After being sworn in by President Prabowo Subianto on Monday (8/9/2025), Minister of Finance Purbaya Yudhi Sadewa stated that he personally chose not to raise tax rates.

"I need to discuss with my friends at the Ministry of Finance. But, in my personal opinion, so far there is no need for it," he said.

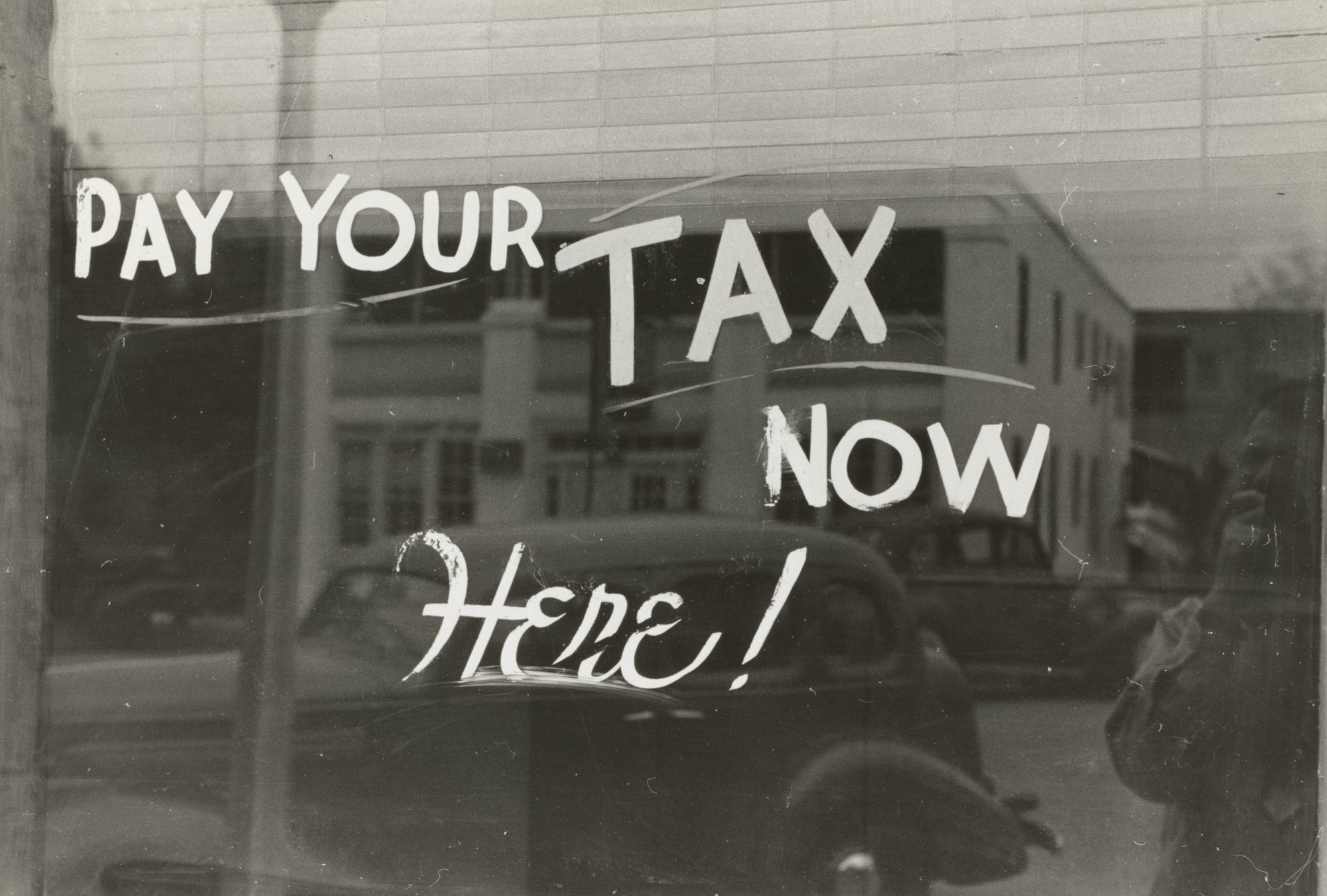

Issues regarding taxation in Indonesia never cease to be discussed, ranging from the topic of high tax targets, tax rates that always increase, to low taxpayer compliance in Indonesia.

