History always repeats its patterns. There is no new cycle under the sun - everything in this world has happened before and will probably happen again.

The protests in late August that led to chaos, looting of private homes of state officials, and loss of life triggered a collective memory of trauma that this situation could trigger an economic crisis like 1998.

Will the economic crisis be repeated?

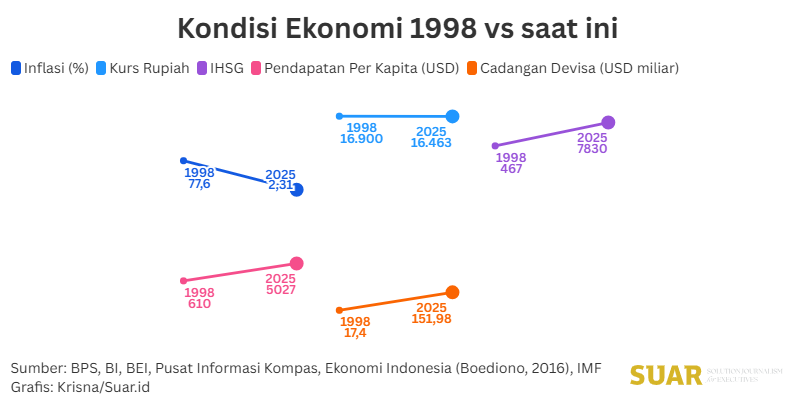

Let's compare the economic conditions of 1998 with now. We do surgery so that we can learn lessons and take the right policies so that the economic crisis can be avoided. Also, so that we are no longer trapped in trauma and excessive fear, although we still have to address the current conditions with caution.

Rupiah exchange rate 1998 versus today

The 1998 monetary crisis or krismon is widely known to the public because of the fall in the rupiah exchange rate against the US dollar to the lowest point in Indonesian history. On June 17, 1998, the rupiah exchange rate in the Jakarta interbank spot money market closed at IDR 16,900 per US dollar. In fact, during trading on January 22, 1998, the rupiah touched the level of Rp 17,000 per US dollar(Kompas, June 18, 1998).

Let's compare it with today's conditions. Quoting the Jakarta Interbank Spot Dollar Rate (JISDOR) released by BI, the rupiah exchange rate at the close of trading on Monday (1/9/2025) was at the level of IDR 16,463 per US dollar.

The current position of the rupiah exchange rate compared to 1998 is not much different. However, the rupiah is currently only 7.56% depreciated compared to its position a year ago at Rp 15,305 per US dollar. While in June 1998, the rupiah depreciated 690% or weakened more than six times in just one year compared to June 1997. At that time the rupiah exchange rate was around Rp 2,441 per US dollar.

Foreign exchange reserves 1998 vs current

In 1998, BI could not pour too much money into the market to stabilize the rupiah exchange rate due to the limited position of foreign exchange reserves. At that time, BI's foreign exchange was in the range of USD 17.4 billion.

It is different this time. As of July 31, 2025, Indonesia's foreign exchange reserves amounted to USD 151.98 billion. The position of foreign exchange reserves is equivalent to financing 6.3 months of imports or 6.2 months of imports and servicing of government external debt, and is above the international adequacy standard of around 3 months of imports. Bank Indonesia considers the foreign exchange reserves to be able to support external sector resilience and maintain macroeconomic and financial system stability.

1998 vs current inflation

The 1998 economic crisis, for one, is also remembered by the public because of the extraordinary surge in the price of goods. In 1998, inflation reached 77.6% on an annual basis or skyrocketed almost 20 times compared to 1997, when the inflation level was 4.7% on an annual basis. This means that at that time, an item that originally cost Rp 100,000 could rise in just one year to Rp 177,600.

In fact, before 1998, Indonesia's average inflation in the 1990s was around 9% per year and tended to decline. Annual inflation in 1996 was 6% and in 1997 was 5.1%. This means that during the 1998 economic crisis, inflation jumped many times higher than normal(Indonesian Economy, Budiono, 2016).

