The government's decision to suspend TikTok 's operating license in Indonesia starting on Friday, October 3, 2025 has once again created uncertainty in the national e-commerce sector. Although the freeze was lifted a day later, this repeat of a similar incident at the end of August has the potential to shake up the digital commerce ecosystem, which is increasingly popular and has become the first choice for shopping.

Growing rapidly along with its existence as a social media platform, TikTok Shop, which was officially launched in 2021, is no longer a marginal player. In 2024, the Gross Merchandise Value (GMV) or value of products sold on TikTok for theSouth East Asia region managed to outperform Lazada and Tokopedia, even being in second place after Shopee.

The increase in market share is quite fantastic, reaching USD 22.6 billion in 2024 from USD 0.6 billion in 2021. The rapid growth of sales on TikTok makes it the fastest growing and most aggressive platform in Southeast Asia, especially Indonesia.

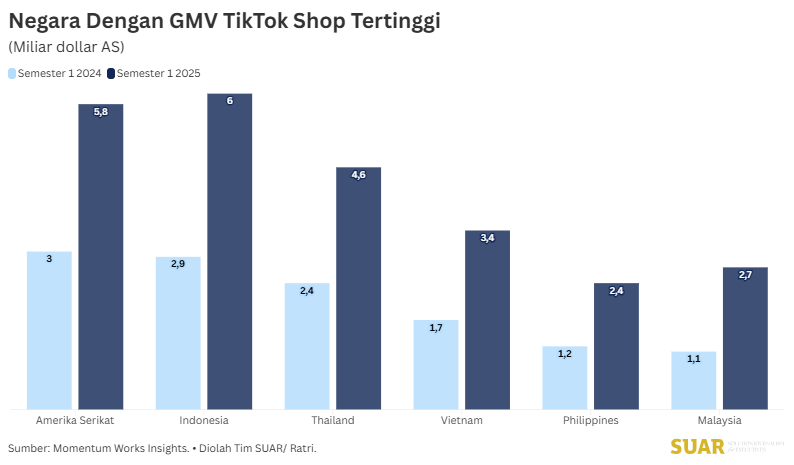

Indonesia plays an important role in the sustainability of TikTok Shop 's business globally. Based on GMV data for the first half of 2025, Indonesia is now TikTok Shop 's largest market in the world. In the first half of 2025, the total GMV of TikTok Shop in Indonesia reached US$6 billion, surpassing the United States which recorded US$5.8 billion.

This figure jumped 107% from US$2.9 billion in the first half of 2024 to US$6 billion in the first half of 2025. The magnitude of this figure proves that Indonesia not only provides a large user base, but is also the most active and profitable market. Therefore, the suspension of operating licenses not only impacts local merchants, but also inflicts significant losses on one of the company's main revenue engines globally.

TikTok Shop' s greatest potential lies in its live commerce and content-driven commerce model, helping Micro, Small and Medium EnterprisesUMKM). The platform offers an easily accessible and relatively low-cost sales channel. Its appeal allows UMKM to visually and interactively market their products to the platform's millions of users.

In the midst of declining public interest in visiting and exploring physical stores and markets in person, for many UMKM, TikTok Shop has become a new alternative. Through the platform they can make sales by interacting directly with customers(live), while building a brand without the need for large investments in traditional marketing.

The situation experienced by TikTok Shop is in stark contrast to the performance of older e-commerce platforms. Through the Momentum Works Insights report , within Southeast Asia, TikTok Shop surpassed platforms such as Lazada and Tokopedia, which experienced significant GMV contraction. Tokopedia's GMV growth decreased by -11.41% and Lazada plummeted by -6.4% in 2023 compared to 2022. In 2024, Lazada and Tokopedia's GMV slumped again. Lazada experienced a decline of -4.2% and Tokopedia -21.5%, while TikTok Shop rose 38.65%.

Although Shopee still leads with a positive growth of 21.23% and takes more than 50% market share, the weak performance of other competitors confirms the role of TikTok Shop as a catalyst for new growth and innovation provider. If the discourse leading up to the policy of freezing TikTok Shop's Live feature continues, the potential lost business will be distributed to other platforms (especially Shopee). However, the main victims are thousands of UMKM that need time to adapt to different business models and platform algorithms.

The suspension of TikTok Shop's Live feature, although it may be based on regulatory reasons, will cause serious economic losses, especially for the growing UMKM ecosystem. That's because this platform has been a driving force in Indonesia's e-commerce growth, even managing to dominate global market positions.

The government needs to be careful in implementing policies by considering the real impact on the micro economy. The solution should not be a total freeze, but rather the implementation of strict and fair regulations that allow social commerce innovation to continue while ensuring compliance with the law. This way, the digital potential that has been built in Indonesia is not hampered.