The value of shopping transactions in Indonesia continues to increase every year. In 2024, the nominal value was more than Rp 1,500 trillion or around 7% of gross domestic product. Until the first half of this year, the value of shopping transactions was already 62% of last year's nominal.

On National Customer Day, which falls every September 4, many stores or product sales outlets provide discounts, special offers, or gifts for customers. This is a strategy to increase the value of shopping transactions and reap greater profits.

Based on Bank Indonesia data, during the 2020-2024 period, the value of shopping transactions recorded through the use of card and digital payment instruments (ATM, debit, credit cards, and electronic money) has doubled. From Rp 721.2 trillion in 2020, to Rp 1,556.8 trillion in 2024. In 2025, during the first 6 months, the value has been recorded at IDR 972.3 trillion or about 62% of last year's value.

This increase in the value of shopping transactions can be seen as an increase in public consumption, especially the upper middle class as users of all types of cards monitored by Bank Indonesia. The largest increase occurred in 2022, which grew 44.6% compared to the previous year.

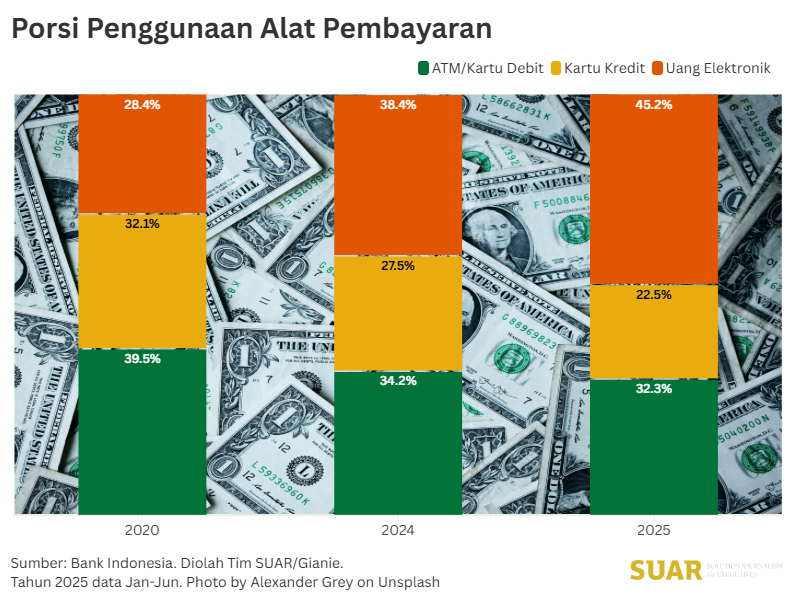

Interestingly, the pattern of using payment instruments has begun to shift in the last five years. In 2020, the dominant payment instrument was still an ATM card or other type of debit, with a portion of 39.5% of the total use of payment instruments. The use of credit cards as a payment instrument accounted for 32.1%. The rest shop using electronic money (28.4%).

The penetration of the use of electronic money is increasingly widespread in accordance with the public campaign in the digital era that prioritizes reducing the use ofcash (cashless society). Since 2024, the portion of shopping using electronic money began to dominate. The portion will be 38.4%. Meanwhile, the use of ATM/debit cards fell to 34.2%. The use of credit cards for shopping is only 27.5%.

In 2025, although it was only one semester, the share of electronic money usage increased again to 45.2%. The share of ATM card usage dropped to 32.3%. Meanwhile, the share of credit card usage also dropped to 22.5%.

Advances in digital technology and the ease of using payment instruments will encourage public consumption. The value of shopping transactions has the potential to continue to grow. Especially if the desire to shop for these consumers is treated with attractive services from producers or sellers.

For the middle class, even though their purchasing power is being eroded, the services and tempting offers from stores or outlets to their customers will provoke loyal shopping. Although shopping only little by little, over time the transaction value will become a hill.

To borrow a phrase from economist M Chatib Basri, the middle class has the skill to regard "discounts" as a form of wealth and "frugal shopping" as an achievement.