The micro, small and medium enterpriseUMKM) sector has long been the backbone of the national economy. In its development, UMKM have proven to be the main support for job creation and income distribution. Thus, it is important to support this sector to develop without obstacles, especially related to the burden of bad debts.

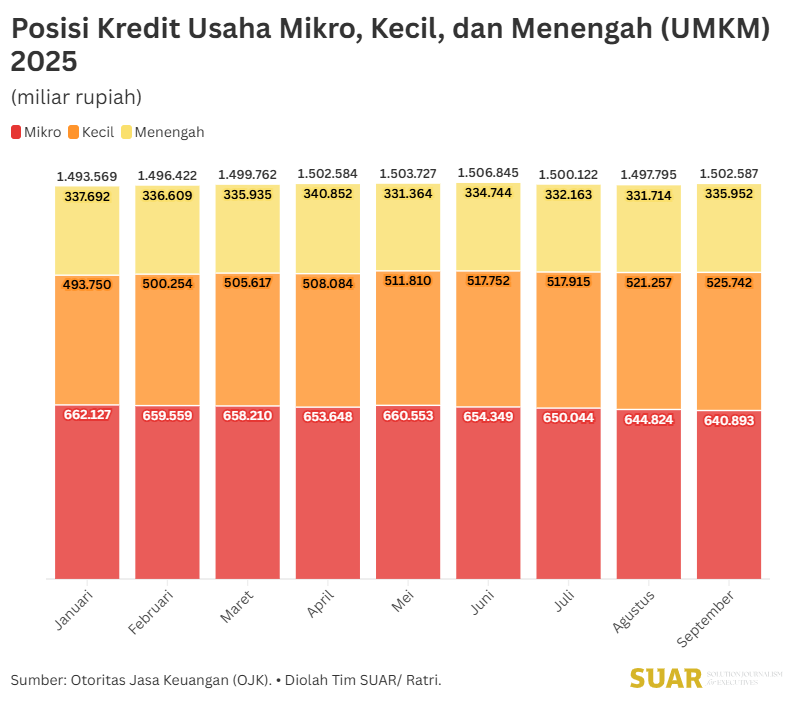

Based on data from the Financial Services Authority (OJK), the position of UMKM credit in September 2025 has reached IDR 1,502.58 trillion with the largest portion still held by micro credit.

Behind this large number, there is a threat in the form of high levels of non-performing loans (NPLs) that can hamper business growth. The policy of writing off books or bad debt bills is relevant and needed by UMKM players.

The urgency of this program is related to the increasing trend of UMKM NPLs in recent years. The increase in NPLs can be seen from the position at the end of 2024, which ranged from 4.00% to 4.15%, slowly increasing until it reached its peak in July 2025 at 4.52%. However, this figure is still below the upper threshold of 5%.

Although still below the threshold, the increase in NPL percentage needs to be watched out for. The slowing UMKM credit growth of 2.18%(year-on-year) in June 2025 was accompanied by NPLs that increased to 4.41% in the same period.

The increase in the NPL percentage is also accompanied by the increasing value of non-performing loans, with the highest value reaching IDR 67,800 billion in July 2025 (NPL 4.52%). This increase in NPLs, which is close to the safe limit, indicates that a number of UMKM are facing difficulties in paying their obligations. If these difficulties are not resolved, it could lead to a liquidity crisis and even bankruptcy.

In the past, the bad debt write-off program has been a policy that has proven successful in saving UMKM, especially during economic crises or major shocks such as the Covid-19 pandemic. The government is committed to maintaining the stability and sustainability of the business world. Now, the same policy is confirmed through Government Regulation (PP) Number 47 of 2024 as a strong legal basis for the government to take proactive steps to restructure the balance sheets of UMKM.

Through the regulation, bad debt write-off support with a maximum value of IDR 500 million is provided for business entities and IDR 300 million for individuals specifically at Himbara banks (BNI, BRI, BTN, Bank Mandiri, and BSI). Bad debt write-offs not only provide relief, but also free UMKM from potential debt traps that limit their ability to access new working capital, make investments, and expand their business scale.

This policy is a breath of fresh air, especially for small business loans which have shown an increasing trend, from IDR 493,750 billion (January) to IDR 525,742 billion (September). With new capital, UMKM are expected to increase production, create innovations, and most importantly, create massive new jobs.

The implementation of the UMKM bad debt write-off program is a strategic and urgent economic policy intervention step. With a strong legal basis and supported by political commitment, this program is expected to be able to contain the rate of increase in NPLs, provide an injection of liquidity, and create momentum for the growth of the UMKM sector. This step is also a long-term investment to strengthen national economic fundamentals and ensure that UMKM remain the main engine of inclusive and sustainable growth for Indonesia.