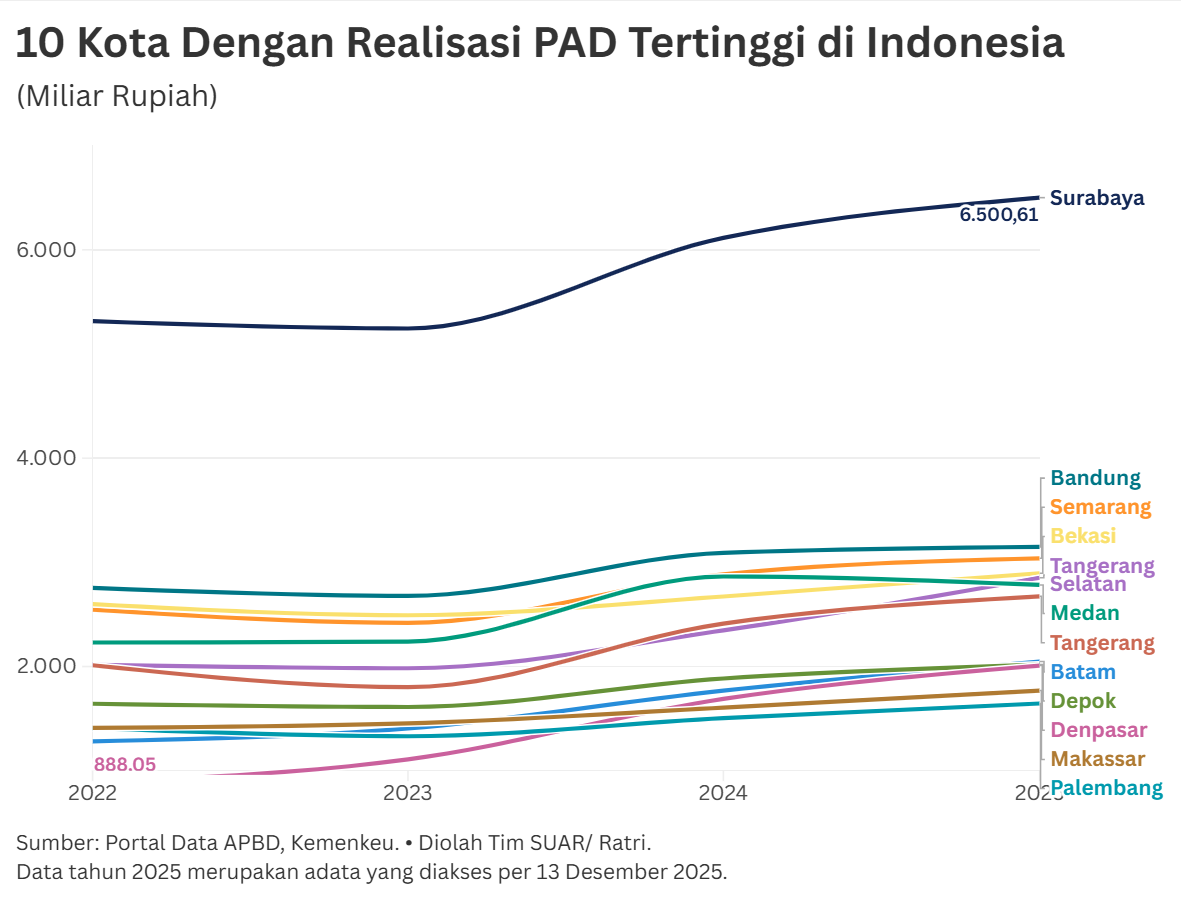

Cities with consistent fiscal strength will become regional economic centers. Cities such as Surabaya and Bandung serve as the centers of economic activity in East Java and West Java, supported by key sectors ranging from manufacturing and trade to accommodation and food and beverage services.

The high capacity of Local Own-Source Revenue (PAD) reflects the high local economic potential and promising tax base in the region. The stability of PAD in these major cities is highly dependent on local taxes, which can contribute to more than 80% of total PAD.

The city of Surabaya, for example, will have local taxes amounting to Rp 5.38 trillion out of a total PAD of Rp 6.5 trillion in 2025. Most of this tax revenue will come from PBB and BPHTB, each of which will amount to more than Rp 1 trillion.

Specifically, of the 10 cities with the highest PAD, property and asset-based taxes, namely Urban Land and Building Tax (PBB-P2) and Tax on Acquisition of Land and Building Rights (BPHTB), play a central role in increasing local tax revenue. The significant contribution of PBB and BPHTB shows that the property and asset transaction sectors are the main pillars of urban fiscal resilience. This makes them less vulnerable to daily consumption fluctuations compared to other taxes such as Hotel or Restaurant Tax.

The year 2025 brings major challenges for regional finances due to the central government's efficiency policy, which has resulted in a reduction in Regional Transfer (TKD) allocations. This policy forces cities that have been heavily dependent on central transfers to adapt quickly.

However, this turbulence did not necessarily weaken cities. Data processed by the Ministry of Finance shows that nearly half (47%) of 91 cities in Indonesia managed to overcome this challenge by increasing their local revenue realization. In fact, around 14% of cities recorded year-on-year (y-o-y) PAD growth exceeding IDR 100 billion or even recorded revenue growth of up to 20%.

Analysis of nominal PAD growth data from 2024 to 2025 shows an aggressive fiscal response from various types of cities. The highest nominal increase in PAD was led by South Tangerang, reaching more than IDR 500 billion, followed by Surabaya (IDR 386.22 billion) and Denpasar (IDR 319.71 billion).

Interestingly, rapid growth was also recorded by cities outside the main economic centers, such as Kotamobagu in North Sulawesi (highest percentage growth of 34.23%) and Palangkaraya (32.38%), which also shows that the momentum of increasing local revenue is not only limited to metropolitan cities. These cities have successfully turned the reduction in TKD into an opportunity to explore local potential, thereby maintaining their fiscal capacity.

The reduction in TKD should be viewed not only as a fiscal threat, but also as a crucial momentum to encourage true regional independence. High fiscal dependence on the central government often makes regional development planning vulnerable and less discretionary. To address this challenge, regional governments need to reform their tax administration with a more efficient system that is secure from the payment transaction process to tax management.

An example of this is the comprehensive digitization of tax services, from registration and assessment to payment and supervision, in order to expand the taxpayer base (extensification) and ensure better compliance (intensification). The effectiveness of taxation that has been transformed by digital innovation has been practiced by the city of Malang.

In addition to improving the tax system to make it more effective, cities must be more creative in increasing local revenue. Apart from optimizing existing local taxes, city governments need to look for new opportunities or untapped local potential. This includes increasing the returns on the management of local assets through the revitalization and professionalization of local government-owned enterprises (BUMD) so that they can contribute significant dividends.

In addition, optimizing idle regional assets can become a source of non-tax revenue, for example through effective Utilization Cooperation (KSP) or leasing schemes. With proactive and creative measures, the fiscal challenges of 2025 can be transformed into a strong foundation for long-term regional autonomy and fiscal resilience.