Compared to that time, the current inflation condition is much smaller and under control. Currently, the latest data released by BPS, as of August 2025, shows inflation at 2.31% on an annual basis. The current inflation rate is also still within the government and BI's target for this year, which is 1.5%-3.5%.

Layoffs, unemployment, and poverty 1998 vs today

During the 1998 financial crisis, it was reported that 20 million people, or 20% of the labor force, were unemployed. The unemployment rate was the largest since the 1960s.

As a result of these layoffs and rapidly rising prices, the number of people below the poverty line has also increased, reaching around 50% of the total population. As many as two out of three Indonesians are said by the International Labor Organization (ILO) to be in extreme poverty by 1999 if the economy does not improve soon(Kompas, December 21, 1998).

Today's conditions are similar with many layoff phenomena. Data from the Ministry of Manpower (Kemenaker) shows: 42,385 workers in Indonesia experienced layoffs during January-June 2025, an increase of 32% compared to the same period last year.

Regarding the unemployment rate, citing the latest BPS National Labor Force Survey (Sakernas), namely February 2025, shows that the open unemployment rate reached 4.76%. This figure reflects the downward trend that has occurred over the past 4 years, namely from 6.62% in 2021; 5.83% in 2022; 5.45% in 2023; and 4.82% in 2024.

Regarding the poverty rate, the latest BPS data as of March 2025 shows that the percentage of poor people reached 8.47%, a decrease of 0.10% points against September 204 and a decrease of 0.56% against March 2024. The number of poor people in March 2025 amounted to 23.85 million people, a decrease of 0.21 million people against September 2024 and a decrease of 1.37 million people against March 2024.

Per capita income 1998 vs. today

The outbreak of layoffs and unemployment during the 1998 economic crisis dragged down Indonesia's per capita income. The annual per capita income that reached USD 1,155 in 1996 and USD 1,088 US dollars in 1997, then shrank to USD 610 in 1998.

Meanwhile, citing the International Monetary Fund (IMF), Indonesia's per capita income in 2024 will reach USD 5,027 or around IDR 80.43 million per person per year.

JCI 1998 vs today

From the trading floor, the Jakarta Stock Exchange (JSX) Composite Stock Price Index plummeted to a low of 292.12 points on September 15, 1998, from 467.339 at the start of the crisis on July 1, 1997. Market capitalization also shrank from Rp 226 trillion to Rp 196 trillion in early July 1998.

While at this time, the demonstration that led to the riot had indeed made the JCI fall last week. At the close of trading on Friday (29/8/2025) or the day after online motorcycle taxi driver Affan Kurniawan died after being run over by a Brimob tactical vehicle (rantis), the JCI had dropped 121.59 points or 1.53% at 7,830.

In fact, on Thursday trading (28/8/2025), JCI had risen so that it broke through the psychological level of 8,000 and reached the highest point in history (all time high) even though later trading that day closed at 7,968.

Banking resilience 1998 vs today

One of the triggers of the economic crisis in 1998 was the public panic that triggered a rush or long queues at a number of banks from customers who wanted to withdraw their cash(bank run). This happened to a number of jumbo banks at the time, such as BCA and Bank Danamon. Capital for a bank is like blood in the human body.

If a bank's capital is depleted, then no matter how big the bank is, it can collapse, just like a human who lacks blood (Indonesian Economy, Budiono, 2016).

While at present, citing the Financial Services Authority (OJK), banking resilience remains strong as reflected in the capital adequacy ratio (CAR) in July 2025 at the level of 25.88%.

CAR shows how much the bank's capital can absorb losses. The higher the ratio, the healthier the bank and the lower the risk of losing customer funds. According to OJK, the amount of CAR can be a strong risk mitigation cushion to anticipate uncertainty.

Economic growth 1998 vs today

The decline in various economic indicators at that time was also evident from a macroeconomic perspective. In 1998, economic growth contracted by minus 13.1%.

