The high interest of electric car manufacturers to invest in Indonesia is favorable for Indonesia's industrial estates. Demand for industrial land is mainly driven by the relocation and massive expansion of Chinese companies - particularly those in the food, electronics and electric vehicle ecosystems.

In the research"Industrial sector acceleration: Optimism amidst rapid growth" released by Colliers, Senior Associate Director of Colliers International Indonesia Ferry Salanto said, geopolitical tensions and global tariff wars are accelerating investment shifts towards Indonesia, which is increasingly seen as a strategic alternative for manufacturing activities in the Asian region.

Industrial estates are designed to attract industrial and manufacturing companies. These areas are usually developed and managed by real estate developers or managers to maintain existing facilities and infrastructure. Industrial estates in Indonesia are generally equipped with facilities such as water treatment plants, wastewater treatment plants, telecommunication lines, fiber optics, electricity, gas, and other facilities.

In addition to the electric vehicle ecosystem, another sector that is investing quite heavily in industrial estate land is technology, especially data centers.

Total investment in electric vehicles: IDR 5.65 trillion

Director of Maritime Industry, Transportation Equipment and Defense Equipment of the Ministry of Industry Mahardi Tunggul Wicaksono said Indonesia's automotive industry is still attractive to electric vehicle manufacturers from a number of countries. The investment value has reached Rp5.65 trillion, which comes from electric cars, electric motors, and electric buses. The investment value has the potential to continue to grow because there are a number of brands that will enter.

"Investment in electric cars is still the largest with a total investment of Rp4.12 trillion with 9 electric car manufacturers with a production capacity of 70,060 units per year," he said in a recent discussion between the Ministry of Industry and the Industrial Journalists Forum.

For electric motors, Tunggul said that currently the total investment is Rp1.15 trillion. It was obtained from electric motorcycle manufacturers with a total of 66 companies that have a production capacity of 2.37 million units per year.

Furthermore, electric buses also began to enliven the Indonesian automotive market with an investment value of IDR 380 billion. There are currently 7 electric bus manufacturers with a production capacity of 3,100 units per year.

As for when viewed as a whole, the total investment in the automotive industry for the 2021-2025 period reaches IDR 174.31 trillion. This consists of IDR 143.91 trillion in four-wheeled investment and IDR 30.4 trillion in two-wheeled investment. This investment comes from investment in 32 four-wheeled vehicle factories and 73 two-wheeled vehicles. From this investment, around 100,000 workers are absorbed.

Electric car TKDN rules

Mahardi added that future investment in electric cars in Indonesia will increase. This is the result of the domestic content rate (TKDN) regulation for electric car manufacturers.

The regulation on TKDN of electric cars has been stipulated in Presidential Regulation Number 79 of 2023 concerning Amendments to Presidential Regulation Number 55 concerning the Acceleration of the Battery-Based Electric Motor Vehicle Program for Road Transportation.

In the regulation, battery electric vehicle (BEV) manufacturers can enjoy tax incentives in the form of exemption from import duties and luxury goods value added tax (PPnBM) for imports. This applies to the import of completely built up (CBU ) battery electric cars in order to increase its population on the streets of the country.

The CBU import period for program participants will end on December 31, 2025. After that, the incentives in the form of import duty and STLG exemptions that have been received will be stopped. Furthermore, from January 1, 2026 to December 31, 2027, manufacturers are required to produce electric cars in Indonesia with an amount equivalent to the CBU import quota. This production must adjust the TKDN rules that have been set.

According to the regulation, the TKDN of locally produced electric cars must reach 40 percent in 2022-2026. Then it rises to 60 percent in 2027-2029 and 80 percent starting in 2030. The fulfillment of TKDN is tantamount to attracting new investment in factories and assembly facilities in Indonesia.

Until the registration of participants in this program closes in March 2025, there are six manufacturers who have participated in it. The six manufacturers are BYD Auto Indonesia (BYD), Vinfast Automobile Indonesia (Vinfast), Geely Motor Indonesia (Geely), Era Industri Otomotif (Xpeng), National Assemblers (Aion, Citroen, Maxus and VW) and Inchape Indomobil Energi Baru (GWM Ora).

