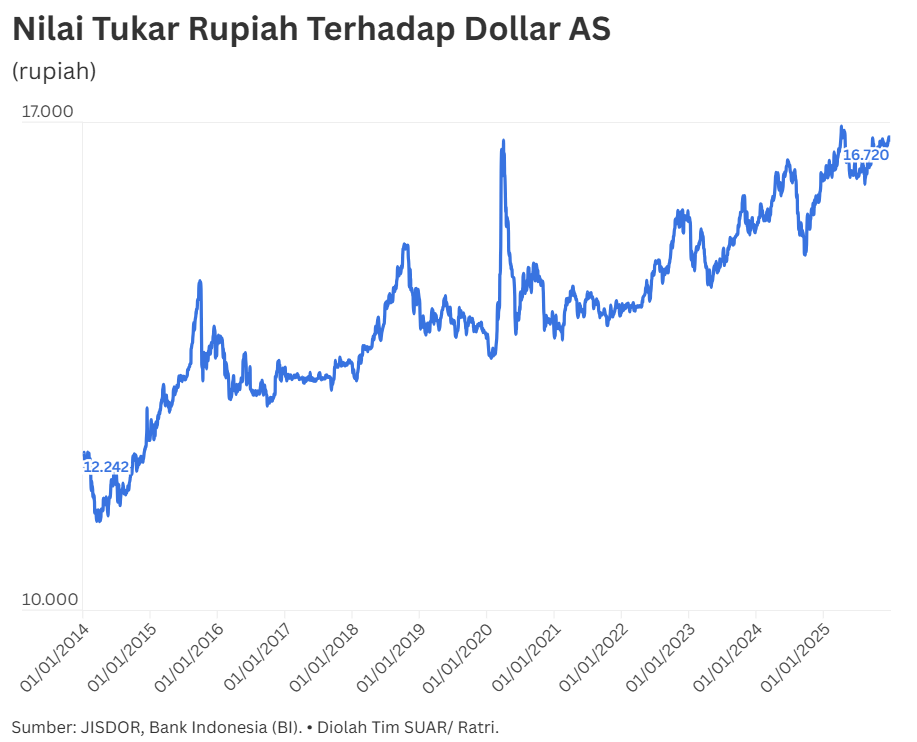

At the beginning of the year (January 2, 2025), the rupiah exchange rate was recorded at Rp 16,236. At the end of the year, the rupiah stood at Rp 16,720. In 2026, based on the macroeconomic assumptions of the Draft State Budget, the rupiah exchange rate will be maintained at Rp 16,500 per US dollar.

The dynamics of the rupiah exchange rate over the past decade show vulnerability to external shocks. The weakening of the rupiah against the US dollar was already apparent in the 2014–2015 period, when the Fed's Taper Tantrum policy weakened the rupiah from around Rp 12,000 to Rp 14,000.

Pressure continued in 2018 due to the US-China trade war, which forced the rupiah to break through the psychological level of Rp 15,000, reaching its peak during the Covid-19 pandemic in 2020, which triggered a sharp decline to Rp 16,600.

Now, at the end of 2025, the rupiah is still in a consistent weakening trend in the range of Rp 16,500 to Rp 16,720 per US dollar due to the US universal import tariff policy and high global interest rates.

This weakening of the exchange rate is alarming, given that the national industrial sector's dependence on foreign supplies of raw materials is at its highest point. Data from the Central Statistics Agency (BPS) shows that the volume of imports of raw materials and industrial auxiliary goods in 2024 jumped by 17.66% compared to the previous year, from 183,699.6 thousand tons to 216,135.4 thousand tons.

Interestingly, even though physical import volume skyrocketed, the nominal value (CIF) only grew by 5.29% to US$169,679.2 million. This phenomenon is believed to be due to industry players implementing a front-loading strategy or stockpiling when global commodity prices were relatively cheap in 2024 to anticipate more severe exchange rate fluctuations.

The industry's concerns are not without reason, as production costs in 2025 are now ballooning due to exchange rate differences (cost-push inflation). Large volumes of raw materials ordered in 2024 are now a costly fiscal burden when they have to be paid for at the 2025 rupiah exchange rate, which exceeds Rp 16,700.

This can be seen, for example, in the food and beverage industry, where import volumes rose by 12.83% (reaching 24,126.10 thousand tons). Because this sector is directly related to the daily needs of the community, the weakening of the rupiah has a rapid impact in triggering increases in the prices of processed foods at the consumer level.

On the other hand, there are indications of a slowdown in industrial support infrastructure. Data on imports of spare parts and equipment show stagnant growth in value, at only 0.04% or US$33,362.30 million in 2024. This figure reflects the cautious attitude of the business world, which is beginning to hold back on investment in new machinery or equipment.

Meanwhile, imports of fuel and lubricants, which had surged after the pandemic, began to level off with a slight increase of 1.52%. However, there remains a significant risk to the national logistics cost structure if the rupiah continues to depreciate.

Entering 2026, the challenge of controlling the rupiah requires synergy between macro policies and micro adaptations. Market uncertainty due to net foreign capital outflows in the stock market and SRBI instruments requires Bank Indonesia to remain optimal in maintaining exchange rate stability through measured market interventions.

However, relying on monetary policy alone is not enough. The government needs to strengthen fiscal policy to restore foreign investor confidence so that capital flows return to the country. This is to prevent the rupiah from falling further to the Rp 17,000 level.

For the business world, supply chain adaptation is key to sustainability. Companies can no longer rely solely on front-loading strategies. The medium-term solution lies in accelerating import substitution and utilizing the Local Currency Settlement (LCS) scheme for international trade transactions to reduce dependence on the US dollar. In addition, the optimal use of certified local raw materials must be increased to break the industry's dependence on increasingly volatile global markets.

The year 2026 will be a moment of transformation for the national industry to become more resilient. Rewards such as tax incentives for companies that successfully carry out downstreaming or use more than 50% local components can be an attraction for the industry. With stable exchange rate control and encouragement for raw material independence, the business world is expected to be able to maintain profit margins while protecting people's purchasing power amid the global economic uncertainty that still looms.