Amid global anxiety about economic slowdown, Indonesia recorded higher than expected growth. The economy in the second quarter of 2025 grew 5.12% year-on-year, supported by a surge in public consumption during the Lebaran period and investment growth.

"The economic performance in the second quarter was supported by public consumption and investment," said Deputy for Balance and Statistical Analysis of the Central Statistics Agency (BPS), Moh Edy Mahmud, in a press conference, Tuesday (5/8).

He added that the strengthening of consumption was supported by the long holiday momentum, tourism activities, and fiscal policies that maintain purchasing power.

However, signals from international institutions still contain a note of caution. The World Bank, OECD, and IMF have collectively cut Indonesia's growth projections for the full year 2025.

The World Bank and OECD, for example, estimate that growth will only be in the range of 4.7% to 4.8%, lower than last year. This means that the impressive Q2 achievement could just be a momentary peak in a year that is still full of challenges.

Holiday momentum, the consumption engine doesn't die

The fact that household consumption is still the largest contributor to Gross Domestic Product (GDP) is nothing new. However, in the context of this year, amid the narrative of weakening purchasing power, growth of 4.97% (yoy) in this sector still sends an important signal: the domestic engine is still running.

This performance is inseparable from the moment of National Religious Holidays (HKBN), school holidays, and joint leave which accelerates the turnover of money in the transportation, tourism, and food and beverage sectors. The number of domestic tourist trips grew 22.32%, driven by a surge in land and sea mobility.

“Increased public mobility is indicated by an increase in the number of rail and sea transport passengers. This is in line with the celebration of HKBN and school holidays,” Edy explained.

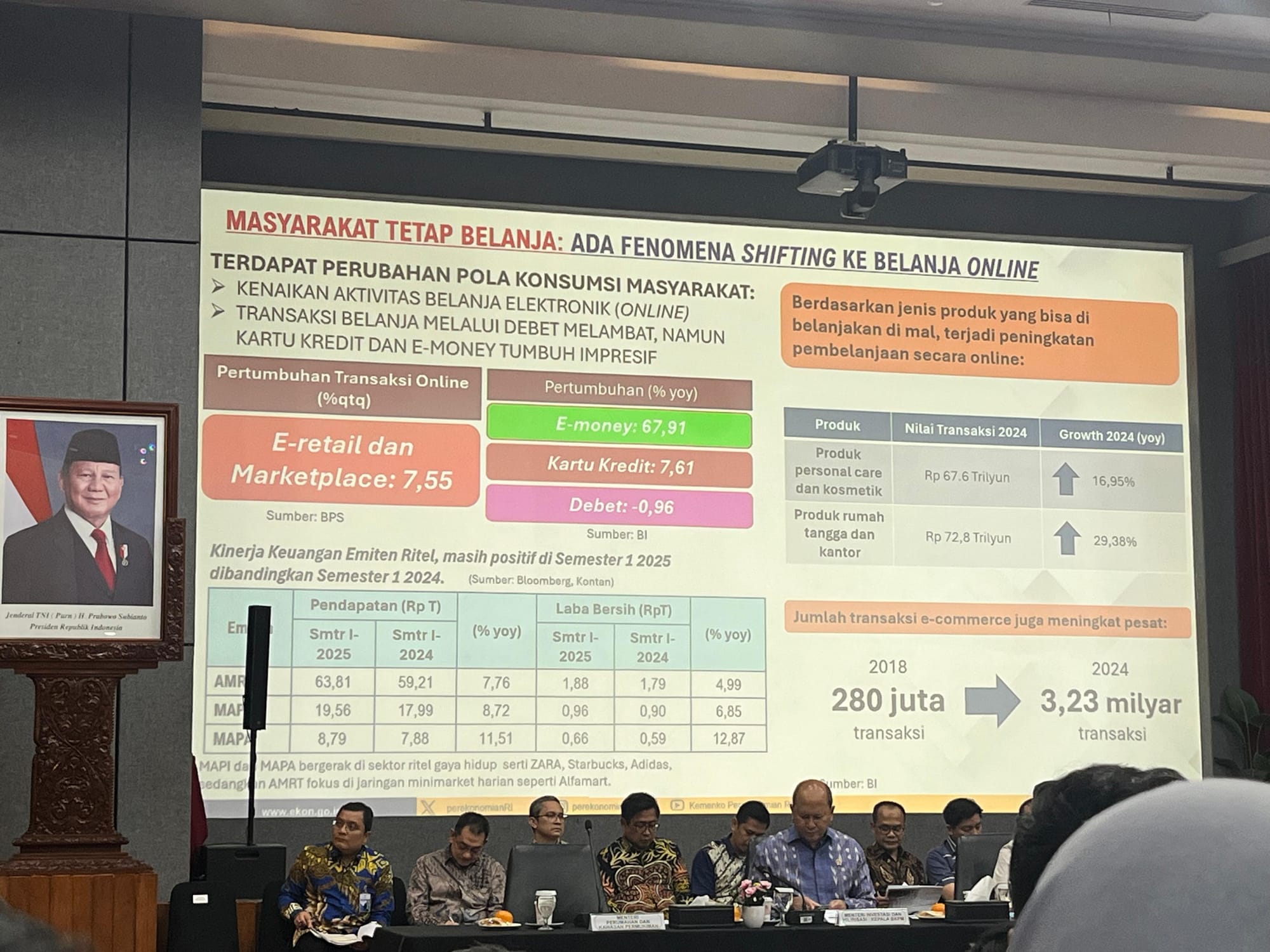

In another event that was in line, Coordinating Minister for Economic Affairs Airlangga Hartarto dismissed the notion that the phenomenon of groups rarely buying (rojali) and groups just asking (rohana) in shopping centers reflects weak purchasing power. According to him, the data in the field is actually the opposite.

