Good morning Chief...

The following is important information related to the development of the business universe that needs attention today based on the curation of the SUAR Team.

Anticipate New US Tariffs on Pharmaceuticals and Furniture

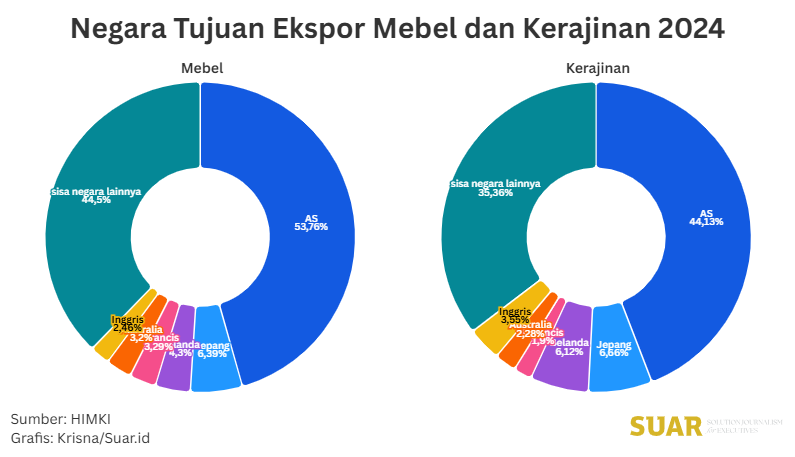

- After announcing trade tariffs to dozens of countries in August, United States (US) President Donald Trump has again set new tariffs on imported products. Starting October 1, imports of pharmaceutical products to the US will be subject to a 100% tariff and household products and furniture at 50%. This needs to be anticipated by related industry players.

- Business people regret the new tariffs. This is because it could reduce the competitiveness of Indonesian furniture and pharmaceutical products. Business people must rack their brains to find diversification of new potential markets other than the US.

Read more here.

Strengthening the Quality of BUMN Governance Without Closing Private Sector Space

- The Ministry of State-Owned Enterprises (BUMN) will change its face. In a Working Committee (Panja) meeting of the DPR RI with the government, Friday (26/9/2025), it was agreed that the nomenclature of the Ministry of BUMN would be changed to the BUMN Regulatory Agency (BP). This change is not just a change of name. The BUMN BP will later hold the functions of regulating and supervising BUMN, while investment management will still be handled by Daya Anagata Nusantara (Danantara) – a strategic investment management institution formed earlier this year by President Prabowo Subianto.

Read more here.

Not Just a Toy, Indonesia's Game Industry Potential Reaches USD 3.66 Billion

- A report by The States of Indonesia’s Game Industry White Paper released by game developer Agate International stated that in 2024, the potential market value of the Indonesian game industry is estimated to reach USD 3.66 billion. With 3.37 billion game downloads in 2022 and a transaction value of USD 2 billion, Indonesia now occupies the third largest position globally. However, this market is dominated by foreign game developers, leaving only 0.5% of the market for local game developers. The economic value of this ecosystem also comes from purchases to support the performance of game players. Mobile game users in Indonesia have spent around IDR 5.6 trillion on in-app purchases, an increase of 15.6% compared to 2022. On average, each game player spends IDR 91,362 per game.

Read more here.

