The attractiveness of SEZs is important for a country to attract foreign investors, thereby increasing capital flows in a specific region. Foreign direct investment (FDI) can be one indicator of whether a specific region is attractive.

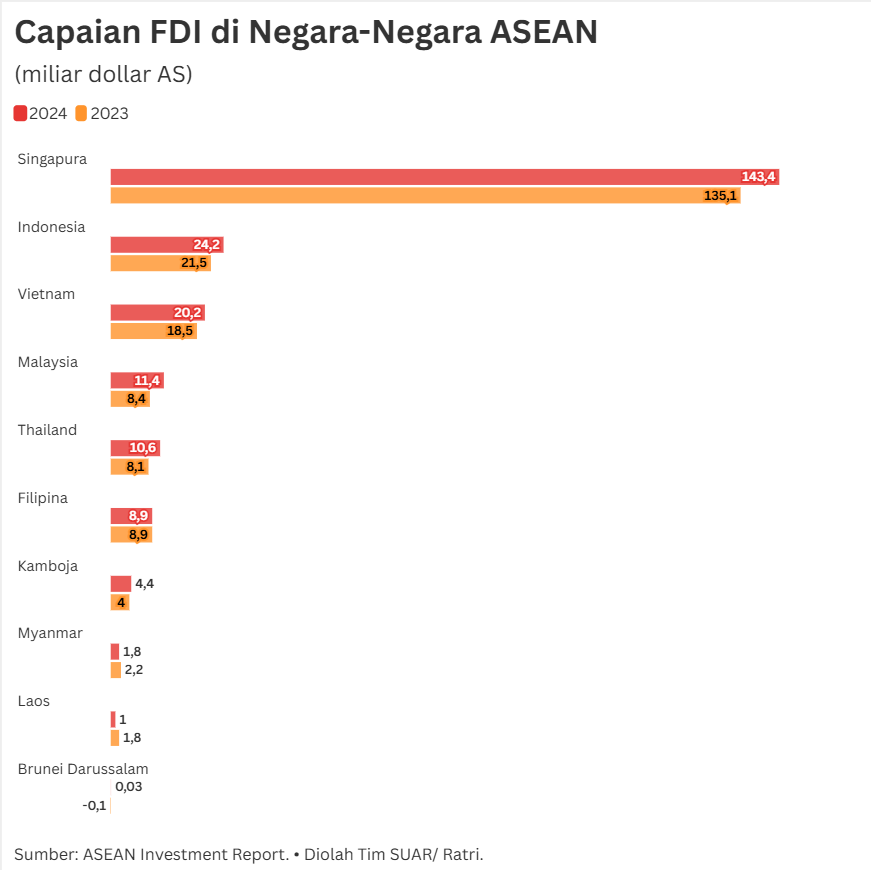

Data on ASEAN investment in 2023-2024 shows that ASEAN is becoming a dynamic global investment center. Within the ASEAN region, Singapore leads with an estimated FDI of US$143.4 billion in 2024. This confirms its position as a major financial hub in the region.

Meanwhile, Indonesia ranks second, with FDI reaching US$24.2 billion in 2024. Vietnam follows with US$20.2 billion. Countries such as Malaysia (US$11.4 billion) and Thailand (US$10.6 billion) also show significant investment flows. This FDI achievement is inseparable from the strategic policies implemented by member countries, where Special Economic Zones ( SEZs) have become the key to attracting foreign capital and accelerating economic development.

To date, Indonesia has established 24 SEZs covering an area of 20,912 hectares. Compared to other ASEAN countries, this number is still relatively small. Malaysia and Vietnam, for example, which have smaller land areas than Indonesia, have larger special economic zones.

Although the area is still relatively small, the main strength of Indonesia's SEZs lies in the variety of fiscal incentives offered. Indonesia provides several incentives such as tax holidays, tax allowances, VAT exemptions, income tax exemptions, customs duty exemptions, and import duty exemptions. These incentives are comparable and, in some aspects, even simpler than the incentive packages offered by Thailand (which focuses on Industry 4.0 and advanced technology) and Malaysia (with reinvestment allowances).

However, the advantages of these incentives need to be balanced with improvements in the ease of doing business and maintaining a conducive investment climate. For example, the Philippines offers a clear Income Tax Holiday (ITH) for 4-7 years followed by a 5% Special Corporate Income Tax or Additional Reduction. This provides legal certainty and convenience for investors. The availability of easy-to-understand schemes and efficient licensing processes are key to turning strong incentive offers into massive investment realization.

Indonesia's SEZs have a strong foundation of attractive incentives. However, to compete effectively with the giants of SEZs in ASEAN, a strategic leap is needed from simply offering incentives to offering ease of business execution. This includes the implementation of clear regional specialization and accelerated bureaucracy. Thus, KEK can transform from merely a land of incentives into a reliable engine of exports and job creation, ensuring that Indonesia reaps the maximum benefits.