“In three large real sector companies, both factories and minimarkets, sales grew by 4.99%, 6.85%, and 12.87% respectively in the first semester of 2025. This is a different fact from the issues being blown out of proportion,” said Airlangga in his presentation at the Second Quarter 2025 Economic Growth Press Conference, Ali Wardhana Building, Coordinating Ministry for Economic Affairs of the Republic of Indonesia (5/8).

Airlangga said that Indonesia's economic growth rate was just below China, which recorded an increase of 5.2% in the same period.

“Several countries recorded figures below us, such as Malaysia and Singapore. Meanwhile, the United States only grew by 2%, and South Korea is also relatively low. So, among the G20 and ASEAN countries, we are among the highest,” he said.

He added that indicators of public consumption and mobility are still solid:

- Household consumption contributes 54% of GDP;

- Investment grew 6.99% (yoy);

- Electronic money transactions increased 6.26%;

- Marketplace transactions grew 7.5% (QtoQ);

- Transportation policies encourage increased land, sea and air travel.

Strong consumption, but not yet evenly distributed

Although consumption growth is high, some economists warn against hastily considering this as a structural recovery.

“The large number of holidays and religious celebrations encourages consumption, especially in the travel and accommodation sectors. Incentives such as ship and train fare discounts also play a role,” said Yusuf Rendy Manilet, an economist at CORE Indonesia, to SUAR via written statement (5/8).

According to him, this type of consumption growth is usually driven by the upper middle class. “We cannot yet conclude that this is an even recovery, especially for the lower middle class segment which is still under pressure,” he wrote.

The government itself is providing stimulus such as social assistance, wage subsidies, transportation discounts, and discounts on Occupational Accident Insurance contributions. Bank Indonesia maintains the BI Rate at 5.50% to maintain rupiah stability.

Gross Fixed Capital Formation: a sign of production optimism?

If consumption illustrates the condition of demand, then investment or gross fixed capital formation (GFCF) reflects the optimism of business actors and the government towards the future of the economy. GFCF grew 6.17% (YoY), becoming one of the biggest contributors to GDP growth after household consumption.

This economic growth is also supported by a number of important indicators. The inflow of investment, both from within and outside the country, shows stronger activity than last year. The realization grew above 11%.

This condition is in line with the surge in imports of capital goods which reached almost 32%, an indication that business actors are preparing to increase production capacity. The government is also not silent. Capital expenditure from the State Revenue and Expenditure Budget also increased significantly, rising by more than 30%.

This encouragement from the state expenditure side also supports the formation of gross fixed capital, which has grown strongly for three consecutive quarters.

This means that both the private and state sectors are expanding capacity, through infrastructure development, machine purchases, and development of production facilities.

According to Yusuf, the surge in GFCF is closely related to domestic demand which encourages business actors to increase capacity. “In addition, the reduction in the benchmark interest rate by BI in recent months has also driven the rate of investment,” he said.

However, he cautioned that this trend will be tested in the third quarter, when there will no longer be a boost from holidays and seasonal effects will decline.

This trend will be tested in the third quarter, when there will no longer be a boost from holidays and seasonal effects will decline.

Industry, trade, and services are the backbone

From the production side, all sectors grew positively this quarter, indicating a relatively even recovery. However, the most notable were the service and manufacturing sectors.

Other services became the business sector with the highest growth, at 11.31% (yoy). This sector includes entertainment, recreation, and various community services, which were boosted by the long holiday period.

Meanwhile, the processing industry remains the main support with the largest contribution (18.67%). The food and beverage, basic metal, and pharmaceutical and traditional medicine industries are the main drivers of its growth. "Domestic demand for pharmaceutical and herbal products has increased, while exports of chemical goods have also strengthened," Edy explained.

Although the majority of components grew, government consumption contracted, especially operational spending. This is the only element in GDP that grew negatively, although capital expenditure still increased.

The "Rojali-Rohana" paradox in the business world

For business actors, this second quarter achievement feels unique. Ajib Hamdani, Economic Policy Analyst at Apindo, calls it the "Rojali-Rohana paradox": on the one hand, the phenomenon of crowds rarely buying and crowds just asking around is still felt; on the other hand, BPS data shows that consumption and investment have soared.

"Our prediction at that time was in the range of 4.69%–4.81%," said Ajib. "Historically, the second quarter is usually lower than the first quarter. Moreover, the manufacturing PMI (purchasing management index) had contracted to 46.7 in April, the lowest in four years."

In reality, investment grew 6.99%, the highest in the last four years, driven by infrastructure projects, and the easing of the BI Rate by 25 basis points in May – pumping Rp 375 trillion of liquidity.

Ajib outlined four steps so that this growth is not just a seasonal spike. First, strengthen purchasing power through the creation of new jobs.

Second, targeted fiscal and monetary incentives, such as accelerating tax refunds or cheap credit for labor-intensive sectors.

Third, deregulation to speed up permits and coordination.

Fourth, attract foreign investment by improving the ease of doing business, from a ranking of 73 to 40 in the world.

"The economic engine still has fuel. It's just a matter of how the government and the business world join hands so that growth is sustainable," he said. Apindo mentions the concept of Indonesia Incorporated, cross-sector collaboration, as the key to making this momentum last until 2029.