grow. Therefore, law enforcement needs to take into account the sense of security for investors who have a vested interest in the integrity of tech companies.

"Don't let investors in fraudulent tech companies who are victims of this economic crime be positioned as perpetrators, unless there is real evidence that they were involved in embezzlement. The enforcement of this law will determine whether Indonesia can remain attractive as a center for digital economic investment due to its enormous potential," he added.

QRIS is gaining momentum

In addition to regulatory support that guides innovation among digital market players, the government is strengthening digital infrastructure and expanding the acceptance of cashless payments through the Indonesian Standard Quick Response Code (QRIS).

Deputy Governor of Bank Indonesia Filianingsih Hendarta stated that this acceleration is in line with the integral vision of the 2025-2030 Indonesian Payment System Blueprint (BSPI) established by Bank Indonesia.

"During November 2025, digital transactions, including mobile banking, internet banking, and QRIS, grew by 40% with a volume of 4.6 billion transactions. The widespread adoption of QRIS shows that the digitization of payment systems has become a major foundation for economic activities in consumption, transportation, and public services," explained Filianingsih during a question and answer session at the BI RDG Press Conference in December on Wednesday (10/17/2025).

With growth reaching 59 million users and 42 million merchants, 90% of which are UMKM, QRIS transactions reached a volume of 13.66 billion transactions, exceeding the target. The expansion of QRIS Tap In/Tap Out use cases in transportation modes, security innovations, and public trust form the basis for the government's projection that digital transactions will grow 29.7% year on year this year.

"In 2026, we are pushing for the expansion of QRIS with the theme of independence: 17 billion transactions, cross-border to 8 countries, 45 million merchants, and 60 million users. Since its launch, QRIS Tap In/Tap Out has recorded 508,000 transactions across 14 provinces, growing by 1,200% month-to-month. Moving forward, we are collaborating with Apple to enable iOS to support NFC, allowing QRIS Tap to be used beyond Android," he emphasized.

Read also:

Supplementing Filianingsih's explanation, Ramdan Denny Prakoso, Executive Director of the Communications Department at Bank Indonesia, emphasized that BI is fully committed to encouraging the expansion of non-cash payment transactions, especially in areas with supportive demographics and infrastructure.

"BI encourages the use of cashless payments because they are fast, easy, cheap, safe, and reliable. The use of cashless payments can protect the public from the risk of counterfeit money. However, cash or cashless payment systems are used according to the agreement and convenience of the transacting parties," said Denny in a written statement on Tuesday (12/23/2025).

Early detection

Maintaining market integrity is synonymous with maintaining public trust in the digital economy. Therefore, the Chairman of the Indonesia Fintech Society (IFSoc), Rudiantara, emphasized that the significant scale of the fintech industry and its integration with the national financial system requires players to focus not only on growth and innovation, but also on governance and consumer protection.

"Without these two foundations, growth will actually create new risks for the ecosystem," said the former Minister of Communication and Information Technology 2014-2019 during the dissemination of the IFSoc Year-End Report in Jakarta on Friday (12/19/2025).

Looking ahead to 2026, IFSoc has identified five issues that require early detection to ensure that Indonesia's digital economy remains resilient and grows faster than this year:

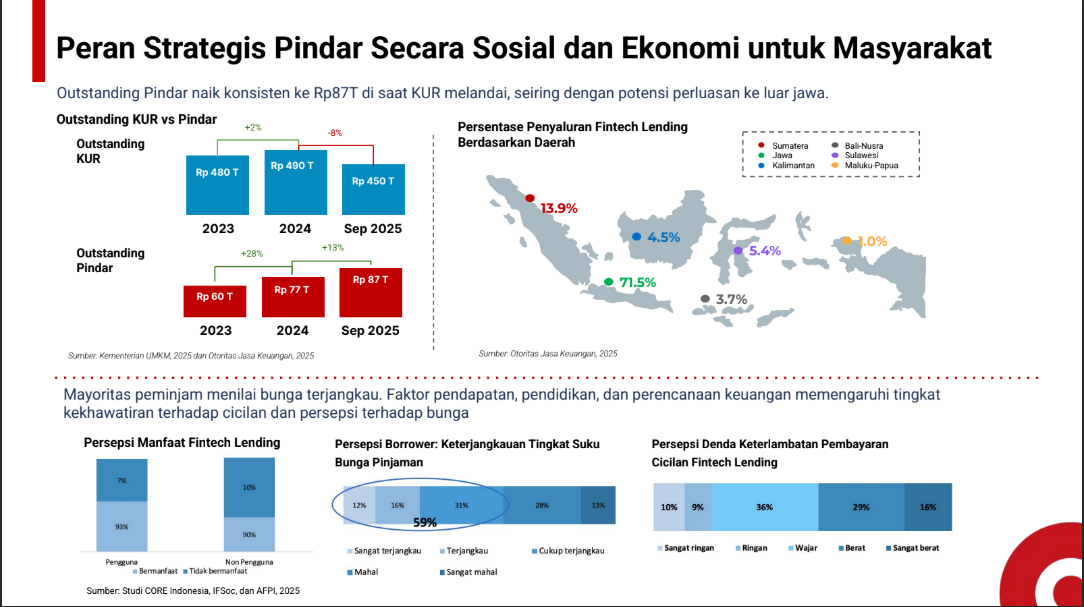

- The role of online lending, which has successfully opened up access to financing for the unbanked and underbanked, needs to take into account consumer protection policies amid the trend of continuously declining interest rates.

- The speed and effectiveness of handling scams and fraud by the Indonesia Anti Scam Center (IASC) and the PASTI Task Force must be improved, especially by simplifying post-account blocking procedures, so that the recovery of victims' funds does not take too long.

- The interoperability and integration of Cross Border QRIS remains oriented towards national interests and regional cooperation needs to strengthen Indonesia's position in the global payment ecosystem, not merely reflect openness.

- The regulatory, innovation, business, literacy, security, and sovereignty ecosystems in the pace of AI investment in the fintech industry in Indonesia need to be established as a follow-up to the level of AI adoption that has successfully reached 2nd place in the Asia-Pacific region.

- Comprehensive attention and monitoring of the quality of startup companies' governance and the transparency of technology companies to maintain trust in the digital economy.

"Strengthening governance must indeed begin with companies, but its effectiveness is highly dependent on the quality of supervision, regulatory infrastructure, and supporting professions. Therefore, governance improvements must occur across all stakeholders and ecosystems," he concluded.