"On its way, the company must also pay attention to the value, the amount of TKDN value. From 40 percent, it must gradually increase to 60 percent of the TKDN value," he said.

Tunggul said, of the six companies participating in the CBU incentive program, they will make an additional total investment of IDR 15 trillion and plan to increase production capacity by 305 thousand units. Of the six companies, two companies are cooperating with local assemblers, namely PT Geely Motor Indonesia and PT Era Industri Otomotif.

Meanwhile, two companies expanded production capacity, namely PT National Assemblers and PT Inchcape Indomobil Energi Baru, and two companies built new factories, namely PT BYD Auto Indonesia and PT Vinfast Automobile Indonesia.

Suppressing performance

The Indonesian Automotive Industry Association (Gaikindo) admits that the incentive to import battery electric cars for market testing has successfully increased the adoption of these cars in Indonesia. However, this has put pressure on the performance of the long-established industry. Gaikindo noted that the utilization of the car industry fell from 73% to 55% this year, as domestic car sales fell.

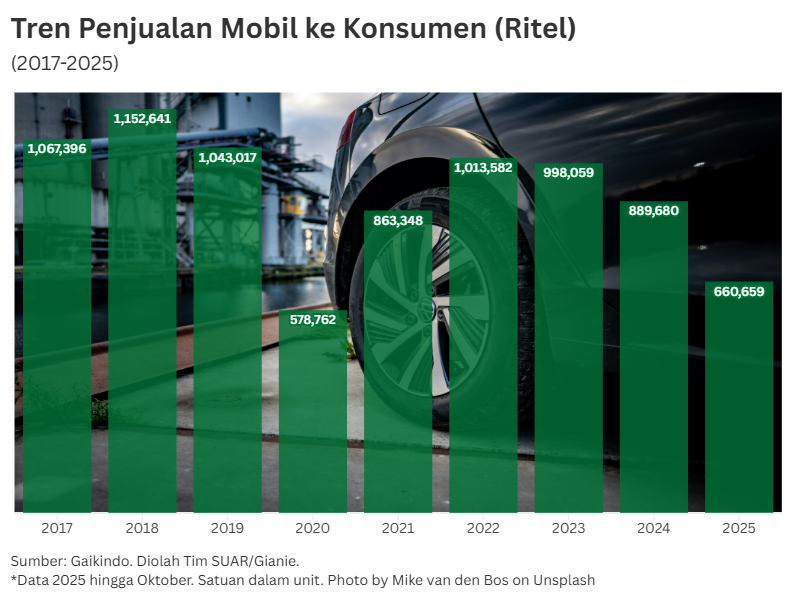

Gaikindo General Secretary Kukuh Kumara said, domestic car sales fell to 865 thousand units in 2024 compared to 1.2 million units in 2014. This trend continues this year, where as of last July, car sales fell 10% to 453 thousand units.

Kukuh stated that the decline in car sales was triggered by weakening purchasing power and high taxes on cars outside BEVs. Currently, not all cars with high TKDN are incentivized. On the contrary, the government has provided large incentives for BEVs to attract investment.

He emphasized that the presence of imported BEVs suppresses domestic car production with high TKDN, ranging from 80-90%. That means, imported BEVs have disrupted the balance of the industry.

Researcher at the Institute for Economic Research at the University of Indonesia (LPEM UI) Riyanto said the BEV incentive for CBU imports was indeed able to boost BEV sales in 2024 and 2025. This means that the BEV market test was successful. In fact, he said, currently, imported BEVs dominate the domestic market. The portion reached 64% as of May 2025, up sharply from only 40.2% in the same period last year.

However, according to Riyanto, the BEV Import incentive only affects the trade sector, which has a much smallermultiplier effect than local production. This also makes the utilization of domestic factory production not optimal.

He recommended that the government provide consistent, fair and proportional fiscal policies based on emissions and TKDN. Vehicles that contribute to reducing emissions enough and the impact on the economy is large, should also receive large incentives.