The surge in gold prices continues. Until October 8, 2025, the world gold price touched US$ 4,000 per troy ounce. Meanwhile, Indonesian Antam gold touched a price of IDR 2.29 million per gram.

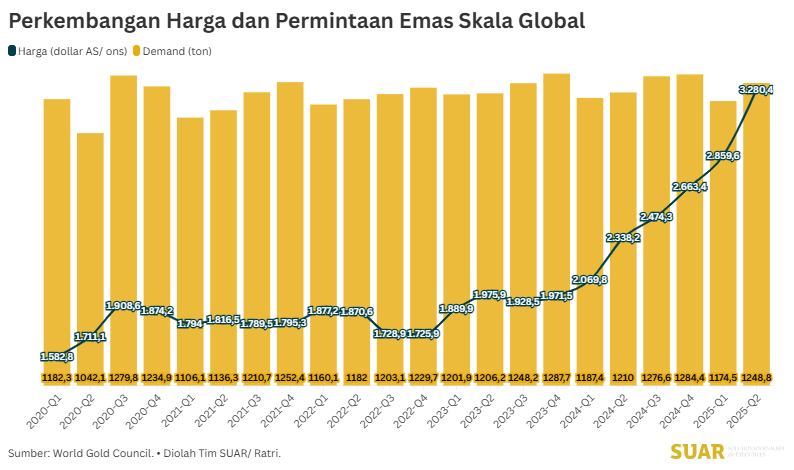

Looking back five years, the price surge began at the end of 2023, when prices started to creep up from US$ 1,975 per troy ounce. Now, the aurum has reached a record US$ 4,000 per troy ounce.

This upward price trend indicates high investor interest. World Gold Council data shows that, since the beginning of 2025, demand for gold has strengthened for investment needs.

In addition to individual investors, demand for the precious metal also comes from official institutions, especially from central banks that continue to add to their gold reserves. For example, in the second quarter of 2025, Poland recorded the largest increase in gold reserves: 18.66 tons; followed by Kazakhstan at 15.65 tons.

When viewed by intended use, the investment factor is the main driver of the surge in gold demand. Total gold demand for investment purposes increased sharply by 78% on an annual basis, from 268.1 tons in Q2-2024 to 477.2 tons in Q2-2025.

This increase indicates that individual and institutional investors are shifting their capital into gold to hedge against inflation and market dynamics. Demand for retail gold investment products such asbars and coins climbed 11% (YoY) in Q2-2025.

A significant increase was also recorded in gold backedexchange traded funds (ETFs), which are exchange-traded gold investment instruments. In the second quarter of 2024, this fund still recorded anoutflow of-7.1 tons, but turned into a massiveinflow of 170.5 tons in the second quarter of 2025.

This positive trend continued into the third quarter of 2025. Year-to-date global gold ETF demand (January-September 2025) reached 618.8 tons with global inflows - indicating positive demand growth of 37.6%.

According to the World Gold Council report for the third quarter of 2025 (7/10/2025), gold-based ETF funds, particularly in Europe, recorded five consecutive months of inflows, adding US$4.4 billion in September (the third strongest month in Europe).

Meanwhile, Asia recorded positive gold ETF inflows of US$2.1 billion in September, ending the quarter with a positive result. India led the Asian region with US$ 902 million in inflows, due to local currency support and safe haven demand amid weakness in domestic equities and geopolitical risks in the region.

China (US$622 million) and Japan (US$415 million) were also big contributors. Understandably, gold prices also strengthened in those countries' local currencies.

The price movement, which set a record since the last 5 years, confirms that gold is currently in a period of very healthy demand, driven by investor sentiment that needs a sense of security amid global economic uncertainty.