After the reformation, Bank Indonesia was one of the strategic institutions in this country that received independent status. Along the way, the independence of the central bank was shaken several times through revisions or amendments to Law Number 23 Year 1999.

In the latest news, the House of Representatives (DPR) is again trying to disrupt the independence of Bank Indonesia (BI) through new articles embedded in the revision of Law No. 4 of 2023 on Financial Sector Development and Strengthening (P2SK). A number of articles to be amended are feared to interfere with the central bank in carrying out its function as the monetary authority optimally.

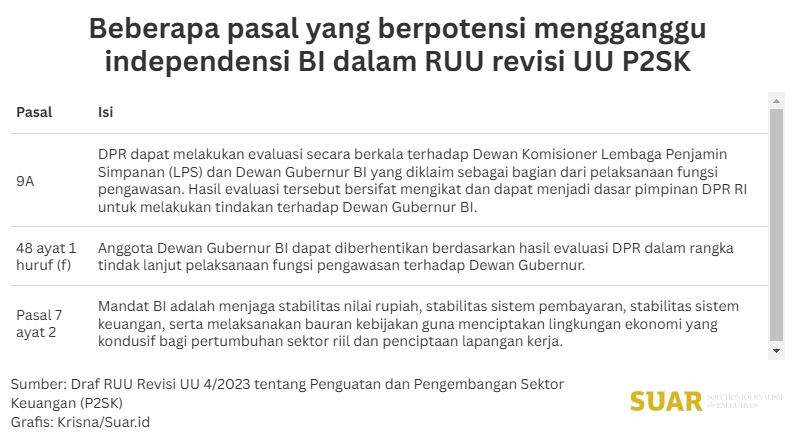

The revision of the P2SK Law itself was designed as a follow-up to the Constitutional Court'sjudicial review of the 2023 P2SK Law. Referring to the draft received by SUAR on Thursday (18/9/2025), there are at least three articles that need attention.

First, Article 9A states that the DPR can periodically evaluate the Board of Commissioners of the Deposit Insurance Corporation (LPS) and the Board of Governors of BI as part of the implementation of the supervisory function. The results of the evaluation are binding and can be the basis for the DPR RI leadership to take action against the BI Board of Governors.

Second, Article 48 paragraph 1 letter (f) states that members of the BI Board of Governors can be dismissed based on the results of the DPR's evaluation in the context of following up on the implementation of the supervisory function of the Board of Governors. In other words, based on this article, the DPR is authorized to dismiss members of the BI Board of Governors based on considerations that are conducted entirely behind closed doors.

Third, Article 7 paragraphs 1 and 2 emphasize that BI's mandate is to maintain rupiah stability, payment system stability, financial system stability, and implement a policy mix to create an economic environment conducive to real sector growth and job creation.

This means that BI gets a new addition beyond its current duties as a monetary authority, payment authority, and macroprudential supervisor. With the new article, BI could sideline its role as the guardian of rupiah stability by getting too involved in managing economic growth - which should be the job of the executive branch of government.

This is not the first time that the DPR has wanted to "get involved" in BI's kitchen. Previously, during the discussion phase before the P2SK Law was officially enacted, around mid-2022, the DPR also wanted to interfere with BI's independence.

At that time, in the fifth section of the P2SK Bill on BI, Article 47 point c, read: "Members of the Board of Governors, either alone or together, are prohibited from becoming administrators and / or members of political parties". Even though the article listed in Law 23/1999 on BI has been amended by Law 3/2004.

However, in the end, the bill contained an article stating the requirement that the Board of Governors not be administrators and/or members of political parties at the time of nomination.

The independence of the central bank was also undermined when a rule emerged stating that BI could buy Government Securities (SBN) in the primary market during a crisis that shook the stability of the financial system and the economy. This rule can be misused if there is no explanation of the criteria for what constitutes a crisis.

To date, the P2SK Law has been effective for two years. Suddenly, there was a discourse to revise the P2SK Law in a limited manner. Again, the parliament initiated it. The reason is that parliament is following up on the decision of the Constitutional Court (MK).

This refers to the Constitutional Court'sjudicial review decision on the P2SK Law related to LPS budget governance which was read out on January 3, 2025 and the article related to OJK investigators whosejudicial review was read out in 2023.

Executive Director of the Center of Economic and Law Studies (Celios) Bhima Yudhistira, on various occasions attended by Suar.id, emphasized that the revision of the P2SK Law was not at all urgent. On the contrary, the changes tend to weaken BI's independence.

Back to the beginning

Although it contains a number of articles that are considered to undermine BI's independence, there is also an alternative perspective that the revision of the P2SK Law will restore BI's mandate as the central bank. Program and Policy Director of Prasasti Center for Policy Studies Piter Abdullah stated that there is a wrong perception if this revision is considered as a maneuver plan by the DPR to "control" BI.

"The amendment to the P2SK Law is motivated by the direction of BI policy which is considered often not in line with the direction of government policy and causes the economy not to grow optimally," Piter told SUAR, Thursday (18/9/2025).

In the draft currently circulating, Piter added, the clearer goal is not to degrade BI's independence, but to restore BI's objectives in accordance with the provisions of Law Number 13 of 1968 concerning Central Banks. The emphasis there: BI helps create jobs and economic growth.

"In my opinion, what BI said in the RDG (board of governors meeting) press conference, for example, already implies that BI can take pro-growth policies without having to worry about losing its independence," said Piter.

Contacted by SUAR after chairing a hearing of Commission XI DPR and the Board of Commissioners of the Financial Services Authority (OJK), Chairman of Commission XI Muhammad Misbakhun was reluctant to give an open statement because the legislative process and revision of the P2SK Law were still in the process of discussing the working committee (panja).

"The P2SK Bill is still in the formulation stage for discussion and is not yet in the finalization process, so there are no points that must be shared as public information," said Misbakhun when contacted by SUAR.

Previously, Misbakhun had told reporters that his committee hoped to complete the revision of the P2SK Law as soon as possible and that it could be brought to a plenary meeting before the closing session of this year. The discussion is currently being conducted behind closed doors, but in due course there will be an open discussion.

"There must be a meaningful participation process, calling experts, everything must be there if all the formulations have been agreed upon," he said.

In line with Misbakhun, BI Deputy Governor Destry Damayanti refused to comment on the legislative process. "Sorry, I can't comment on this yet," Destry replied briefly when contacted by SUAR.