The need to process and store massive data has shifted the focus of companies to cost-effective and scalable cloud computing-based services. This condition becomes an investment opportunity and even attracts international attention, such as the interest shown by Finnish investors at the G-20 forum in South Africa recently. That interest became an important part of the cooperation agreement with Indonesia.

The rapid pace of digitalization is reflected in ambitious market projections. The Indonesian data center market is estimated to reach US$1.61 billion in 2025 and is projected to grow rapidly to US$3.09 billion by 2030, with a CAGR of 13.93%. In fact, in terms ofIT load capacity, the market is projected to increase from 1.44 thousand Megawatts in 2025 to 3.56 thousand Megawatts in 2030, representing a CAGR of 19.89%.

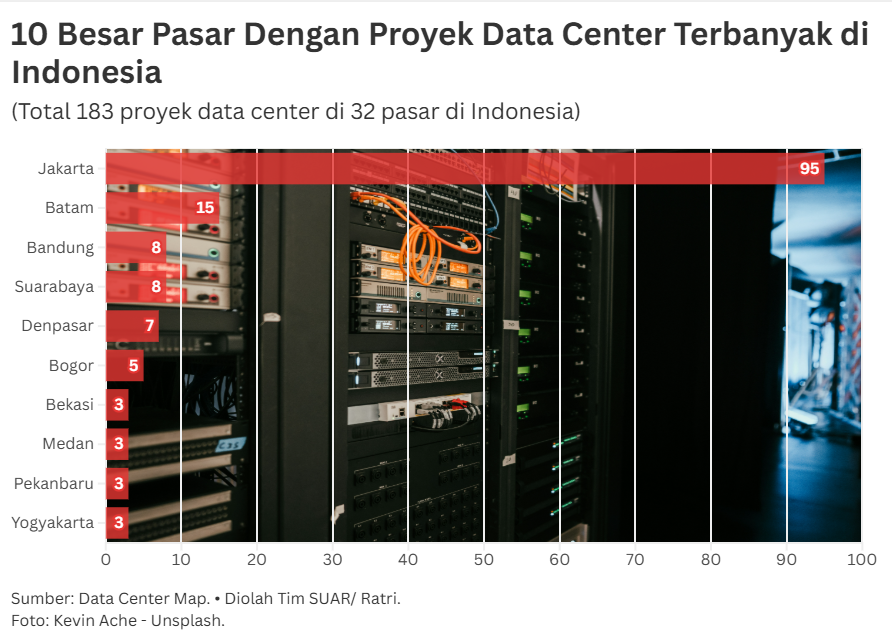

The growth of data center projects is dominated in the Jakarta area, with almost 60% (out of a total of 95 data centers). However, decentralization is starting to appear with existing projects in other regions, such as Batam (15 data centers), Bandung (8), Surabaya (8), Denpasar (7), Bogor (5), and many others.

In the context of pricecompetition, Indonesia currently still recordsrelatively higher rental rates compared to Singapore, Hong Kong and Tokyo, due torelatively little competition. For example,Retail Colocation rates in Indonesia are in the range of US$275 - US$340/kW/month, surpassing Singapore's US$230 - US$280/kW/month, but slightly below Hong Kong's US$300 - US$350/kW/month. These high rates provide an opportunity for new players to enter and increase price competition.

Meanwhile, market dominance is currently held by several key players. Based on Colliers' analysis report, market holders in terms of whitefloor area and rack capacity, DCI Indonesia leads with the largest capacity, followed by NTT Global Data Centers and Telkom Indonesia.

The future prospects of Indonesia's data center market need to be supported by the strategic measures of the government and operators. The operation of the National Data Center in Cikarang in March 2025 marks the consolidation of ministry data on sovereign infrastructure.

In addition, efforts to improve global connectivity continue, such as the completion of Telin's Bifrost Cable landing in Manado and Jakarta in February 2025, which adds a new trans-Pacific bandwidth corridor. Energy infrastructure upgrades are also a focus, with PLN signing MoUs with Huawei and SDIC Power in November 2024 to accelerate network digitization and hydropower development, which is crucial given the large power requirements of data centers.

Looking at the regional landscape, Indonesia has considerable potential to become a strong regional digital hub. Backed by a rapidly growing ecosystem, plus the need for data storage and processing for the Cloud and supported by infrastructure commitments, including submarine cable networks and energy availability.

While the challenge of geographical concentration in Jakarta remains, the investment drive for decentralization and increased connectivity across islands will strengthen Indonesia's position as a major data center market, while attracting more foreign investment to balance and keep rents down in the future.