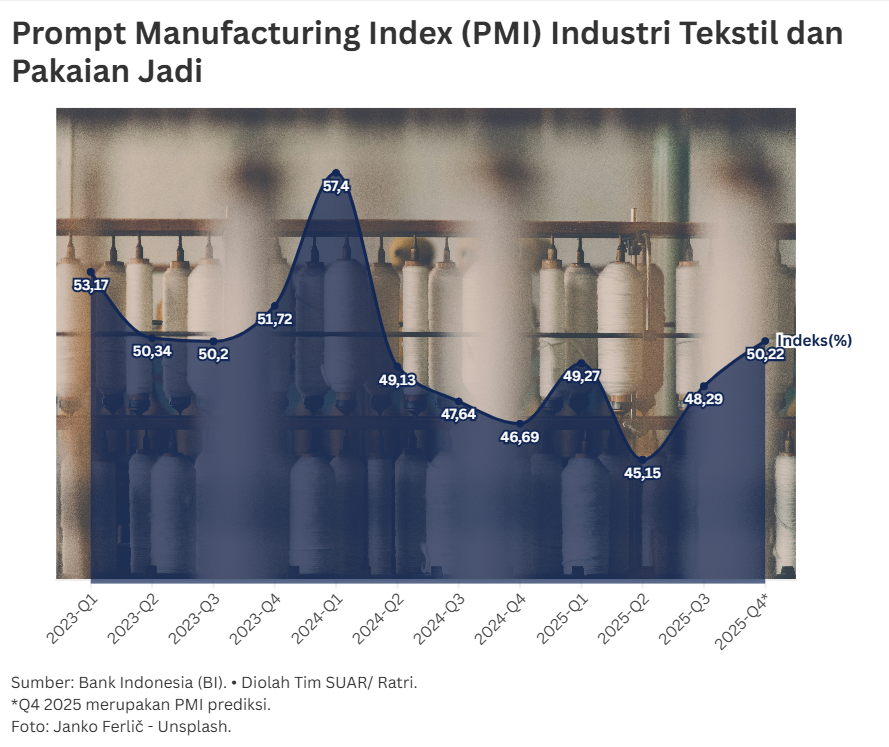

The performance of the textile industry is under pressure as seen from the contraction in the October 2025 Industrial Confidence Index (IKI) which stood at 49.74 points. Indications of contraction are also reflected in Bank Indonesia's Prompt Manufacturing Index (PMI) data for the Textile and Apparel Industry Subfields which were below the 50% mark throughout the second quarter and third quarter of 2025, at 45.15% and 48.29% respectively.

This contraction indicates a significant decline in business performance, especially amid the issue of "import floods" of downstream textile products, including apparel. Less stringent import policies are the main cause of mass layoffs in several large textile factories such as Sritex Group and PT Bapintri. Most recently, the Indonesian Fiber & Filament Yarn Producers Association (APSyFI) reported that five upstream textile manufacturers have officially stopped production operations due to continued decline.

The contribution of the textile and apparel industry is still significant to gross domestic product (GDP) with fluctuating developments. In 2022, its value was IDR 139,326.50 billion, increasing to IDR 136,568.70 billion in 2023, and to IDR 142,392.80 billion in 2024 or an increase of 4.26% (y-o-y).

To increase production, the upstream industry requires imports of raw materials, which are not only intended for domestic needs, but also for export.

The government needs to implement policies that can balance the smooth supply of raw materials for the upstream sector and tighten the supervision of imports of downstream products that enter through various loopholes, including bonded zones, wholesale imports, and illegal goods. Efforts to control imports aim to create healthy competition for the national textile industry both in the global and domestic markets.

Facing this challenge, the Ministry of Industry will focus on strengthening the capacity of the domestic industry and rearranging the import mechanism. The steps taken include machinery and equipment restructuring programs, increasing labor productivity, and accelerating the implementation of the domestic component level (TKDN) in the textile sector. The Ministry of Industry also fully supports efforts to curb the illegal textile import mafia, which is in line with the direction not to close trade flows, but to rearrange the mechanism so that raw materials remain available and local products are protected.

These efforts will be optimized if they are strengthened by local product innovation starting from the UMKM level such as finished products of clothing, mukena, hats, and others. Product competitiveness must be improved through diversification. Indonesia's textile and apparel industry must regain its strength, by balancing upstream and downstream interests towards sustainable growth.