Whereas previously, in the early 90s Indonesia's economic growth averaged above 7% per year. This was among the highest in Asia at that time. In 1996, economic growth reached 7.8% and 1997 reached 4.7%.

While the current situation, citing BPS data, economic growth in the second quarter of 2025 reached 5.12% on an annualized basis.

Different causes, similar symptoms

A number of these indicators show that Indonesia's economic conditions are currently much better than 27 years ago. But that does not mean there is no guarantee that a crisis will not occur.

In 1997, various economic indicators also showed no signs of an economic crisis. However, in just one year everything changed. All stakeholders still need to be vigilant and careful not to take the wrong steps.

All stakeholders need to take a closer look at the fact that, although the symptoms are similar, the causes of economic anxiety today are different from 1998. One of the main triggers of today's concerns is fiscal management that deviates from the spiritual and economic conditions of the people.

Three of the country's leading think tanks - Center of Reform on Economics (Core) Indonesia, Institute for Development of Economics and Finance (Indef), and The Prakarsa - have stated that the wave of demonstrations taking place in various regions reflects a fundamental failure in economic management. These three institutions urge the government to immediately carry out fiscal reforms that are fair, transparent, and in favor of the people.

They said the failure was due to policies that did not favor the welfare of the people and the protection of workers, which actually widened the economic gap. There are several strong indications that triggered the wave of protests.

First, taxes that burden the people. While many local governments are raising land and building tax (PBB) due to cuts in transfers from the central government, members of the House of Representatives are designed to receive a huge housing allowance.

Second, fiscal priorities are wrong. As an illustration, the Police budget in 2026 is designed to reach Rp 145.65 trillion, up from Rp 138.54 trillion in 2025. This even surpasses the Ministry of Health's budget of Rp 114 trillion, up from Rp 86.08 trillion. In addition, the reduced education budget allocation to finance the Free Meal Program (MBG) shows a low commitment to the substance of education.

Third, the crisis in the labor sector. Indonesia's unemployment rate is still the highest in ASEAN (5.2%). In addition, 59% of workers are in the informal sector without adequate protection. Waves of layoffs are also rife.

Fourth, the wave of demonstrations in recent days is also because the government chose a repressive response to the protests, instead of opening a dialog and addressing the structural root causes of the economy. This approach will only worsen the government's image.

The same thing was also stated by the Center for Strategic and International Studies (CSIS). In a media briefing entitled Wake Up Call from the Streets: The Test of Our Democracy and Economy at the CSIS office, Central Jakarta, Tuesday (2/9/2025), Senior Researcher of the CSIS Economics Department Deni Friawan argued that the risk of an economic crisis has the potential to occur if the government does not immediately address the root causes of the demonstrations.

CSIS believes that the current problems also stem from the irony of policies that benefit the elite and burden the people. For example, spending on social assistance and protection continues to shrink, while BPJS contributions are planned to rise next year.

State spending is efficient on the one hand but wasteful on the other. The budget for the Free and Nutritious Meal (MBG) program rises from IDR 107 trillion to IDR 335 trillion by 2026 and accounts for 44% of the education budget. There are also the salaries and allowances of DPR officials that rise from Rp 6.69 trillion to Rp 9.9 trillion for 2026.

If the problem is left unaddressed, CSIS warns of the risk of a repeat of the multidimensional crisis that occurred in 1997-1998.

"Inequality, economic hardship, corruption, and weak law enforcement can lead to a severe and long-lasting multidimensional crisis," Deni said.

Chairperson of the Indonesian Employers Association (Apindo) Shinta Kamdani emphasized that the business world needs a guarantee of security and order. This can ultimately drive the economy.

"The business world and society basically need a sense of security and stability to be able to continue to contribute to economic activity," he told SUAR (31/8/2025).

"The business world and society basically need a sense of security and stability to be able to continue to contribute to economic activity," said Shinta.

