The Indonesian carbon market organized by the Indonesia Carbon Exchange (IDXCarbon) is an instrument to achieve the 2030 net zero emission (NZE) target. Until the end of October 2025, the total trading volume reached 698,639 tons of CO2e with a cumulative transaction value of IDR 27.86 billion.

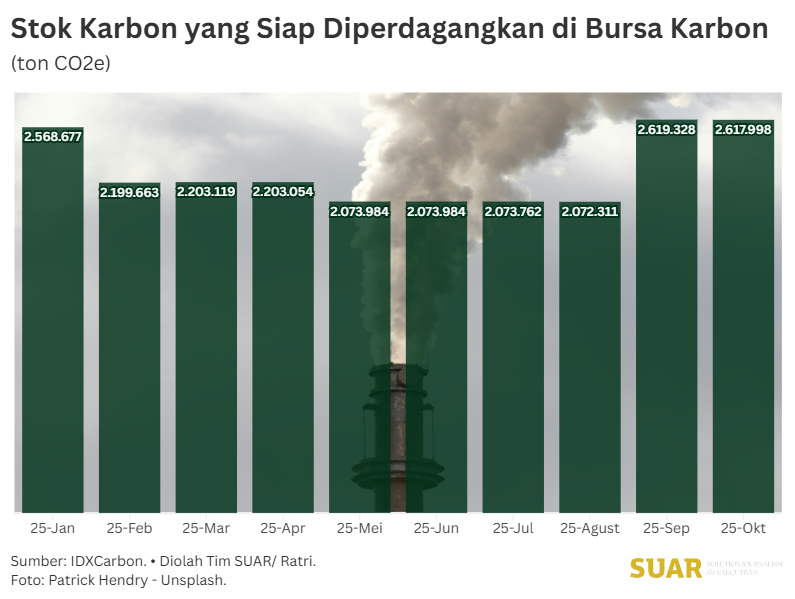

At the same time, the availability of ready-to-trade carbon units (stocks) stands at 2.6 million tons CO2e, indicating an abundant supply potential for businesses. This is a strong asset for Indonesia to expand its market reach to the global level. Starting January 2025, IDXCarbon will also market carbon units to the international market.

IDXCarbon noted that carbon trading activity in 2025 was dominated by thenegotiated market segment, which accounted for the largest share of total sales. Specifically, the domestic carbon unit IDTBS(Indonesia Technology Based Solution) had the largest sales through negotiated channels, reaching Rp 23.65 trillion during the January-October 2025 period.

The dominance of the negotiated market, which facilitates transactions that have been agreed off-exchange, suggests that most of the current transaction volume comes from meeting the offset or allowance trading needs of domestic coverage.

The domestic carbon market, which opened in September 2023, accounts for a sizable share. However, carbon units with international trading authority (IDTBSA and IDTBSA-RE), which opened in January this year, are still relatively small. The total sales value of these international units is still lower than that of domestic transactions.

In addition, overall trading momentum has also slowed down, with monthly transaction volumes plummeting from 1,234 tons CO2e in September 2025 to only 601 tons CO2e in October 2025. Carbon transactions are still fluctuating on a monthly basis.

With such conditions, the Climate Change Summit (COP30) forum which will take place in November 2025 is a strategic stage for Indonesia. COP30 is a venue to attract global investors, especially for IDTBSA and IDTBSA-RE products specifically designed for the international market.

The strategy to attract global carbon investors should focus on promoting transparency, project quality, and the authorization status of IDTBSA units as legitimate tools to meet overseas emission targets. This step is to increase the liquidity of Indonesia's carbon market in the international market.

Indonesia's success in capitalizing on the COP30 momentum to increase international carbon unit demand is key to accelerating domestic climate mitigation finance. With a carbon unit stock of more than 2.6 million tons CO2e, Indonesia has great potential to become a major player. Mobilizing climate investment through this carbon exchange is important to support the green energy transition and ensure the achievement of the net-zero emission target by 2030.