Indonesia's gold production in 2024 is reported to reach 100,000 kg (100 tons). This should make domestic stocks quite secure. However, the fact remains that the country still has to import to meet growing domestic demand.

This paradoxical situation has prompted the government to discuss the Domestic Market Obligation (DMO) policy for gold for domestic mining producers.

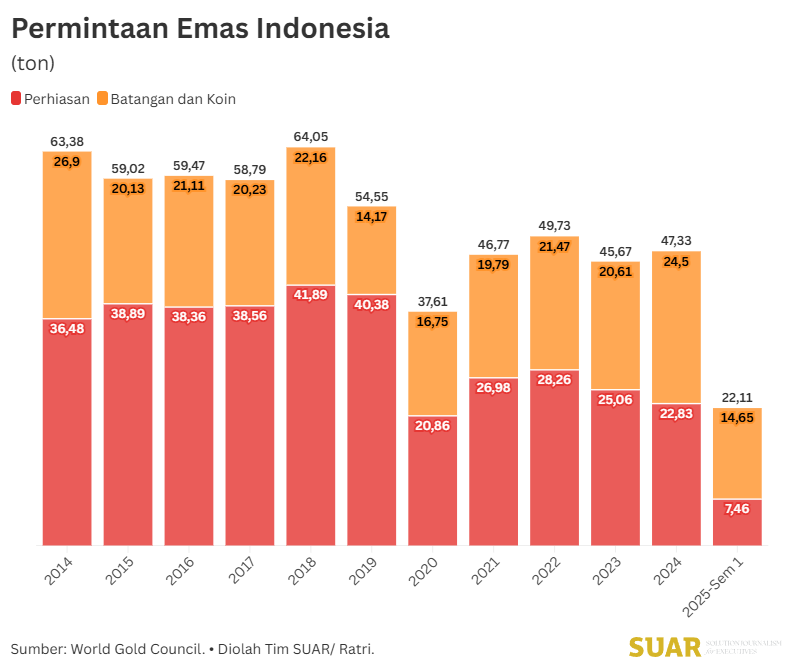

Following the development of global turmoil, gold demand in the global and domestic markets shows the need to invest for the long term. During the Covid-19 pandemic, domestic gold demand declined. However, a year after the pandemic demand began to surge. There was an increase in demand from 37.61 tons in 2020 to 47.33 tons in 2024.

This increase is driven by a surge in investment interest in the form of demand for gold bars and coins reaching 24.50 tons in 2024, surpassing demand for gold jewelry (22.83 tons). There is a gold buying rush phenomenon in the community that continues to this day.

The increase in demand is projected to continue through 2025 (22.11 tons). Several institutions such as J.P. Morgan, Reuters, and Goldman Sachs project that price growth is expected to increase by more than USD $4,000 to USD $5,000.

With a relatively large gold production (reaching 100 tons), while domestic demand is lower (around 47 tons, 2024), most of the raw or pre-processed gold from domestic mines is exported abroad. As a result, when downstream industries and the domestic market require a larger supply of refined gold to be molded into jewelry or Indonesian investment instruments, imports from other countries are forced.

This large gold production data is illustrated by the Ministry of Energy and Mineral Resources (2025) by stating that gold produced by one of the largest gold mines in Indonesia, PT Freeport Indonesia, is capable of managing 3 million copper concentrates that produce 50-60 million tons of gold. However, nationally, imports continue to occur up to 30 tons of gold.

In the January-August 2025 period, BPS recorded a gold export and import trade balance based on a volume deficit of 24 tons with a value of 2,257.97 million US dollars. During the price spike phenomenon that occurred this year, to meet domestic needs Indonesia experienced a surge in imports in April 2025, amounting to 13.13 tons with a value of 1,346.7 million US dollars.

Hence, the gold DMO discourse emerged as a solution to address this anomaly. The DMO policy would oblige large gold producers to channel a portion of their output to the domestic market before being exported. This is similar to policies applied to energy commodities that aim to secure supply and price stability in the country.

The list of the largest gold producers in Indonesia is also the main focus for the implementation of this DMO, such as PT Freeport Indonesia, PT Amman Mineral International Tbk, PT Merdeka Copper Gold Tbk, PT Aneka Tambang Tbk, and PT Bumi Resources Mineral Tbk.

The gold DMO aims to secure supplies for the jewelry industry and investment market, reduce the number of processed gold imports that drain foreign exchange, and support the domestic downstream industry. DMO is not just a regulation, but a step to realize supply sovereignty, ensuring that Indonesia is no longer a giant producer that still depends on imports amidst the abundance of its own mining wealth.