The business community understands the public unrest behind the demonstrations. However, they also emphasize the importance of conveying aspirations that do not add to social wounds. Shinta reminded that prolonged tension has the potential to deepen polarization.

Chairman of the Indonesian Chamber of Commerce and Industry (Kadin) Anindya Novyan Bakrie also urged all parties to calm down. Difficult economic conditions must be faced together by maintaining security so that everyone can return to work and carry out activities.

"As long as the security situation is not conducive, economic activities will be disrupted and adverse impacts will also be experienced by the community," said Anindya, Saturday (30/8/2025).

He added that Kadin fully supports President Prabowo Subianto's statement that the chaotic situation does not benefit the people and the developing nation of Indonesia.

Kadin, Anindya continued, appealed to state officials so that all policies, statements, and actions really pay attention to the real conditions faced by the community today. The psychological condition of the community is being squeezed by economic difficulties, minimal income, rising living costs, difficult employment conditions, and social disparities that are still quite wide. In facing this situation, state officials need to have sensitivity.

The psychological condition of the community is being squeezed by economic difficulties, minimal income, rising living costs, difficult employment conditions, and a wide social gap. In dealing with this situation, state officials need to have sensitivity.

Coordinating Minister for Economic Affairs Airlangga Hartarto said that the Indonesian economy is still in good condition. This is reflected in economic growth that is still growing at more than 5% and controlled inflation.

To calm the market and the business world, the government also launched three economic stimuli to maintain economic growth in the third quarter.

- First, revitalizing credit for labor-intensive industries including textiles and textile products (TPT), furniture, and food and beverages (F&B) such as revitalizing production machinery. This is expected to boost people's purchasing power.

- Second, people's business credit for the housing sector with an increase in the Housing Financing Liquidity Facility (FLPP) from 220,000 to 350,000 housing units, the application of 100% VAT DTP, and self-help housing stimulant assistance for 41,000 houses.

- Third, accelerate the Free Nutritious Meal (MBG) program by targeting 25,000 units of nutrition service units (SPPG) with 75 million recipients in November 2025.

Economy and politics

Governor of Bank Indonesia 1993-1998 Soedradjad Djiwandono, in the article "Small is Beautiful:AnEclectic Approach to Fighting Inertia", written in the book 80 Years of Mohammad Sadli: Indonesian Economy in the New Political Era (2002), said that the 1998 crisis started with economic problems and then spread to other fields and became a national crisis.

"Through a process with the impact of financial shock contagion, it hit the banking sector, then investment activities, production, trade, real sector consumption, so that the entire national economy experienced a crisis. Finally, this economic crisis continued to hit the social and political sectors, so that this process led to a comprehensive and multidimensional crisis," said Djiwandono.

World economic expert Joseph E. Stiglitz, in his book The Great Divide, said that with the power granted by law and the mandate of democracy, public policy makers have a big role in bringing economic equality or even creating inequality.

The 2001 Nobel laureate in economics advocates stronger fiscal and regulatory policies to address inequality, promote broader prosperity, and ensure that the economy serves human dignity and freedom.

A veteran economist who is also the 2009-2014 vice president Boediono in his book Indonesian Economy said, from history, we note that political goals at one time were not always in line or synergistic with economic goals at the same time.

But at certain times, for example, an economic crisis, economic goals take on a heightened urgency and subordinate political goals. This is at least in the short term until the crisis is overcome.

History shows that when the gap between political goals and economic goals is too wide, difficulties await the country. Adjustments to both must occur and that can be painful. "The task of the state manager is to keep the two goals from deviating too far from each other at all times," said the 2008-2009 BI Governor.

Having just celebrated its 80th birthday on August 17, Indonesia needs to continue to learn from history so that it does not fall into the same mistakes. "If history repeats itself and the unexpected always happens, (it shows) how incapable man is of learning from experience." So said the famous Irish writer, George Bernard Shaw.