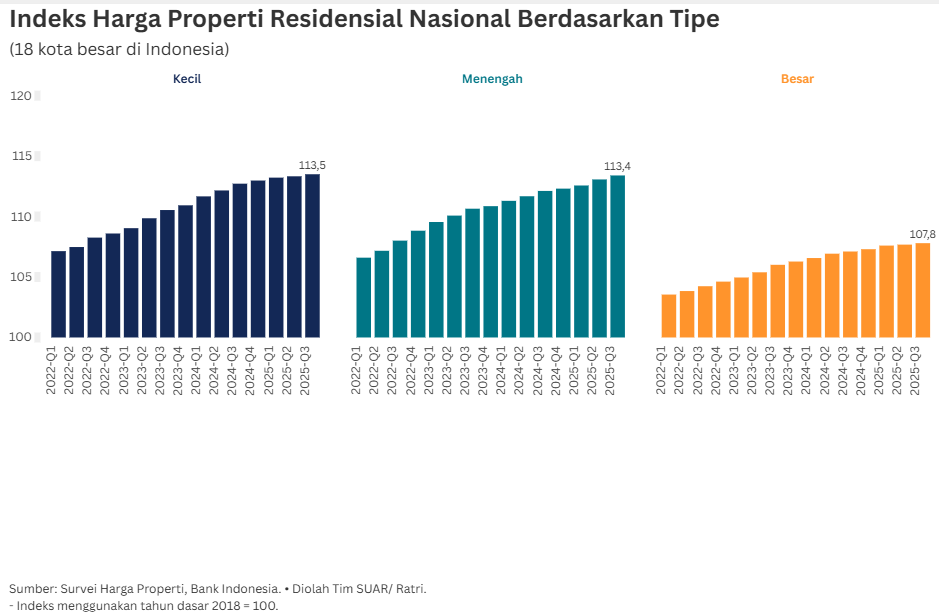

Although property prices tend to rise, the rate of increase is relatively lower compared to the same period last year. This slowdown was mainly influenced by slowing price increases in small and medium-sized houses.

Quarterly IHPR growth in the third quarter of 2025 was relatively stable at 0.22% (q-t-q) driven by increases in small and large houses. The medium and large types also showed a similar trend, albeit with a slightly slower rate of increase.

This price increase reflects the steady increase in demand, especially for more affordable properties, as well as the potential for increased construction and land costs to push selling prices up in the developer segment.

On a city-by-city basis, there were notable differences in the rate of increase in IHPR between regions. The highest quarterly price increases occurred in the cities of Pontianak and Yogyakarta. The price increase in Pontianak jumped from 0.38% (q-t-q) to 1.87% (q-t-q), while in Yogyakarta prices increased from 0.12% to 1.23%. In contrast, a number of cities such as Banjarmasin experienced price contraction of 0.17% (q-t-q).

The upward trend in property prices both nationally and regionally has an impact on reducing the level ofaffordability by the community. Price increases that are faster than the increase in average household income will widen the gap between the ability to buy and the price of property offered by developers.

Under these conditions, developers to contractors need to diversify products and cost efficiency. House construction is prioritized on small and medium type houses that have the highest demand and those in urban buffer locations that have good transportation access.

Developers can also apply modular or prefabricated construction technology to reduce the cost of raw materials and shorten the construction time so that the selling price is more affordable. In addition, collaboration with financial institutions to offer in-house financing schemes or mortgages with more flexible down payments and tenors can be a major attraction for consumers.

Both central and local policymakers play a role in stabilizing the market. Local governments should ease the licensing process and ensure the availability of basic infrastructure (roads, water, electricity) in areas of affordable property development to reduce development costs.

Meanwhile, Bank Indonesia can continue to utilize macroprudential instruments such as Loan-to-Value (LTV) that are flexible, tailored to property types and regions. For example, LTV easing or tax incentives could be applied specifically for properties in the small type segment in cities with high price pressure (such as Pontianak and Yogyakarta) to boost supply and facilitate easier access to financing for the public.