In fact, the government always increases the tax revenue target every year in the state budget, although often the target is never achieved 100%. A strategy needs to be formulated to boost tax revenue.

In the 2026 Draft State Budget, the government has set a tax revenue target of IDR 2,357.7 trillion. Up 13.5% compared to the 2025 State Budget.

Finance Minister Purbaya Yudhi Sadewa is committed to not raising tax rates, instead he wants to focus more on encouraging the pace of the economy, so that the amount of tax collection can increase by itself. In addition, he also encourages taxpayer compliance.

Purbaya will not increase the tax rate, instead he wants to focus more on boosting the economy. For this reason, he also encourages taxpayer compliance.

Strategies that need to be considered to boost tax revenue without raising rates are tax administration reform and digitalization.

Tax observer from Tax Research Institute (TRI), Prianto Budi Saptono, said that tax reform and digitalization have been carried out by the Directorate General of Taxes through the launch of the Coretax system. The initiative is good enough, meaning that the Directorate General of Taxes has followed technological developments.

The main function of the Coretax system is to facilitate services, strengthen supervision, and law enforcement. Therefore, this system must continue to be guarded and continuously improved so that it is well received by taxpayers.

"The implementation of the Coretax system must be monitored, how is the mechanism in the field whether it is as expected," he told SUAR in Jakarta (11/9/2025).

Read also:

Prianto said, after improving the performance of tax digilitation, the Directorate General of Taxes must provide excellent service to taxpayers. To attract taxpayers, the service must be friendly and not complicated with bureaucracy.

Tapping into carbon tax potential

Economic observer from the Institute for Development Economics and Finance (Indef) Eko Listiyanto said that there are many new tax sources that the government can explore to optimize state revenue. One of them is carbon tax.

Carbon taxes provide financial incentives for companies and individuals to reduce their carbon emissions, encouraging the use of cleaner and more efficient energy.

Revenue from the carbon tax can be used by the government to fund programs related to climate change. For example, investment in public transportation infrastructure, renewable energy development, and environmental adaptation programs.

"By reducing greenhouse gas emissions, carbon taxes contribute to the achievement of sustainable development goals and help maintain biodiversity. There are many benefits for the country," he told SUAR in Jakarta (11/9/2025).

Tax contribution increased

The realization of tax revenue for the January-July 2025 period reached IDR 990.01 trillion. Indeed, this achievement experienced a contraction of 5.29% compared to the same period in 2024 which was recorded at IDR 1,045.3 trillion.

However, Director General of Taxes Bimo Wijayanto said that the contribution of tax revenue to state revenue has recorded an increase. In January-July 2025, the contribution increased by 1.67% compared to the same period last year.

In addition, gross tax revenue from January to July 2025 was recorded at IDR 1,269.4 trillion or grew 2.3% compared to last year. For the record, gross tax revenue is the total tax deposit that enters the state treasury before taking into account restitution (refund of overpayments) or other tax refunds.

Read also:

In addition to taxes, the realization of state revenue until July 2025 was also supported by customs and excise amounting to IDR 171.1 trillion, non-tax state revenue (PNBP) IDR 266.2 trillion, and grants IDR 1.3 trillion.

In total, state revenue was recorded at IDR 1,428.6 trillion until July 2025.

Don't disrupt the business world

Executive Director of the Indonesian Employers Association (Apindo) Danang Girindrawardana appreciated Purbaya for not raising the tax rate, as it focuses more on tax compliance.

Tax compliance, according to Danang, can be improved through education and socialization. Education is a priority because there are still many Indonesians who do not understand about taxes, especially in remote areas.

In addition, there needs to be a tax policy that is acceptable to the business world. For example, providing tax relaxation to priority sectors that have contributed greatly to state revenue.

"The government must sort out which sectors can be given tax relaxation and can discuss with the business world," he told SUAR in Jakarta (11/9/2025).