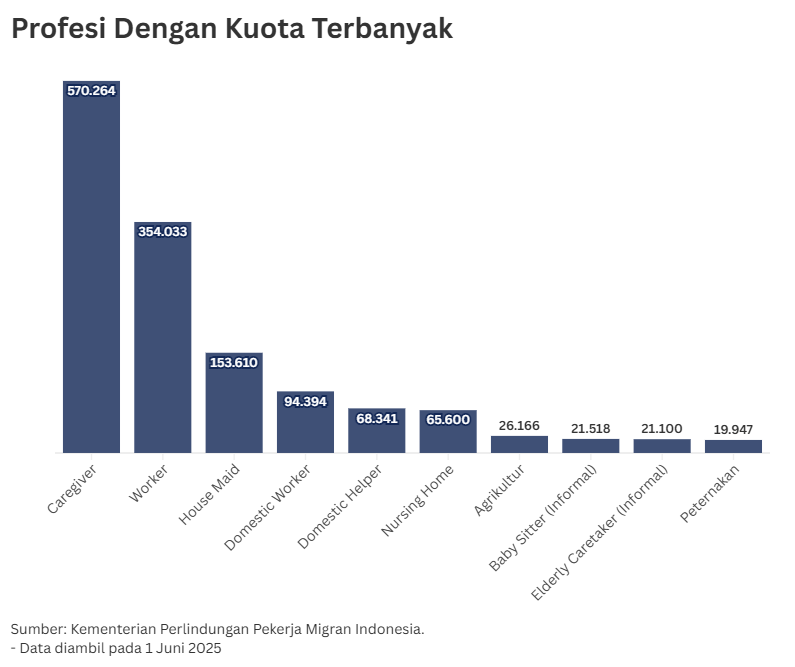

Absorbing Labor, Indonesia Ready to Send Qualified Caregivers to Singapore

- Amid limited job opportunities domestically, there is a significant demand for elderly caregiver workforce from Singapore. Preparation from job training institutions (LPK) in the form of language skills, work skill training, and cultural insights of the destination country, is invaluable for prospective migrant workers to become qualified caregivers. To ensure that prospective migrant workers are equipped as highly skilled labor, the Deputy Minister for Protection of Indonesian Migrant Workers (Wamen P2MI), Christina Aryani, visited the Center for Vocational Training and Productivity (BBPVP) in Bekasi, West Java, on Tuesday (23/9/2025).

Read more here.

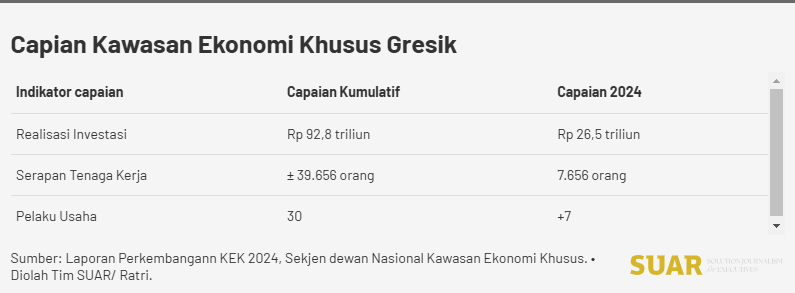

Building a Resilient Economic Ecosystem in the Gresik SEZ Style

- Of the total investment in the Gresik Special Economic Zone (KEK) of Rp 92.8 trillion, the dominant contribution comes from the private sector or business actors, amounting to Rp 83.3 trillion. This demonstrates high investor confidence.

- The effectiveness of the Gresik SEZ is inseparable from strong investment-attracting factors. Its strategic location with adequate industrial infrastructure, such as integrated port access, reliable energy and water supply, and a good road network, ensures smooth operations and reduces logistics costs for investors. The availability of this physical infrastructure streamlines the business process, from raw materials to product distribution, which directly contributes to the low Incremental Capital Output Ratio (ICOR) in the region.

Read more here.

Strategic Forum: Indonesia–Canada CEPA & Indonesia–European Union CEPA: This strategic discussion organized by the Indonesian Ministry of Trade will explore the opportunities, challenges, and strategies for utilizing the Comprehensive Economic Partnership Agreement (CEPA) with Canada and the European Union to promote more inclusive and sustainable trade. Taking place on Monday, September 29, 2025, from 09:00–15:00 WIB, at the Auditorium of the Indonesian Ministry of Trade, this forum will involve stakeholders to synergize and collaborate in maximizing the great potential of CEPA. Participants can attend this event offline at the location or via live streaming on the Indonesian Ministry of Trade's YouTube channel.

Public release of the Annual Indonesian Flow of Funds Balance 2020–2024: As a routine agenda, this publication by the Central Statistics Agency (BPS) aims to provide a comprehensive overview of investment data and information in Indonesia during the 2020–2024 period. It includes the development of annual financial and non-financial investments in various transactions by six main economic institution sectors (Non-Financial Corporations, Financial Corporations, Public Administration, Households, Non-Profit Institutions Serving Households (NPISH), and Overseas). This data release is scheduled for Monday, September 29, 2025, and the results can be accessed by the public through the official BPS website.

"The opportunity to secure ourselves against defeat lies in our own hands, but the opportunity of defeating the enemy is provided by the enemy himself" (Sun Tzu – Chinese Strategist)

Have a good day Chief.

SUAR Team